When you notice a charge labeled “Charter Services” on your bank statement, it could be tied to several legitimate or unauthorized transactions.

Let’s break down what these charges could represent:

- Spectrum Telecommunications Company: If you see a charge originating from Spectrum, it is genuine. Spectrum is a renowned telecommunications firm providing various services, including internet, TV, and phone.

- Charter Bank: Charges from Charter Bank, a subsidiary of Charter Communications, are legitimate. Charter Communications is a broad-reaching telecommunications entity, and Charter Bank is one of its arms.

- Companies Owned by Charter Communications: Payments directed to a company that falls under the ownership of Charter Communications are valid. Charter Communications has multiple subsidiaries that offer various services.

- Affiliated Companies: It is legitimate if the payment is made to a business affiliated with Charter Communications. Charter Communications has tie-ups with various companies that might reflect “Charter Services” on your statement.

- Fraudulent Charges: However, if none of the above situations apply and you can’t recognize the transaction, the charge could be fraudulent. Always ensure you acknowledge and can account for all the transactions on your statement.

For those uncertain about the authenticity of a “Charter Services” charge on their bank statement, reaching out to Spectrum’s customer service is a practical first step to seeking clarity.

Additional Information:

- The term “Charter Services” might also make its way to your statement if you’ve transacted with a company that isn’t directly owned or affiliated with Charter Communications but utilizes Charter’s payment processing system.

- If any charge under “Charter Services” seems suspicious or unfamiliar, do not hesitate to contact your bank and consider disputing the payment for your security.

Staying informed and vigilant can ensure the safety of your financial transactions and give you peace of mind regarding your expenditures.

Spectrum changed the charge to “Charter Services.”

In September 2022, these changes were implemented. The underlying reason for shifting from “Spectrum” to “Charter Services” remains undisclosed.

Speculation suggests that Spectrum might be undergoing a rebranding process, though an official statement still needs to be provided.

This transition has led to some confusion among the clientele, with many questioning the unfamiliar “Charter Services” label on their bank statements.

However, Spectrum has reassured its customer base that this modification will maintain the standard of service they are accustomed to.

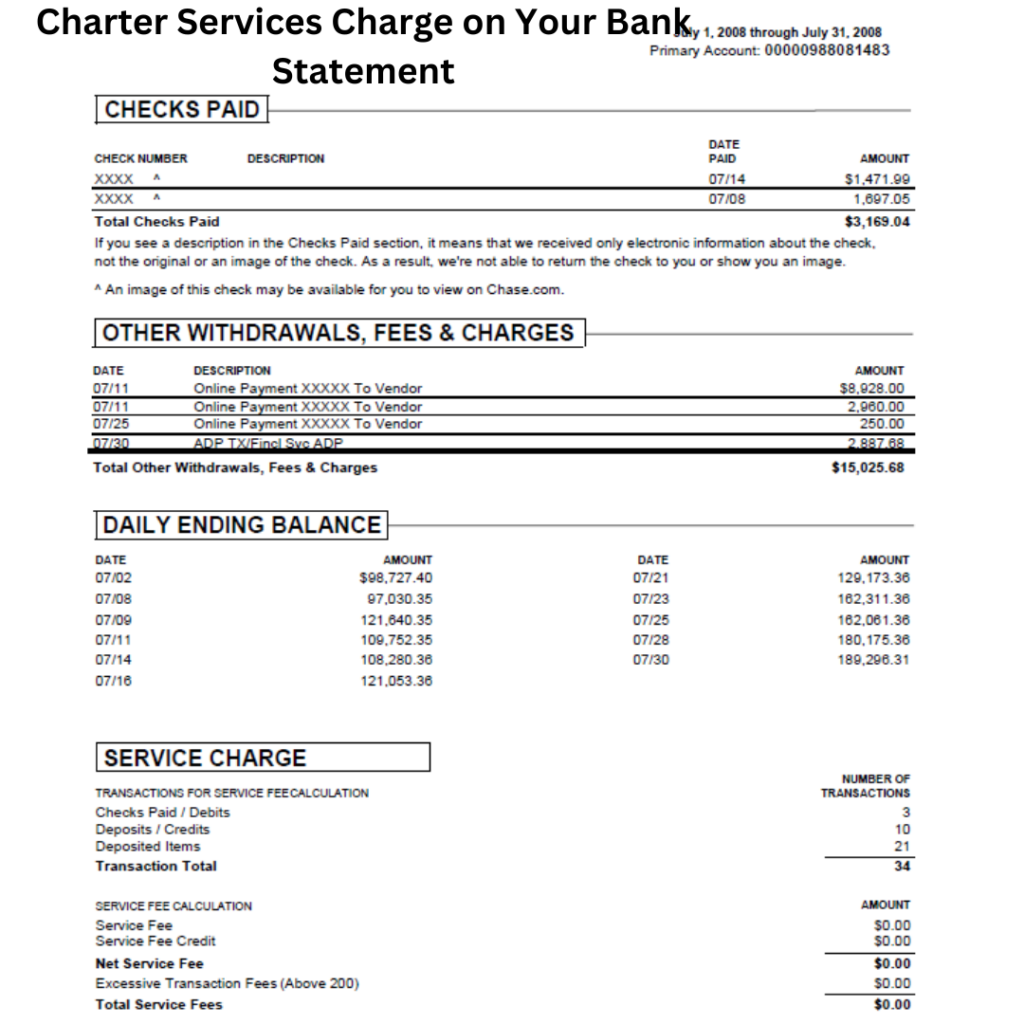

For a clearer perspective, here’s a direct comparison of how the alteration might reflect on a customer’s bank statement:

Old Statement Entry:

Spectrum – Internet – $50.00

New Statement Entry:

Charter Services – Internet – $50.00

Customers are advised to stay informed and to contact Spectrum’s customer service for any clarifications regarding their billing statements.

How to Verify if “Charter Services” is Legit?

Follow these steps to ensure that a “Charter Services” charge is genuine:

Check the billing statement.

- Scrutinize the charge details for Charter Services on your statement. Confirm if it aligns with companies you recognize, such as Spectrum or Charter Bank.

- The statement should mention the company’s physical address and contact number.

Contact the company

- If any uncertainties persist after checking the statement, contact the company directly.

- Spectrum’s dedicated customer service number is 1-855-777-7653. They can provide clarity regarding any charges from Charter Services.

Check online reviews

Investigate online reviews related to the company. Feedback from other customers can offer insights about the company’s legitimacy and experiences.

Look for red flags

Keep an eye out for any unusual details, such as:

- A charge is significantly different from your expectations.

- The absence of a physical address or contact number for the company on your statement.

Dispute with your bank

- If, after your investigations, you remain skeptical about the legitimacy of the charge, get in touch with your bank. They can assist in disputing the order and offer further guidance.

Additional Verification Tips:

- Company’s website: Ensure the company has an official, professional website that uses secure protocols (look for “https” in the URL).

- Logo & contact details: The company’s official logo and comprehensive contact information should be prominently displayed on its website.

- Privacy policy & terms of service: Review the company’s privacy policy and terms of service. This can offer insights into their operational practices.

- Be cautious with companies that immediately request sensitive personal details, such as credit card information or Social Security numbers.

Staying vigilant and proactive in these matters can help ensure the safety and security of your financial information.

Contacting Spectrum Regarding Charter Services Inquiries

If you have queries or need assistance related to “Charter Services,” here’s how to reach out to Spectrum:

- Phone: For immediate assistance or to speak directly with a representative, call 1-855-777-7653.

- Chat: To chat in real-time with a representative, navigate to the Spectrum website and click on the “Chat with us” option.

- Email: For email communications, you can reach out to [email protected]

- Social Media: Spectrum is accessible via social media channels like Facebook, Twitter, and Instagram. If opting for this, remember to provide your account number to expedite the support process (but avoid sharing personal details publicly).

- My Spectrum App: The My Spectrum app offers another convenient channel for communication.

Helpful Tips When Contacting Spectrum:

- Keep your account number handy. This accelerates the process irrespective of the mode of contact.

- Clearly articulate your concerns or issues for effective communication.

- Phone communications might entail waiting times; remain patient.

- If you’re using the chat option, understand that representatives might need a few moments to reply. Your patience is appreciated.

Regardless of your choice of communication, Spectrum is committed to addressing your queries and providing timely solutions.

Similar Charter Services appear on the bank statement:

- Charter Communications

- Charter Spectrum

- Charter Cable

- Charter Bank

- Spectrum Enterprise

- Spectrum Mobile

- Spectrum Bundle

- Spectrum TV

- Spectrum Internet

- Spectrum Voice

- Spectrum Home Phone

How to Protect Against Wrong Charter Services Charges?

Awareness of Scam Signs: Always look for potential red flags, especially in digital communications.

Be skeptical of emails or text messages that unexpectedly request personal details like your credit card or Social Security number.

Trusted Transactions: Paying only to reputable and familiar companies is crucial.

If you receive emails or text messages with links you need clarification, refrain from clicking on them.

Regular Monitoring of Statements: You can promptly identify and address any unauthorized charges by frequently reviewing your bank and credit card statements.

The sooner you notice a discrepancy, the easier it will be to rectify.

Document Everything: Always keep copies or records of your transactions and account statements.

This documentation can be invaluable if you ever need to challenge an unexpected charge.

Online Privacy: Be informed about the personal and financial information you share online. Only provide your details on secure platforms and when necessary.

Strong Password Practices: Ensure that all your online accounts have robust passwords. Regularly updating these passwords and using a mix of characters can significantly reduce the risk of unauthorized access.

Additional Tips:

- Stay informed about scammers’ varied techniques, like phishing emails, deceptive phone calls, or suspicious text messages.

- If there’s ever uncertainty about a specific charge, contacting the respective company to verify the transaction is always a good practice.

- Should you suspect you’ve fallen prey to a scam, immediately report the incident to appropriate authorities, like the Federal Trade Commission.

Charter Services on Your Bank Statement Might Appear in the Following Form:

When perusing your bank statement, you might notice several variations of entries related to Charter Services.

Primarily if you’ve engaged in any transactions or availed of their services.

Here are some of the ways these entries might manifest:

- CHKCARDCharter Services 855-707-7328 MO

- CHECK CARD Charter Services 855-707-7328 MO

- POS Debit Charter Services 855-707-7328 MO

- POS PUR Charter Services 855-707-7328 MO

- POS PURCH Charter Services 855-707-7328 MO

- POS PURCHASE Charter Services 855-707-7328 MO

- POS REFUND Charter Services 855-707-7328 MO

- PRE-AUTH Charter Services 855-707-7328 MO

- PENDING Charter Services 855-707-7328 MO

- Visa Check Card Charter Services 855-707-7328 MO MC

- Misc. Debit Charter Services 855-707-7328 MO

You might also stumble upon charges that closely resemble those of Charter Services, such as:

- CHARTER COMMUNICATIONS 888-438-2427 CA

- CHARTERCOMMUNIC CO ENTRY

- CHARTHOUSE LEARNING CORP

- CHART POOL USA PORTAGE IN

- CHARTWELLS @ I281147 IND

- CHARTWELLS Q21209325

It’s essential to review these entries carefully. If you need more clarification about any charge, it’s advisable to contact the service provider or your bank to ensure that the transactions are authentic and legitimate.