Borrowell claims to be Canada’s most trusted personal finance platform, but does it live up to the hype?

In this honest Borrowell review, we take an in-depth look at this app and tell you everything you need to know about it, including its benefits and drawbacks.

In our in-depth review of Borrowell, we found that Borrowell is not a scam but a legit platform. With its reputation alone, this brand has a lot going for it. Millions of Canadians are loyal to it. To learn more about how to borrow money safely, keep reading!

Borrowell Overview

Here are some details you might want to know about Borrowell.

There are over one million customers of Borrowell, making it one of the largest financial technology companies in Canada.

Since 2014, the company has been in business, with its headquarters in Toronto. It has partnered with Equifax to provide credit score coaching and monitoring services.

Among its innovations, Borrowell offered free credit scores to Canadians for the first time, as well as the first AI-powered Credit Coach, Molly, who shared tips with Borrowell users. These tips can help them improve their credit.

When it comes to borrowing money, Borrowell functions under the following principle.

In addition to getting a free credit score from Equifax when you sign up for Borrowell, some of the other things it does help with borrowing and choosing whether you want a credit card or a mortgage.

Borrowell Quick Highlights

- Have been affiliated with various financial institutions and brokerage firms

- Personalized matching program

- Received thousands of positive reviews on the internet

- Credit coach powered by artificial intelligence

- Includes an array of financial services, including monitoring

- Free credit score

- Loan guides and mentors for mortgages

At Borrowell, you’ll find all sorts of financial products that will be helpful with any financial needs.

This brand also boasts a knowledgeable management team. It has garnered the backing and partnership of well-known brands like CIBC, BMO, EQ Bank, Scotiabank, National Bank of Canada, Capital One, Wealthsimple, and MBNA.

For now, these Borrowell services are unavailable in the following Canadian provinces and territories: Saskatchewan, Nunavut, Yukon, and the Northwest Territories.

Will I Have To Pay Extra Money While Using Borrowell?

Borrowell is not a lender but rather an alternative credit-monitoring service. This means you don’t have to pay fees or costs when using Borrowell. Sign up, link your financial accounts, and check your credit score regularly.

Borrowell offers free access to your credit report and score on their website. They offer three different subscription plans (Basic, Essential, and Premium) that provide additional services at different prices.

If you subscribe to one of these packages, Borrowell will automatically charge your payment method once per month. However, it is possible to cancel your subscription anytime if you are unsatisfied with their services.

As long as you do so before your next billing date, there will be no extra charges from Borrowell. So how much does it cost to use Borrowell? The short answer: nothing!

Does My Credit Score Factor Into The Approval Of A Loan?

Your credit score is significant when applying for a traditional bank or credit union loan. Poor credit scores typically lead to banks turning down applicants with poor credit scores. Your credit score simply shows how well you can handle repayments and debts.

Unlike traditional lenders, alternative lenders offer more flexible requirements and consider more factors than just your credit score.

They will usually examine your income, employment, debt-to-income ratio, and other factors to determine eligibility.

What Are The Advantages Of Using Borrowell Compared With Other Credit Score Services?

The most significant advantage of using Borrowell is that it’s free or looks like it. When you sign up for their services, they’ll ask you if you want an instant credit score. You can say no, but most people will click yes and get an instant score.

They don’t tell you that there are strings attached: You have to give them your email address and agree to receive marketing emails from them.

If you don’t do either of these things, then there will be no way for them to send your score directly to your inbox; instead, they will have it sent via snail mail.

This isn’t necessarily a bad thing—if you need your credit score now, why not just enter your information?

But what about those who want to monitor their scores over time? Do they need to provide all of their personal information to receive regular updates on how they’re doing concerning their FICO score?

It seems dubious at best. In fact, we found several reviews online claiming Borrowell has been sending them spam emails after signing up for their service. In one case, someone said they had been receiving dozens of spam emails every day since signing up with Borrowell.

We didn’t find any cases where someone was receiving legitimate updates on their credit score by opting out of receiving marketing materials from Borrowell.

So, What Does All Of This Mean?

Well, as far as we can tell, Borrowell only cares about getting your email address so they can market to you.

They aren’t interested in helping you improve your credit score unless it means more money for them (i.e., through affiliate links).

This doesn’t sound too great compared to other options that help users manage their credit scores effectively and responsibly.

For example, Credit Sesame provides free access to your TransUnion credit report and score, which is updated monthly.

There are also helpful articles on their website explaining how to use your credit wisely and avoid identity theft.

So, while Borrowell may be accessible upfront, it could cost you later down the road if they continue to inundate you with unwanted marketing material.

What is the Borrowell Boost Program?

With Borrowell Boost, you’re getting both an insurance policy and a personal loan simultaneously. It costs $4.99 + tax per month. Using Borrowell, you can track your checking account, forecast your bills, and be alert when you run low on cash.

The $75 boost can provide a temporary boost if needed. You can apply no matter what your credit history is.

The growth can only be used once per person and must be repaid within 15 days. However, as long as you subscribe to the program, you can have as many boosts as you would like.

What Are The Pros And Cons Of Borrowell?

Here are some pros and cons of Borrowell.

Pros

- Superior safety standards at the bank level

- Monitoring of your credit score is offered for free

- It is an excellent alternative to using a credit card company for debt management

- Getting a loan is fast and hassle-free

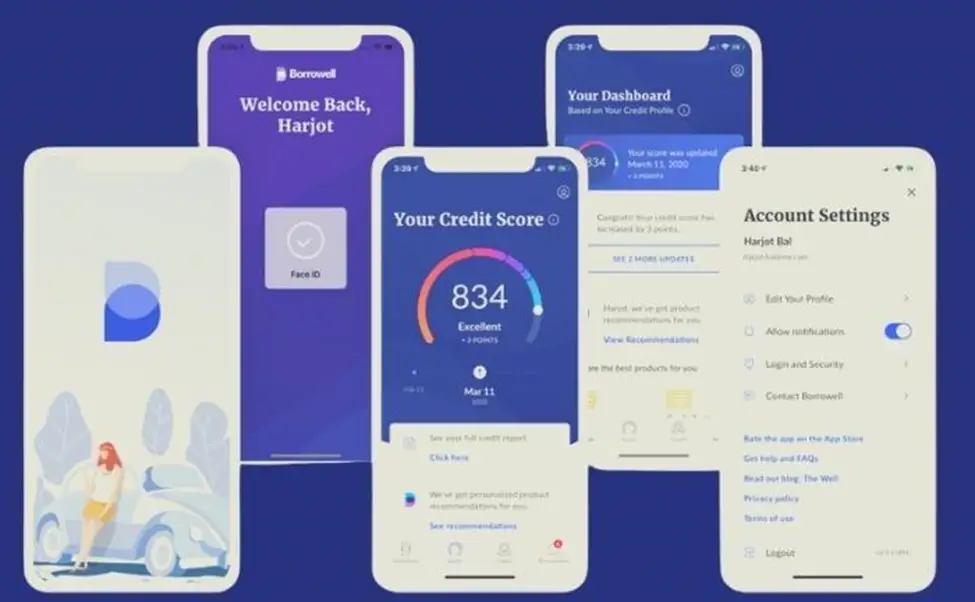

- The application is simple to easy to use

- There are free credit scores and improvement tips provided every week.

Cons

- A limited selection of loans

- Interest rates aren’t as low as those on the Home Equity Line of Credits

- High risk/return financial services (or content)

My Verdict on Borrowell

To be honest, I’m amazed about Borrowell. At first, I couldn’t believe it could work, but now that I tried it myself, I’m sure Borrowel is 100% legitimate.

Everything changed as soon as I signed up for Borrowel’s free trial. This service works amazingly well! And to top it off, their customer support is second to none!

In conclusion: If you’re reading these words right now and thinking should I try out Borrowel?, my answer would have to be YES! You won’t regret it!

Frequently Asked Questions (FAQs)

Here are some faqs about Borrowell.

Is Borrowell Legit & Secure?

The most important thing about online lending, in general, is security. ‘Ensuring the security of user data is their utmost priority, and they spend a lot of money on it,’ states Borrowell.

There is no shady business here; it uses advanced 256-bit data encryption and similar technology to traditional banks.

How Does Borrowell Make Money?

They make money by providing you with periodic recommendations.

A few of Borrowell’s recommendations are as follows:

- Personal banking recommendations

- Personalized product recommendations

- Personalized credit card recommendations (cards with a high likelihood of approval)

As a result of your signing up for Borrowell’s recommendations, Borrowell receives a commission from them (for no additional charge to you). That is how Borrowell generates revenue.

What Does The Average Borrowell Personal Loan Cost?

Borrowell’s website provides information about the costs of their loans, which is another positive aspect.

As with most lenders, they can help you calculate how much interest you will theoretically pay throughout the loan. Unlike many lending websites, Borrowell details its loan origination fees within its FAQ section.

Borrowell charges the following fees:

- Origination fees of 1% to 5% (of the loan balance) are charged once.

- The interest rate ranges from 5.6% to 29.19% APR (the average rate is 11%-12%)

Borrowell Accepts What Types Of Borrowers?

Being a Borrowell member isn’t tricky, but you might have difficulty getting approved for the most cost-effective loans if you don’t have perfect financial conditions.

A good credit score, a low amount of outstanding debt, and a minimum yearly income of $20,000 will increase your chances of receiving favorable results when applying.