You have finally got your first credit card after months of waiting and filling out applications. However, most people have problems with logging in or registering. Most people are facing issues with payment or want to cancel their subscriptions at any time. You can find all of the solutions here.

The promise of payment is the basis of using credit cards and other forms of credit in the financial industry. You can use your credit card to buy many things. It’s like money. You can also cash in your unused or leftover credit from statements with which you have big bills to pay.

Before you go out and spend like crazy on your Milestone Credit Card, make sure that you are familiar with your credit card account details. The following guide covers some essential points regarding Milestone Credit Card login, payment, customer service, cancellation, rewards points, etc. Let’s start reading.

What Is a Milestone Credit Card? And Its Benefits

Milestone Master Credit Card is a credit card issued by Milestone Mastercard to help you achieve your goals. Milestone Master Credit Card is a prepaid card used to make payments online or offline. This company offers various merchant services to businesses, such as credit card processing and payment gateway solutions.

The Milestone Master Credit Card is an excellent choice for anyone who needs to take payments over the phone or in person. Businesses and individuals can use this card, but it’s beneficial for those who need to accept payments directly from their customers or clients.

So, if you run a small company that sells products online or at trade shows, you might want to use this card so that customers can pay for their orders with their credit cards, preferable to sitting around waiting for checks to arrive in the mail.

Benefits Of Milestone Credit Card

- The main advantage of using the Milestone Master Credit Card is that you do not need to maintain a bank account or have a credit history. This makes it ideal for people without a bank account or with poor credit scores.

- The initial credit limit on this card is $265, so you can start rebuilding your credit history immediately. This amount is enough for most people to start building their budgets responsibly after an event like bankruptcy or foreclosure.

- The Milestone Master Credit Card does not charge monthly or “processing” fees like other secured cards. This means you don’t have to worry about paying extra monthly to have the card in your wallet!

- Using this credit card will earn interest on your security deposit and keep it safe from unauthorized charges without having to open another account or pay monthly fees or interest rates too high for your budget.

- The Milestone Master Credit Card’s APR is relatively low compared to other credit cards in its class.

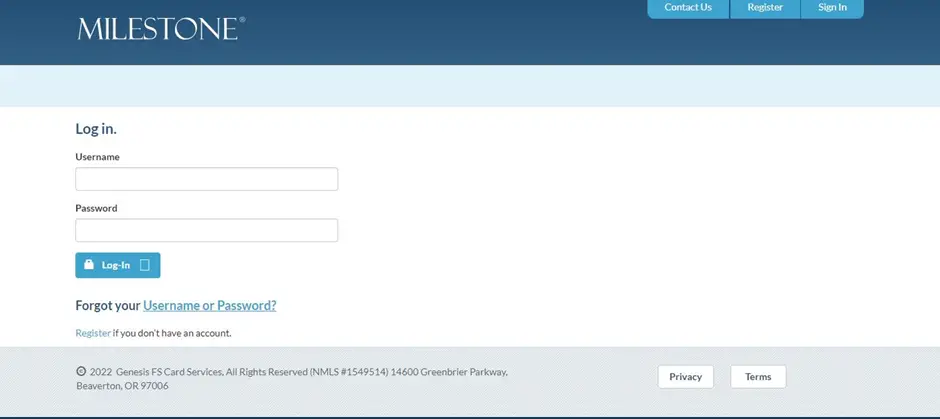

How To Login To Milestone Credit Card?

To login and assess your Milestone Credit Card, you have to go to its website https://milestone.myfinanceservice.com/ and then enter your valid email ID and password to log in. (if you have one), or click “I don’t have an account yet” if you haven’t registered yet. Then click “Create an Account” and follow the prompts to complete the process.

In this case, if you have forgotten your username or password, you can reset it from the website.

If you do not have an email id, you need not worry, as there is an option called “Forgot Password,” where you can enter your registered mobile number so that they can send you an OTP on that number which will help you reset your password easily.

How To Activate Your Card?

For the activation of the card, follow these steps:

- Log into the Milestone website using your registered email address and password.

- Click on “My Account” from the home page, and you will be directed to your account dashboard.

- Click the “Activate Your Card” button to activate your card.

- You will get a unique activation code on your registered mobile number, which you need to enter in the text box and click on the “Submit” button to activate your card.

How to Make Milestone Credit Card Bill Payments?

Milestone Credit Card bill payment is a significant thing for every customer. Paying as early as possible is crucial to avoid late charges and penalties.

You can make Milestone Credit Card bill payments in four different ways: online, by phone, by mail, and by MoneyGram. Here is the guide to help you make the payment.

1) Online

You can pay your Milestone Credit Card bill online through the website. You need to log into your account and click on the Bill Payment link to make a payment. Then, please fill out the required details and submit them.

After that, you will receive a confirmation message stating that your payment has been processed successfully.

2) Contact via phone

You can make your Milestone Credit Card bill payment by calling customer service (866) 453-2636.

If you’d like to pay over the phone, you’ll need to have your credit card number and expiration date ready to enter so they can quickly verify your account and charge your card.

3) By Mail

Send your money order payable or check to Milestone Credit Card at

- Genesis FS Card Services

- P.O. Box 84059

- Columbus, GA 31908-4059

4) Through MoneyGram

This is also available through MoneyGram if you’re looking for an alternative way of making a Milestone Credit Card bill payment.

Best Way To Check Your Milestone Credit Card Balance

You can check your Milestone Master Credit Card balance by logging in to your Milestone Account and going to the “My Account” section. Here you can view your statement, payment history, and outstanding balance.

Moreover, The best way to know about your Milestone Credit Card balance is by calling on their customer care number.

The customer care number for Milestone Credit Card is (866) 453-2636. You can call on this number 24 hours a day and get the complete details of your account from the representative.

Milestone Customer Service

The Milestone Mastercard gives you access to a dedicated customer service team available 24/7. You can call or chat with them to get answers to any questions you have about your account, including questions about your spending limits and spending patterns.

They are very professional, friendly, and helpful. When you have an urgent request, they always make an extra effort to accommodate you.

They will answer my questions in detail and ensure everything is taken care of before leaving the phone call or email.

You can contact them by their Contact numbers:

- 1-866-453-2636

- 503-268-4711

How To Cancel Your Milestone Credit Card Account?

If you want to cancel your Milestone Credit Card, there are some essential things to consider first.

Step 1

An essential step is checking your account balance and paying off any outstanding.

If there is a balance on your milestone card, you must pay it before canceling the account. Milestone will charge a balance transfer fee if you don’t pay your balance before canceling.

Contact Milestone if you don’t know how much money is still owed on your account and ask if they can provide that information via phone or email.

Step 2

Contact (866) 453-2636 and let them know you want to cancel your account. Be polite but firm in asking them to close your account immediately, as some representatives may try to convince you otherwise or keep the line open to keep charging interest on your debt (this is illegal).

Be aware that they may try and offer incentives such as lower interest rates or rewards points to keep your business. Still, these are usually just temporary offers that expire after a specific time.

Step 3

You should receive confirmation that the account has been closed. Before contacting Milestone, request written proof that your account was closed and that all payments have been made in full. This will help ensure that no further charges will be placed on your invoice after it has been canceled.

If there’s any confusion about whether your request has been honored, follow up with another call or letter until it’s resolved in your favor.

Step 4

The last step in canceling your milestone credit card is to check your credit report to ensure that there are no outstanding balances or other open accounts listed under your name.

If there are any outstanding balances or other available accounts, contact the company directly to find out how you can resolve them before moving on with canceling your milestone credit card account.

Conclusion

Belonging to a credit card is one of the most crucial things. Whether for a new adventure or an everyday purchase, Milestone Cards are the intelligent choice.

Please consider applying for a Milestone Credit Card to take advantage of all they offer if you haven’t already.

This card provides various unique features that make it possible to save money, earn rewards and help you take care of your everyday expenses in the best way possible.

Hopefully, you have found the answers that you are looking for. If not, then feel free to post your questions or comments below. We try our best to respond and assist everyone.