1. Introduction

Accounting concepts make up the backbone of the accounting principle. These are the set of basic rules, laws, regulations, and assumptions which are kept in mind when entering a transaction in accounts books. Experienced accountants keep the entire accounts rule in mind when preparing an accounts book.

These are as common to accountants in their work as the air is around us. These are concepts and assumptions, and there is no evidence for these. But, everyone in accounting believes that these concepts are self-evident.

2. Main accounting concepts

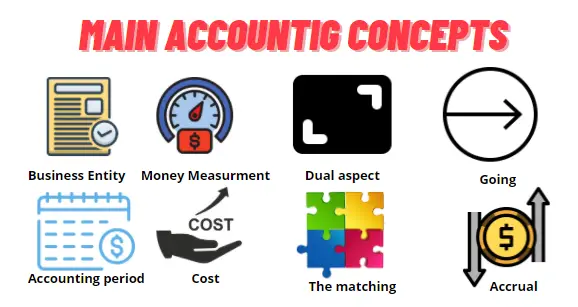

There are multitudes of accounting concepts, but the main ones which are also the most important ones are given in figure 1 below:

Figure 1: Main types of accounting concepts

The eight main types of accounting concepts noted in figure 1 are the business entity concept, money measurement concept, dual aspect concept, going concept, accounting period concept, cost concept, the matching concept, and accrual concept. The details regarding all eight of the accounting concepts are given below:

2.1 Business Entity concept

It is the most basic of the accounting concept. The business entity concept assumes that business owners are completely separate entities from the business. It means that the business is a standalone entity. The accounting books are kept separated from the books of the business owners. The books are kept from the point of view of the business.

The owners are referred to as creditors to the Business. So, when an owner puts money into the business, it is seen as the owner extending a line of credit to the business.

2.2 Money Measurement Concept

The money measurement concept refers to the transaction recorded by a business only in terms of money. What it means is that for a business, an account book can record only those transactions which involve monetary transfers. Any other transfers or transactions which do not involve any money transfer are not recorded into the accounts books.

This means that many important transfers which do not include money are not noted in the accounts book of the business. This concept also requires that a business also put a monetary value on its intangible assets such as brand name or intellectual property.

2.3 Dual Aspect Concept

The dual aspect concept refers to the double-entry bookkeeping method. It means each transaction must be noted twice. Once on the debit side and secondly on the credit side; the dual aspect concept is very important because it helps balance the accounting books.

When a transaction is noted two times on the opposite sides of the same balance sheet, it makes it incredibly easy to check whether the transactions recorded in the balance sheets are correct or wrong. It significantly reduces the chances of any financial mishaps happening.

2.4 Going Concern Concept

The accountants use this concept when there is a significant concern regarding the liquidation of the assets. The going concern concept is applied when the chances are high that the company would be liquidated in the next two or four quarters.

Usually, when keeping books, accountants do not think that the businesses would soon be bankrupt or be liquidated; this allows the accountants to put a price on assets that can be correct for a long time.

But, if there are serious concerns regarding the financial health of the company, meaning the company is going bankrupt or would be liquidated or sold, the accounts put a value on the resources of the company.

2.5 Accounting period Concept

The accounting period concept refers to the division of accounts records into similar multiple measured times. The time can be a quarter, semi year or a whole year. The performance of the company is measured and then disclosed to the investors in regular time periods.

The time period for which a company discloses the information mainly depends upon whether the company is privately held or publically listed.

If it is publically listed, it must disclose its performance every quarter, if it is a private company, it is left to the company on how or whether it discloses its financial performance.

2.6 Cost Concept

This concept allows for the value of an asset to be noted in the balance sheet at the price at which it was purchased, or cost price, as opposed to the current price of that asset.

For example, machinery or equipment purchased would be noted at its purchased price rather than its current price, even if the machinery is very old, and is not worth the purchased price. For this, depreciation is introduced to take into account a reduction in the price of an asset.

2.7 Matching Concept

The matching concept refers to reporting of the revenues and expenses in the same time period. The revenues and expenses of a company must be recognized by the company under the same accounting period.

This is very important because if a company does not recognize the expenses and revenues under the same accounting period, it would lead to a mismatch between profits and expenses, as profits may be overstated due to the mismatch between accounting timelines.

2.8 Accrual Concept

The accrual concept allows for the income and expenses to be stated in the same accounting period that it was incurred in and not in the accounting period in which the income was obtained or the expenses were paid. This is known as the Accrual concept.

A lot of times, suppliers are not paid exactly when they deliver the goods. The payment time can range from one week to six months. The accrual period allows the supplier to note the income from delivering goods at the time those goods were delivered and not the time when those goods were paid for. The accrual concept allows for precise measurement of income and expenses.

3. Conclusion

A good accountant must have a complete grasp of all the important accounting concepts. These are the bases of the accountings. If the base is not good, then the bookkeeping would also be not good.