“WUVISAAFT” stands for “Western Union Money Transfer, Visa, Account Funding, Transaction.”

It’s a merchant code used by Western Union to classify credit card transactions related to funding money transfers.

Occurrences of WUVISAAFT Charge:

- The charge is legitimate if you used your credit card for a Western Union money transfer.

- If unauthorized, contact your credit card issuer immediately to report and dispute.

- Payment of bills through Western Union results in a valid charge.

- Accidentally entering credit card info can lead to a legitimate account.

What is WUVISAAFT?

“WUVISAAFT” is an abbreviation for Western Union Money Transfer, Visa, Account Funding, and Transaction.

Western Union employs This designation as a merchant code to categorize credit card transactions related to funding money transfers.

You might encounter “WUVISAAFT” on your credit card statement if you utilized your credit card to fund a Western Union money transfer.

The notation includes the amount of the money transfer and any applicable fees Western Union charges for their services.

If you observed a “WUVISAAFT” entry on your credit card statement and did not authorize this transaction, it is crucial to take immediate action.

Contact your credit card issuer immediately to report the unauthorized charge and initiate the process of disputing the transaction.

This swift response is essential to safeguard your financial interests and rectify unauthorized activity.

Other information you might want to know,

| Merchant name | Description | Explanation |

| WU | Western Union | Money transfer |

| VISA | Visa credit card | Purchase made with a Visa credit card |

| AFT | Agent Financial Transfer | Money transfer |

| MTCN | Money Transfer Control Number | Unique identifier for a money transfer |

| TRF | Transfer | Money transfer |

| WIRE | Wire transfer | Electronic transfer of money |

| PAY | Payment | Could be for anything, such as a bill payment, online purchase, or cash advance |

| FEE | Fee | Charge for a service, such as a foreign transaction fee or ATM withdrawal fee |

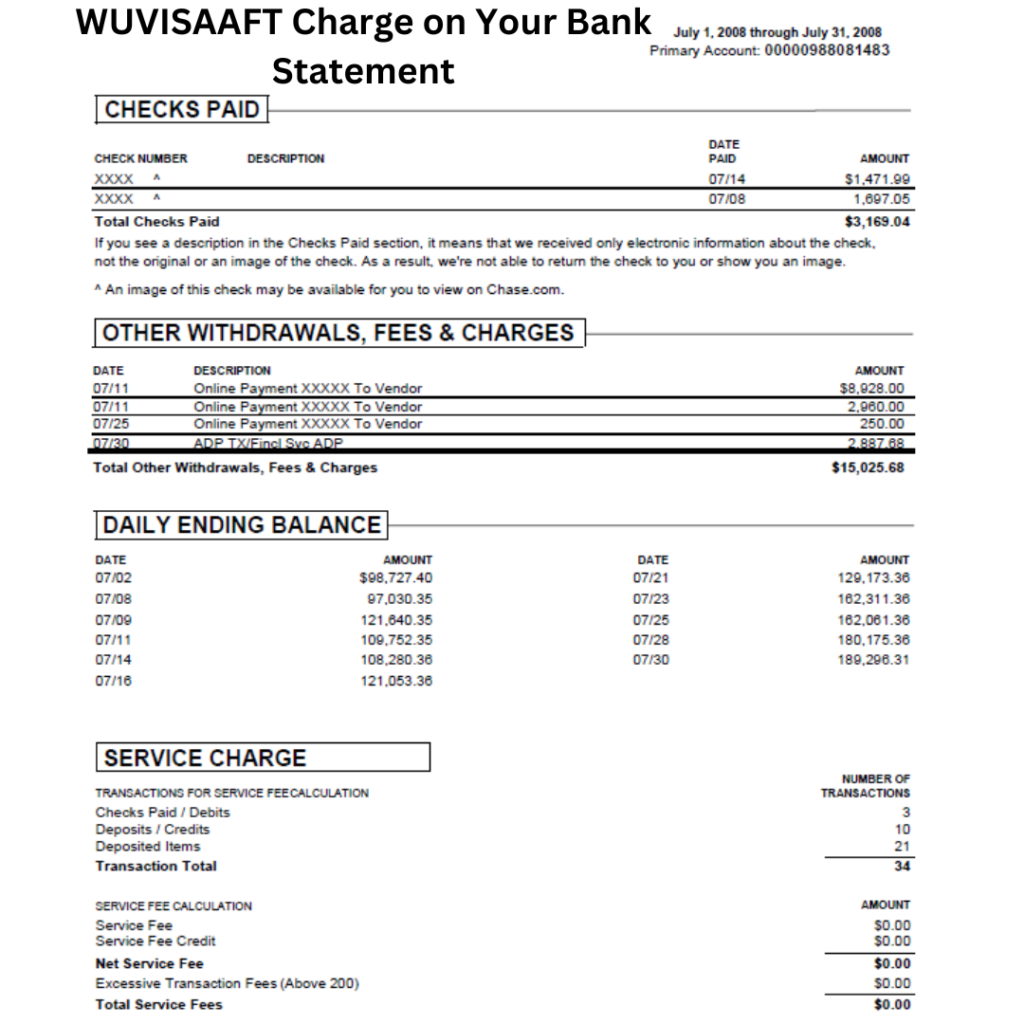

Why Is the WUVISAAFT Charge on Your Bank Statement?

The appearance of a WUVISAAFT charge on your bank statement can be attributed to several distinct reasons, each with its underlying explanation:

- You used your credit card to fund a Western Union money transfer: The most common scenario leading to a WUVISAAFT charge is when you employ your credit card to finance a money transfer through Western Union. If you’ve engaged in such a transaction, the charge reflects the payment for the money transfer, including any associated fees. This is a straightforward indication of a legitimate amount you’ve made.

- Your credit card was used fraudulently to fund a Western Union money transfer: If your credit card details have been compromised and used by unauthorized individuals to support a Western Union money transfer, you could observe an unexpected WUVISAAFT charge on your statement. In this distressing situation, contacting your credit card issuer is imperative. Report the fraudulent activity, commence disputing the charge, and safeguard your financial security.

- You paid a bill with Western Union: Some entities extend the option to settle accounts via Western Union. If you’ve chosen this method and employed your credit card to pay, the resulting WUVISAAFT charge indicates the bill settlement. This type of charge implies that the transaction was intentionally executed for bill payment purposes.

- You made a mistake: Occasionally, errors can lead to the appearance of a WUVISAAFT charge. You might observe this charge if you unintentionally inputted your credit card information into the Western Union platform. To rectify such an occurrence, it’s advisable to contact Western Union’s customer service. They can assist in reversing the charge if it was indeed a mistake.

In essence, a WUVISAAFT charge on your bank statement stems from these various scenarios.

Understanding the underlying reasons can guide you in appropriately addressing the charge, whether it involves legitimate transactions, fraudulent activity, bill payments, or inadvertent errors.

Is WUVISAAFT Charge Scam or Fraudulent?

Determining whether a WUVISAAFT charge is a scam or fraudulent hinges on the specific circumstances surrounding the charge.

Here’s how to discern the legitimacy of the charge based on different scenarios:

- You did not authorize the charge: If you identify a WUVISAAFT charge you did not trust, it’s likely a scam or fraudulent activity. In this case, it’s imperative to take swift action. Contact your credit card issuer immediately to report the unauthorized charge and initiate the process of disputing the transaction.

- You used your credit card to fund a Western Union money transfer: If you utilized your credit card to support a Western Union money transfer and subsequently noticed a WUVISAAFT charge, this is not a scam or fraudulent activity. It represents a legitimate charge from Western Union for a money transfer you willingly authorized.

- You paid a bill with Western Union: If you paid a bill through Western Union and come across a WUVISAAFT charge on your statement, rest assured that this is not a scam or fraudulent occurrence. It denotes a valid license from Western Union for a bill payment you deliberately authorized.

- You made a mistake and accidentally entered your credit card information: Should you realize that you accidentally provided your credit card information to Western Union, leading to a WUVISAAFT charge, this is not a scam or fraud. It signifies a legitimate charge stemming from an accidental money transfer you authorized.

If you are still determining whether a WUVISAAFT charge is legitimate, contact your bank or credit card issuer for clarification.

Here are some essential tips to help safeguard yourself from potential Western Union scams:

- Only employ Western Union for transactions involving people you genuinely know and trust.

- Exercise caution when dealing with individuals you’ve met online or through phone communications.

- The approach offers that seem too enticing with skepticism, as they could be scams.

- Refrain from disclosing your credit card information online or over the phone unless you are sure of dealing with a legitimate entity.

- If you suspect being scammed, promptly notify your credit card issuer to report the fraud and initiate the dispute process.

What should you do when seeing a WUVISAAFT charge in your bank statement?

Encountering a WUVISAAFT charge on your bank statement can be unsettling, but there are clear steps you can take to address the situation effectively:

- Check your records: Begin by reviewing your papers to ensure that you indeed authorized the charge. Verify whether you have made any transactions related to Western Union recently. If you did not allow the payment, move on to the next step.

- Contact your credit card issuer: If you confirm the charge was unauthorized, immediately contact your credit card issuer. Reach out as soon as possible to report the unauthorized account. Your credit card issuer will initiate an investigation into the matter and may proceed to reverse the charge if deemed appropriate.

- File a police report: If the unauthorized charge indicates fraudulent activity, consider filing a police report. This step is essential, as it aids your credit card issuer in their investigation and can potentially lead to the recovery of your funds. A police report adds a layer of legitimacy to your claim.

- Monitor your credit report: Stay vigilant by monitoring your credit report for any other unauthorized charges. If you encounter such tasks, promptly report them to your credit card issuer. Swift action can mitigate potential further damage.

Confronting a WUVISAAFT charge necessitates a thorough response to safeguard your financial interests.

Adhering to these steps enhances the chances of resolving the issue efficiently and minimizing any potential negative consequences.

How to Protect Against Wrong WUVISAAFT Bank Charges?

Shielding yourself from erroneous WUVISAAFT bank charges involves adopting vigilant practices and protective measures.

Here’s a comprehensive approach to safeguarding your financial well-being:

- Regularly Review Your Bank Statements: The cornerstone of prevention is vigilance. Examine your bank statements for unfamiliar or unauthorized transactions, including the WUVISAAFT charge. If you spot discrepancies, promptly report them to your bank for resolution.

- Opt for Credit Cards in Online Transactions: Choose credit cards over debit cards when making online transactions. Credit cards provide enhanced fraud protection, offering an extra layer of security against unauthorized charges.

- Exercise Caution with Email and Text Links: Beware of clicking links in emails or text messages, especially if they claim to be from financial institutions. Phishing attempts often lead to fake websites that capture personal or financial data. Refrain from sharing information via suspicious links.

- Implement Two-Factor Authentication: Elevate your online security by enabling two-factor account authentication. This safeguard mandates entering a code from your phone and your password during login. This added layer thwarts unauthorized access.

- Maintain Updated Software: Keep your software updated, as updates often incorporate vital security patches. These patches bolster your defenses against potential fraud and cyber threats.

- Exercise Skepticism with Offers: Stay cautious when confronted with offers that appear exceptionally lucrative. Scammers frequently use promises of free money or prizes to manipulate individuals into divulging personal and financial data. Treat such requests with skepticism.

Incorporating these proactive measures into your financial routine can significantly diminish the risk of erroneous charges, like the WUVISAAFT charge, and fortify your protection against potential fraud or scams.