MBI SETL, also known as Med-I-Bank or Med-I-Bank Payment System, provides diverse methods for convenient and flexible premium payments for Medibank services.

Quick summary:

MBI SETL and Med-I-Bank Payment System?

Med-I-Bank, also called MBI SETL, offers multiple methods for streamlined premium payments for Medibank services, ranging from direct debits, a mobile app, and an online platform to in-person prices at Australia Post outlets.

Why MBI SETL Charges Appear on Your Statement:

MBI SETL is a legitimate payment processor used for healthcare transactions.

Charges with its name on your bank statement could be due to medical treatments, reimbursements from Flexible Spending Accounts or Health Savings Accounts, employer-sponsored benefits, or a test debit to verify your account information.

With various options designed to suit different preferences, Med-I-Bank ensures ease of payment management.

Here’s an overview of the available payment methods within the Med-I-Bank system:

- Direct Debit: Direct debit is an automated payment method deducting your premium from your bank account on a predetermined monthly date. This hands-off approach eliminates the need for manual payments and ensures timely processing.

- My Medibank App: The My Medibank app, available on mobile devices, offers a platform for payments, balance checking, and claim viewing. Seamlessly manage payments and direct debit settings through this user-friendly app.

- My Medibank Online: My Medibank Online extends the convenience of payment management, balance checking, and claim viewing to a web-based platform. This option offers functionalities like the app, including managing direct debit preferences.

- Automated Phone Service: A computerized phone service operates around the clock, enabling you to make payments using your credit or debit card. This option provides flexibility for payment submission via a phone call.

- BPAY: The BPAY system facilitates bill payments through most Australian banks. By utilizing your Medibank BPAY biller code, you can seamlessly make payments directly from your bank account.

- Post Billpay: Post Billpay, managed by Australia Post, presents another avenue for payment. Your Medibank Post Billpay number allows you to make payments from your bank account through this service.

- Australia Post: At any Australia Post outlet, you can pay your premium in cash or by cheque. This in-person option offers flexibility for those who prefer physical payment methods.

While these payment methods provide convenience, some options involve associated fees.

Refer to the Medibank website for comprehensive information and specific details about each method.

In conclusion, the Med-I-Bank payment system offers a variety of choices to cater to different preferences, ensuring smooth and efficient premium payment experiences.

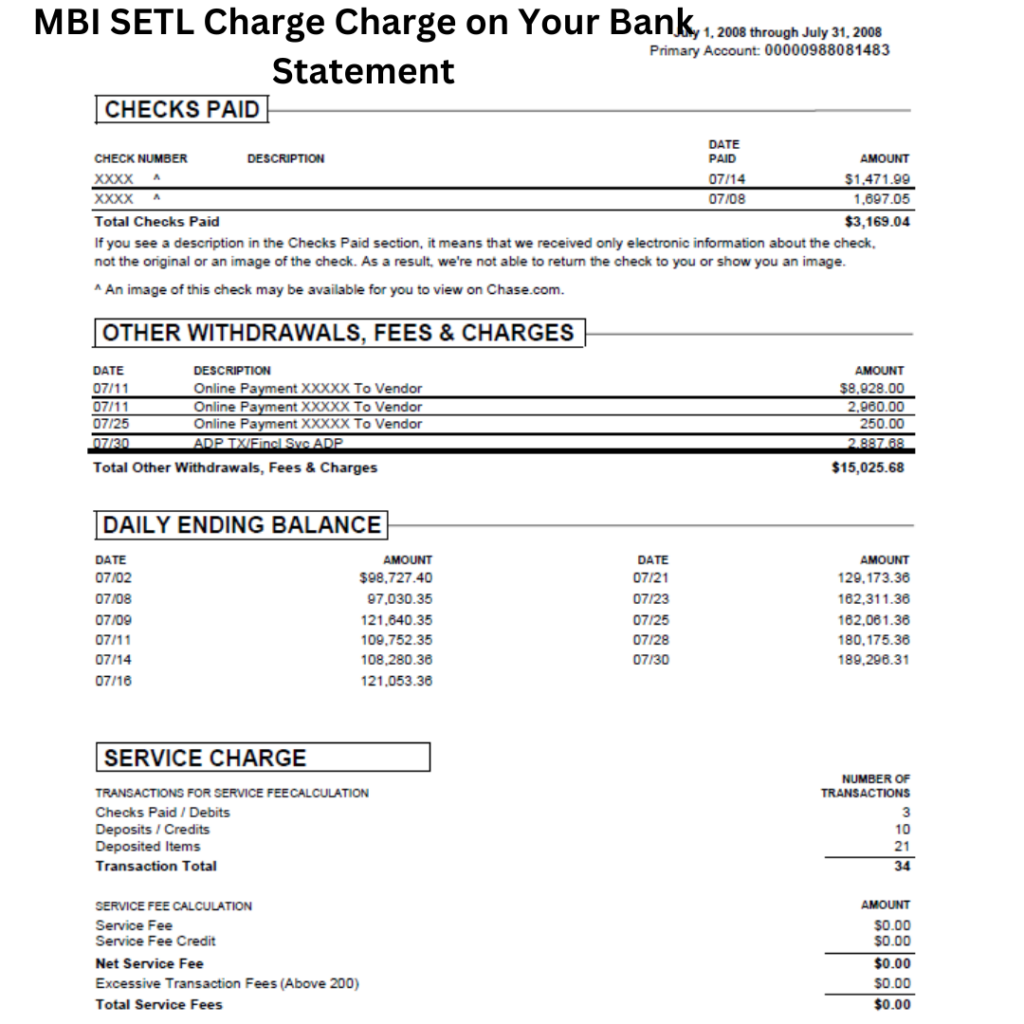

Why is MBI SETL Charge on Your Bank Statement?

The appearance of an MBI SETL charge on your bank statement can be attributed to various reasons related to healthcare transactions and financial processes.

Here’s a breakdown of potential explanations for the MBI SETL charge:

- Healthcare Payment: MBI SETL serves as a payment processor for healthcare providers. If you’ve recently undergone medical treatment or received healthcare services, the charge could represent payment for those services processed through MBI SETL. This scenario is common when settling medical bills.

- Flexible Spending Account (FSA) or Health Savings Account (HSA) Reimbursement: If you possess an FSA or HSA, you might employ it to cover eligible medical expenses. Upon submitting a reimbursement claim, funds could be transferred from your FSA or HSA account to your bank account through MBI SETL. This mechanism facilitates the reimbursement process for qualified medical costs.

- Employer-Sponsored Benefits: MBI SETL is also utilized by some employers to handle payments for employee benefits like health insurance, dental coverage, and vision insurance. If you’ve recently received a benefit payment from your employer, the charge on your bank statement could originate from MBI SETL as part of the benefits processing procedure.

- Test Debit: During the initial setup of a payment method with MBI SETL, a small test debit may be initiated to your bank account. This action serves to validate your account information. Typically, this test debit amount is refunded to your account within a few days, confirming the authenticity of your provided details.

An MBI SETL charge on your bank statement indicates various financial activities associated with healthcare payments, reimbursements, and employer-sponsored benefits.

The nature of the charge will depend on your recent interactions with healthcare services, benefit claims, or account setup procedures.

Is MBI SETL Charge a scam or fraud?

The “MBI SETL Charge” is a legitimate financial transaction associated with Med-I-Bank Settlement, a reputable payment processor within the healthcare industry.

To better understand this context, it’s essential to clarify the terms “scam” and “fraud”:

- Scam: A scam is a deceptive or fraudulent scheme that manipulates individuals into providing money or personal information under pretenses.

- Fraud involves intentionally deceiving someone through dishonesty to gain an advantage, such as money or property.

In the case of the “MBI SETL Charge,” it is not a scam or fraud. This charge is genuine and originates from a well-established company.

Observing this charge on your bank statement indicates that a payment related to your medical care has been processed through MBI SETL.

However, it’s important to remain cautious. There have been instances where scams attempt to exploit the name “MBI SETL” to deceive individuals.

Scammers might send emails or texts that appear to be from MBI SETL, soliciting personal information or payment.

To safeguard yourself, never disclose personal information or make payments to anyone claiming to represent MBI SETL unless you can verify the authenticity of the communication.

While the legitimate MBI SETL Charge is not a scam or fraud, there could be fraudulent activities attempting to misuse the company’s name for illicit purposes.

Stay vigilant and verify the legitimacy of any communication requesting personal or financial details.

What to Do if You Find an MBI SETL Charge on Your Financial Statement or Credit Card?

Discovering an MBI SETL charge on your financial statement or credit card prompts a careful and thorough response.

Follow these steps to address the situation effectively:

- Review Your Bank Statement: Examine your bank statement meticulously. Confirm that you comprehend the nature of the charge and its source. If any uncertainty arises, contact your bank for clarification and additional information.

- Contact Your Healthcare Provider: If you’ve recently undergone medical treatment, contact your healthcare provider. Inquire whether they utilized MBI SETL to process the payment for your medical care. This direct communication can help confirm the legitimacy of the charge.

- Check Your FSA or HSA Account: If you maintain an FSA or HSA account, inspect it for any pending reimbursements. MBI SETL might have processed a refund from your FSA or HSA administrator. This check can help ascertain the origin of the charge.

- Reach Out to Your Employer: If your employer provides benefits such as health insurance, dental coverage, or vision insurance, communicate with them. Determine if they utilize MBI SETL for processing payments related to your employee benefits. This step can provide insights into the charge’s purpose.

- Report Unauthorized Charges: If you identify an unauthorized charge on your financial statement, immediately report it to your bank. Your bank will investigate the cost, implement measures to protect your account and resolve the issue.

Addressing an MBI SETL charge requires a proactive approach, scrutiny, direct communication with relevant parties, and prompt reporting of unauthorized charges.

By following these steps, you can effectively navigate the situation and ensure the security of your financial transactions.

How to Protect Against Wrong MBI SETL Charge Bank Charges?

Safeguarding yourself from erroneous MBI SETL or unauthorized bank charges requires vigilance and proactive measures.

Employ these strategies to ensure the security of your financial transactions:

- Regularly Review Bank Statements: Consistently examine your bank statements to identify unauthorized charges, including MBI SETL charges. The timely review helps you catch discrepancies early and take appropriate action.

- Set Up Account Alerts: Enable bank and credit card account alerts. These notifications will promptly inform you of any account changes or unauthorized transactions, allowing a swift response.

- Guard Personal Information: Exercise caution when sharing personal information online or over the phone. Disclose details only to reputable and trusted websites or companies to minimize the risk of unauthorized access.

- Enhance Security Practices: Bolster your account security by using strong passwords and adopting robust security practices. These measures fortify your accounts against unauthorized access.

- Stay Alert to Scams: Be aware of potential scams that exploit the name “MBI SETL.” Refrain from sharing personal information or making payments unless you can verify the legitimacy of the communication.

- Promptly Contact Your Bank or Credit Card Company: If you encounter an unrecognized charge, promptly contact your bank or credit card issuer. Their investigation will help uncover the source of the head and secure your account.

Additionally, consider these supplementary tips to protect against various bank charges:

- Avoid Overdraft Fees: Familiarize yourself with your bank’s overdraft policy and ensure your account holds sufficient funds to cover your purchases.

- Prevent Late Payment Fees: Pay your bills on time to evade late payment fees, promoting financial discipline.

- Manage Credit Card Balance: Maintain a low credit card balance to minimize interest charges and promote financial stability.

- Exercise Caution with Cash Advances: Beware of high-interest rates and fees associated with cash advances on credit cards.

- Read the Fine Print: Thoroughly understand the terms and conditions before engaging in any financial products to make informed decisions.

Implementing these practices creates a robust defense against unauthorized charges, promotes responsible financial management, and safeguards your economic well-being.