Introduction

Debit and credit are the opposite sides of the same coin in accounting terms. When an entry is done, at one side it is entered as debit, while on the other side of the accounts book, it is entered as a credit.

This is known as the double-entry bookkeeping method. It is the standard across every financial industry. The history of double-entry bookkeeping goes back to almost a thousand years!

The debit and credit entries create double entries for every single transaction. This makes it easy to track any issues, financial imbalances, or any other problem by checking both the debit and credit entry.

For an accounts book to balance, the credit side of the accounts book must be equal to the debit side of the accounts book. The debit goes to the left side of a T-accounts book, whereas on the right side is where the credit is entered.

Example

Consider, for example, a Business called company A, which receives orders worth ten thousand dollars from one of its suppliers. Company A is expected to pay for that product after three months, but it has already received the products. Now, to accounts, the company has ten thousand dollars worth of products which it is not expected to pay for after three months.

How would this order of ten thousand dollars worth of product go into the accounts book of company A? Ten thousand dollars would be entered as both a credit and debit? It would be entered as an increase on the debit side because the company has received products worth ten thousand dollars, while at the same time, the ten thousand dollars would also be taken out of the credit side, but after three months, because the company is expected to pay for it after three months.

The increase in ten thousand dollars on the debit side is equal to the decrease of ten thousand dollars on the credit side. As a result, the accounts book of Company A is balance. This is the advantage of double-entry bookkeeping.

Rules of debits and credits in accounting

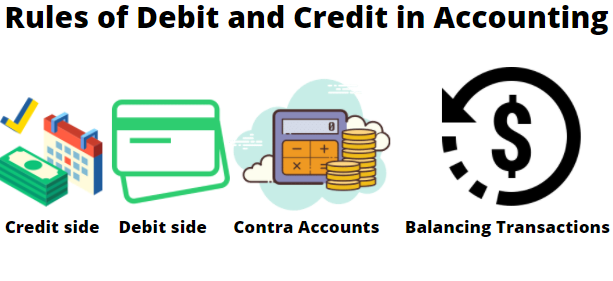

There are four simple rules to remember when doing entries in an accounts book regarding debits and credits in accounting. The four rules are visualized in figure 1 below:

Figure 1: The four rules of Debit and credit in accounting

The four rules shown in figure one for debit and credit in accounting are when does credit side increases, when do debit side increases, what are contra accounts, and it is extremely important to balance the credit and debit side.

When does credit side increase?

This is the very first rule in debit and credit in accounting. The credit side, which is on the left side of the T-Balance sheet, increases when credit is added to it. The credit side only decreases when the debt is added to it. This is because the debt is on the opposite side of the balance sheet.

The addition of the debit means, either the suppliers have received payments, or if your company is the one which is supplying, it has supplied products to the other company. The credit side of the balance sheet includes liabilities, revenues, and equity.

A simple example of this can be seen when you take out money from your bank account, you would receive a message from your bank that one hundred dollars have been debited from your account. The bank transaction follows the same logic.

When does the debit side increase?

It follows the same principle as when the credit side increases. But, in this case, the debit side increases when debt is added to the left side of the T-account balance sheet and decreases when credit is added to the right side of the T-account balance sheet.

This happens because in the double-entry bookkeeping both sides of the accounts balance sheet must balance. The increase in credit must be balanced by an equal decrease in debit. The debit side includes assets, dividends, and expenses.

Keep in mind above stated example of the bank transaction. The other side of it would your credit side of the bank would decrease, as you have debited your account for one hundred dollars.

Contra Accounts

A contra account is a connected account that offsets the balance in another account, related to that account. Contra accounts are really important for credit and debit entries.

For example, a contra asset account would be connected to the liabilities side, and a contra liabilities account would be connected to the asset side. An increase or decrease in one side of the accounts causes an increase or decrease in another side of the contra account.

The debit and credit sides are also connected through the same contra accounts. When the credit side increases, the contra account decreases the amount on the debit side for a similar amount. In a similar way, the increase on the debit side causes an equal decrease on the credit side of the T-Balance sheet.

Balancing Transaction

This is the final and most rules of the debits and credits in accounting. The credit side must equal the balance side for each and every transaction. This is the basic rule of a double-entry bookkeeping method.

The increase on the credit side of the T-accounts balance sheet must be matched by an equal decrease on the debit side of the T-accounts balance sheet, and vice versa.

If both sides do not match, it means that the books are not balanced, which means either an error occurred in the noting of transactions in the accounting books or a financial mismatch exists in the accounting books. So, it is extremely important that the transactions are balanced.

Conclusion

There are four simple rules of debits and credits in accounting. It is extremely important that all four of these rules are followed when entering a transaction in accounting books. If these rules are not followed, then multiple issues could occur which would cause financial problems for the company in the future.