In the past, checks were many people’s favorite mode of payment. However, with the rapid technological development, things have changed for the better.

Now, people can pay their utility bills, make online purchases and transfer funds to their loved ones by just making a few clicks and taps on their bank’s mobile application.

That’s the reason why the once-important mode of payment has become less common. The number of checks written is dropping by a huge percentage every year.

However, even if writing checks seems old, people still do it as they consider it a reliable mode of payment for transferring huge funds.

Generally, when a check is written to you, you take it to a bank and cash it out. However, it is not always the case.

If you are a frequent user or receiver of checks, you might be familiar with the term third-party checks.

Third-party checks are written to one person but signed over to another to cash. As checks are not a preferred mode of payment for many people, they often use them to pay others rather than cashing out themselves.

Are you still not sure what third-party checks are?

Suppose your grandfather gave you a $100 check on Thanksgiving.

However, you are unable to find the time to cash it out. While shopping with your friends, you like one jacket worth $100, but you are out of cash.

You ask your friend for cash and, in return, sign over the check to them. That’s what a third-party check is.

The check was written to you, but you transferred the ownership to your friend by signing it over to them.

Now, the transaction involves three parties – your grandfather, you, and your friend. Do you want to learn more about third-party checks? Read on to find answers to all your third-party checks’ queries!

Why are Third-Party Checks Useful?

Third-party checks might come with a few technicalities and risks, but they also prove quite useful in many situations such as:

Mistakes made on the original check

If the original check writer has made a mistake and the option of writing a new check is not readily available, the recipient can endorse the check to another party. The mistake will matter no longer.

Therefore, if you have a check written to you with few mistakes, it is better to sign it over to a third party.

No Bank Account

What to do if someone has written you a check, but you don’t have a bank account to deposit it?

You might think that opening a bank account is the only way in which you can cash out the check.

However, it is not. If the original recipient does not have a bank account, they can sign it over to a third party to cash it.

Are you wondering how someone can write you a check without putting in your account number?

While it may seem confusing, it still happens. Usually, checks to the minors are written in this particular way so their parents can keep the money safe until they are grown up.

Form of Payment

It is undoubtedly the most common way third-party checks are used. Suppose you owe $150 to your friend and receive a check for that money from your family on your birthday.

In that case, it will be more convenient for you to sign that check over to the friend you owe money to instead of cashing it out and writing a new check to pay your debt.

How to Sign Over a Check to a Third Party?

While endorsing a check to a third party may seem straightforward to many people, some might not be familiar with it.

Do you fall in a similar category?

Stress no more. Here are a few simple steps you need to follow to endorse a check to a third party:

- The original check receiver must write “Pay to the order of” in the endorsement area at the back of the check.

- After that, the original receiver must put their valid signature and the name of the new recipient below the endorsement area.

- The new recipient must put their signature and endorse the check.

Signing a check over to a third party is a simple process. However, some people often make a few mistakes, such as multiple payees’ names, misspelled names, or invalid signatures that the bank notices, and the check gets rejected.

How Do you Deposit a Third Party Check?

Cashing a third-party check does not always go as smoothly as planned. The third-party checks are evaluated by bank employees closely, so no fraud goes undetected.

Therefore, to make sure the check endorsed to you does not get canceled by the bank, you must go well-prepared.

Here are a few simple steps you need to follow to deposit a third-party check successfully:

- Verify the check has been endorsed to you properly. Ensure the original recipient has signed the back of the check and endorsed the check in your name. The bank will not allow you to deposit it if you are not listed as a payee at the back of the check.

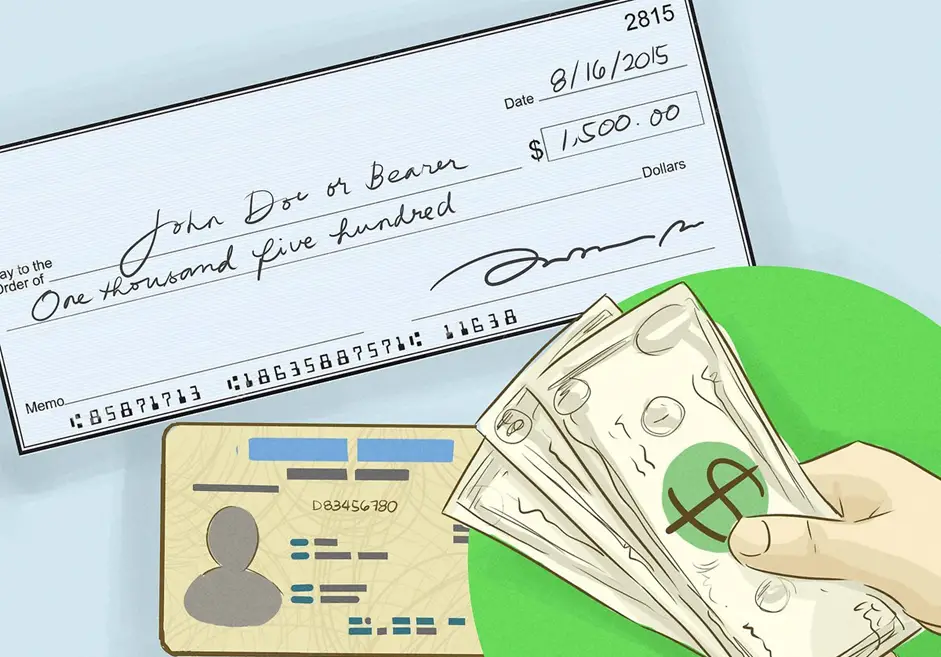

- Before depositing a third-party check, the bank may require you to present your proof of identification, such as an ID card, passport, or driver’s license. Therefore, take your proof of identification with you.

- Visit the bank with the endorsed check and proof of identification. The bank will allow you to cash the third-party check if no fraud is detected.

- Third-party checks can also be deposited at ATMs. However, most banks do not accept third-party checks through ATMs.

List of Banks that Don’t Support Third Party Checks

While third-party checks offer a lot of convenience to people, they also come with unexpected risks and dangers.

Therefore, many banks do not support third-party checks to avoid complications in the future. Here is a list of bank and credit card unions that do not support third-party checks:

- Alliant Credit Union

- Ally Bank

- Bank of the West

- Charles Schwab Bank

- Citizens Bank

- Discover Bank

- KeyBank

- PenFed Credit Union

- Regions Bank

- Wells Fargo

Why Do Most Banks Not Support Third Party Checks?

In today’s world, scammers are targeting people in many creative ways. Unfortunately, third-party checks have become one of the ways through which they scam innocent people.

Many people have fallen victim to the third-party check scam in recent years.

As the danger of fraud and theft is greater with third-party checks, banks and credit card unions have set rigorous guidelines for the approval of third-party checks.

Most of the time, banks have to deal with fraudulent third-party checks.

Therefore, many banks and credit card unions are quite hesitant to accept third-party checks.

Now, you must be wondering how people can be scammed through third-party checks. Here are a few dangers associated with third-party checks:

Depositing a Bad Check

Cashing out a third-party check does not always go well. Therefore, if someone asks you to deposit a check for them, think carefully before you head out to the bank. Many individuals often think of it as a small favor.

However, they don’t know that a small favor can cost them a lot of damage if they unknowingly deposit a bad check.

If the check bounces because of insufficient balance or any other reason, the bank will not only charge you a hefty amount but may freeze your account.

Therefore, you should always accept your close friends and family-endorsed checks only.

Scams

In the past, hundreds and thousands of people have fallen victim to the endorsed checks scam. In this kind of scam, a neighbor, colleague, friend, or a stranger approaches you to deposit a check on their behalf as they cannot do it themselves for some reason.

Also, they will offer you a good amount of money for causing you trouble.

You might not think of it as a big deal. However, it often ends up putting you in big trouble. Later the check gets bounced.

Either the amount will be deducted from your bank account, or the bank will take legal action against you. Therefore, the best approach is to take endorsed checks from only the people you trust.

Conclusion:

Third-party checks are undoubtedly one of the preferred modes of payment for many business people. While it may bring a lot of convenience to people, it is still often associated with fraud and scams.

However, it is not always the case. Many people use third-party checks to pay the amount they owe to someone. Doing so will help them avoid the hassle of depositing the check and writing a new one.

However, most banks and credit card unions do not support third-party checks. In the past, third-party check scams became so significant in numbers that many banks decided to stop accepting third-party checks.

While it may have kept them on the safer side, customers with legitimate third-party checks have suffered a lot.