When you’re reviewing your bank statements while filing tax returns or for other purposes, there are many instances of surprises for you.

More importantly, any unauthorized change or something you didn’t expect or know about can be real patience testers.

At such moments, keeping your calm and tackling the situation can be challenging for many.

However, when you are well aware of why some charges appear on your bank statements, things can be easier to resolve.

Many charges appearing on your bank statements might be unknown to you.

But you should invest time to learn about common terminologies, charges, and other items that might appear on your bank statement- otherwise, you would never know some companies are robbing money out of your pockets for no obvious reasons.

In today’s article, we’re going to talk about a company’s charge that you might be paying every month even without knowing.

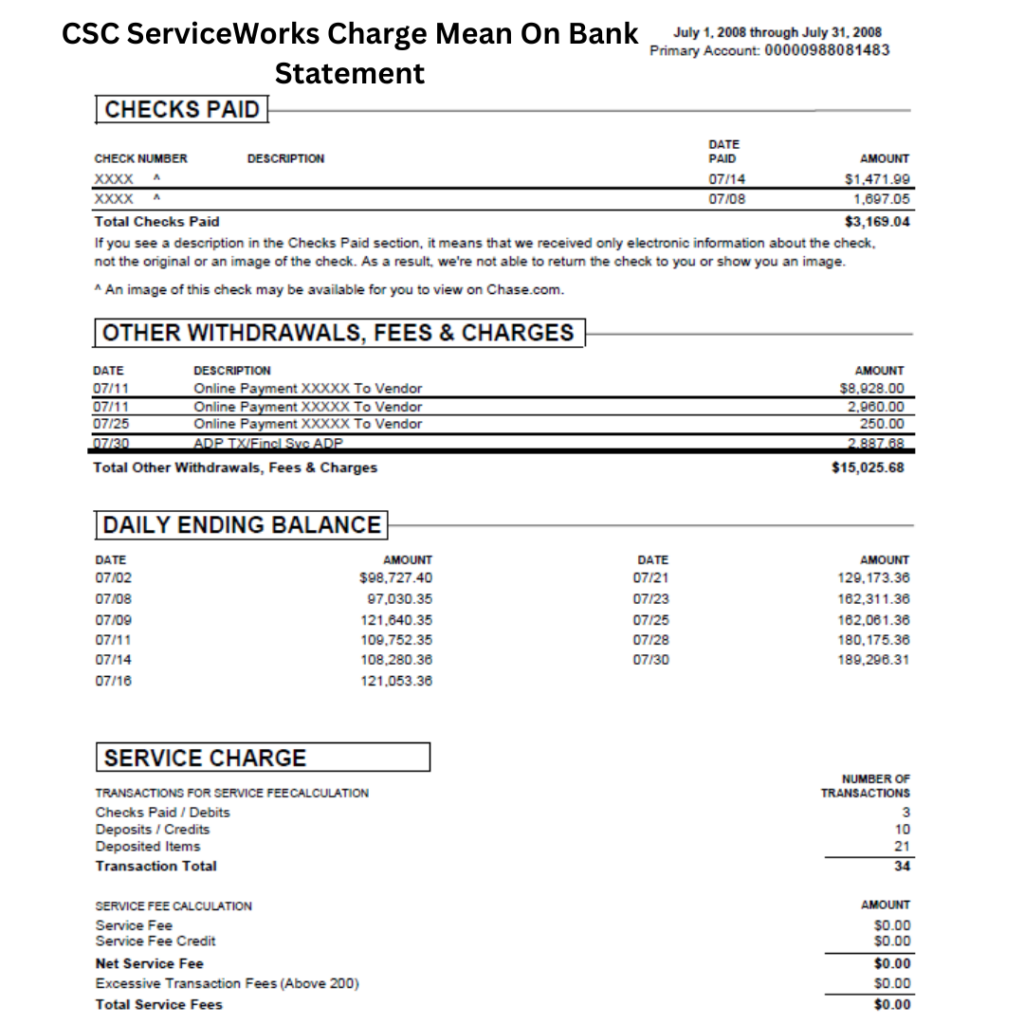

We will explore why you’re being changed and what the CSC ServiceWorks charge means on your bank statement.

Our purpose is to educate you on personal finance and related issues so that you know about things and how to examine your bank and card statements.

So let’s get into it.

What Is CSC ServiceWorks Charge?

For most people, CSC means “Card security code,” or what many of us understand as CVC. However, the CSC we’re referring to means something else.

Therefore, if you had ignored the charge because you believed it to be some regular charge, you are making a mistake and should know if you’re subject to these charges.

So, what is the CSC ServiceWorks charge on your bank statement?

CSC ServiceWorks charge is subject to the charges implemented by a New York-based laundry and air vending service to commercial and individual users.

The company has over 150,000 clients.

The charge appears on the bank statements of those users who had purchased or used services or products of The mentioned company.

However, many users have reported that they were charged the amount for no known reason. Before we dig into why the charge might appear on your bank statement, let’s briefly overview CSC company.

What is CSC ServiceWorks?

CSC ServiceWorks has a rich history of almost 100 years in laundry and air vending services for individual and commercial customers.

The company serves different markets including European countries, the USA, and Canada.

The team of 3200 employees has over 150,000 satisfied clients in different regions of the world. The company is based in New York, and the current CEO of the company is Sal Niola. A brief overview of the company’s services is as follows:

Laundry service

The laundry services of the company are further divided into community, in-home, and commercial markets.

The company has covered all markets, be it a community laundry unit or an in-home machine. The community laundry solutions provided by the company include a complete design of the system for lease agreements & digital laundry payment and monitoring system.

The commercial solutions of the company include industrial equipment, on-premise services, after-support line evaluations, analysis, customizations, installation, etc.

Air services

Air services of the company and for commercial users with a promise of increased revenues by in air & vacuum equipment the CSC ServiceWorks.

The company commits to take care of everything from installation to maintenance and operational reports.

How Can You Be Charged the CSC Serviceworks Fee?

When you see the CSC ServiceWorks change on your bank statement, and you’re sure it is not a CSC/CVC charge, there can be two possible scenarios for which your card or bank is charged for this company.

- One-time payment

- Recurring charges.

One-time payments usually refer to the payments due for using the service of the company. On the other hand, recurring charges mean a regular payment is being deducted from your account at intervals.

If you’re sure these charges do not belong to your account, we will tell you what you need to do in the next section.

What to do?

If you’ve not bought or used services of CSC company in the near future directly or indirectly, there are certain ways to resolve the issue. We will briefly overview these ways:

Contact Company

When you see the charge on your account, the first thing you must do is make sure the change belongs to the service product you or your family members think you might have used.

However, if you’re sure that change doesn’t belong to you, contact the company first. It will help you clarify why the change is shown in your statement.

Whatever the case, you will get a better perspective of your circumstances.

Dispute with Bank or Credit Card Company

Once you’ve confirmed from the company that no such change was applicable to your account, it’s time for real-time resolution.

You can open a dispute with your bank or card company and get a refund of the amount taken away from your account.

You can also request the CSC company to remove or refund the change that doesn’t belong to your account.

Case Study: CSC Serviceworks Sued For Unauthorized Charges

Before we jump to the next part to guide you about analyzing your statements, let’s have an overview of the case study where clients accused CSC ServiceWorks of Misc. charges.

According to the case, Rrb2, LLC vs. CSC ServiceWorks, the company CSC was accused of imposing an unlawful “administrative fee” fee on its clients’ accounts.

This practice is a breach of contracts.

The contents of the lawsuit also explained the company’s business as a coin-operated laundry machine business.

As per the lawsuit, the company gained a competitive advantage and acquired a major market share. However, after the company’s success, they started to charge a 9.75% administrative fee.

The charge was claimed to be unlawful because it was not mentioned in the original agreements.

Regardless of the verdict of the lawsuit, it is a supreme example of why you should regularly review and analyze your bank statements and rectify any mistakes and unlawful charges.

How To Review Your Bank Statements For Mistakes And Unlawful Charges?

Here is the step-by-step guide on how to review your bank statements on a regular basis:

1. Conduct scrutiny

The first thing you need to do is an initial scrutiny of your bank statements and transactions to make sure that any charges appearing on your statements relate to your account.

If you find any unauthorized or suspicious charges.

1. Contact Your Bank

Once you have located unrelated charges or unauthorized expenses, you next should contact your bank and inquire about the suspicious charges appearing.

2. Check your mails

When your bank confirms that the payments made from your account have been authenticated, the next step is to check your old emails to retrieve any information about invoices, receipts, etc.

3. Discuss with other users of your account

Even if you cannot retrieve any information, you should discuss it with your family members who might be sharing your account or card.

4. File dispute for discrepancies

After confirmation from all sources, you might reach a conclusion if the payments are authorized or unauthorized.

Depending on the review conclusion, you can initiate a dispute with your bank or the company that has charged your account without your agreement.

Conclusion

We have discussed everything you need to know about what CSC ServiceWorks charge means on your bank statements and why your account might have been charged for these fees.

When you’re sure that the charges do not belong to your accounts, you should review your account statements and file the dispute for appropriate resolution or refund.

FAQs

What does CSC ServiceWorks mean?

CSC can have different meanings depending on the field or industry. However, CSC ServiceWorks is a US-based company that offers laundry and air vending services to community, commercial, and individual users.

The company offers solutions to different customers and assists in turning in tech-based system installations, maintenance, and operations.

What is the full form of CSC in finance?

In finance, CSC stands for Card security code, a 3-digit or 4-digit code printed on your debit/credit cards. The code is mandatory when you’re using The card for online payments and authorizations.

How do I put money on my CSC ServiceWorks card?

If you want to put money on your CSC ServiceWorks card, you can reload it via the online portal. For cards having letters ‘E’ or ‘ESD’, reload your card at http://sdirevalue.com.

On the other hand, if your laundry card begins with ‘HMPD’, refill it at https://m.revuemycard.com/cscserviceworks/register.aspx.