What Is Absorption Costing?

Absorption costing is a tool used in management accounting to capture entire expenses connected to manufacturing a certain product. For external reporting, generally recognized accounting principles (GAAP) demand absorption costing.

Moreover, it is a costing process for valuing inventory. It’s also known as complete costing because it accounts for all direct manufacturing costs, including labor, raw materials, and any fixed or variable overheads.

Components of Absorption Costing

Fixed and variable selling and overall administration costs are treated as period costs in absorption costing, and they are expensed in the period in which they occur; they are not included in the cost of production.

The following are the primary components of the product cost in absorption costing:

- Direct Labor (DL) – the direct labor consumed due to the unit’s making, valued at the applicable labor rate;

- Direct Materials (DM) – the direct resources utilized in the unit’s creation, valued at the applicable labor rate;

- Fixed Manufacturing Overheads (FMOH) – costs of running a facility that do not change with output volume, such as rent, insurance, and so on;

- Variable Manufacturing Overheads (VMOH) – The rate of running an industrial plant that fluctuates depending on production volume, for example, energy, water, and so on.

Steps of Absorption Costing

These three procedures must be followed to use the absorption costing method of cost allocation:

- Allocate costs to cost pools – create a record of groups of financial records to numerous cost pools; it should be carefully examined, as everyday alterations obstruct upcoming examination;

- Estimate the procedure based on activity metrics, such as a machine or labor hours;

- Assigning costs – determine the distribution ratio and allot overhead to manufactured possessions.

What Is Absorption Costing Income Statement

The traditional income statement, also known as the absorption costing income statement, is created using absorption costing. Costs are divided into product and period costs in this income statement.

Absorption costing states that every product has a set overhead cost, regardless of whether it is sold or not during a certain period. This means that all costs must be included at the end of an inventory, which is normally done as a balance sheet asset.

As a result, when using an absorption statement, it is common to find that the expense on the income statement is smaller.

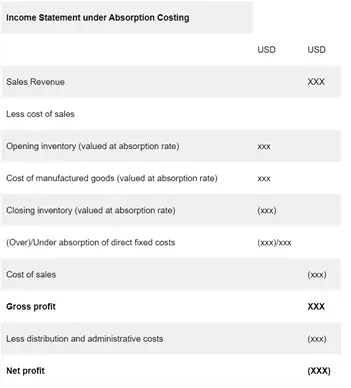

Income Statement Under Absorption Costing

Administrative, selling and manufacturing costs are all separated into three categories by absorption costing.

Category 1: In order to calculate gross margin/gross profit on sales in the income statement, all production expenses, both fixed and variable, are deducted from the sales revenue.

Category 2: The net operating income is found by subtracting the variable and fixed administrative and selling expenses from the gross profit/gross margin.

Category 3: Fixed factory or manufacturing overheads are charged to the units produced at a predetermined fixed manufacturing overhead rate.

The fixed manufacturing overhead rate is calculated using the formula:

= (Standard fixed manufacturing overheads / Normal level of output)

Adjustments are made for the level of output differences if the actual output level is higher or lower than the normal output level. The amount of over-absorption is deducted from the total cost of items created and sold if the actual output level exceeds the typical output level.

The amount of under-absorption is added to the cost of items created and sold if the actual output level is less than the normal output level.

The Format For the Traditional Income Statement

The most basic approach is to represent gross profit as sales minus the cost of items sold. Also, indicate the operational income equal to the gross profit minus the selling and administrative expenses.

Creating an Absorption Costing Income Statement

According to accounting tools, the primary item on an absorption income statement is gross revenues for the period. The cost of products sold is next. To calculate COGS, add the cost of products produced for the time to the dollar worth of initial inventory.

The resulting figure represents commodities for sale. The cost of goods sold (COGS) is calculated when the ending inventory dollar value is subtracted. To get the gross margin, minus gross sales from the cost of goods sold. To compute net operating income for the period, subtract selling expenses.

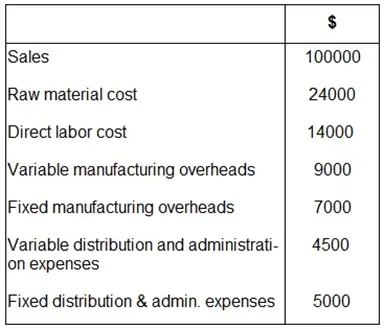

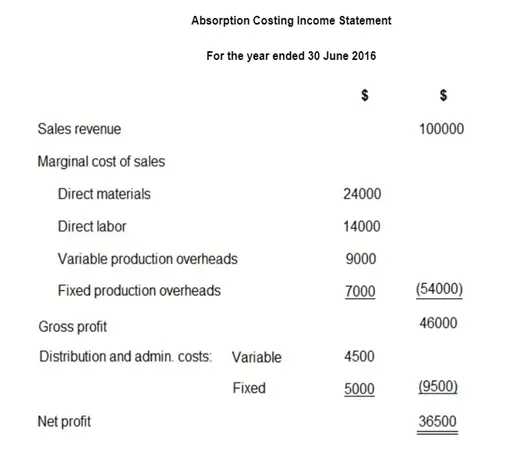

Example

By means of this technique to determine profits, no distinction is made between variable and fixed costs. As the absorption costing statement assumes that products have fixed costs, all manufacturing costs must be contained within the creation cost, whether variable or fixed.

A company sells ice cream. The following data is available for the fiscal year ending June 30, 2016.

Solution:

Advantages

Since it is the generally acknowledged type of accounting idea needed by the Internal Revenue Service, absorption costing offers an advantage over other account formats; however, there are a number of reasons and benefits to absorption costing, including but not limited to:

- It assists in the tracking of returns earned over the course of an accounting period, taking into account all production expenses, not just direct costs.

- It provides a summary of the fixed expenses associated with the end of an inventory.

- It keeps a check of profit more precisely during an accounting period by accounting for all expenditures of making (as well as fixed costs) rather than just primary costs.

- It assures accountability for unsold products and allows for a better net profit calculation by lowering real expenses reported on the income statement for a given period.

- It can be useful in assessing a product’s acceptable selling price.

- It obeys the Internal Revenue Service’s (IRS) and Generally accepted accounting principles (GAAP).

- It allows for precision, especially in terminating inventories. On the other hand, this is to avoid the loss of expenses related to the whole cost of inventory.

Disadvantages

While we may want to recognize absorption costing is different advantages/benefits, such as financial and tax reporting, we also need to be aware of its few disadvantages/cons. Among them below are the following:

- Absorption costing is not effective for product decision-making since it comprises attributing fixed production costs to the product cost.

- It is not always easy to evaluate and comprehend. This is because this strategy’s fixed overhead incremental expenses are not stated.

- It is also impractical for analysis meant to improve financial and operational efficiency, along with linking product positions.

- Since not all fixed costs are deducted from revenue unless the products are sold, absorption costing might tilt a business’s profit level.

- It has the potential to overstate a company’s profitability throughout a financial period. This is because not all fixed costs are accounted for and deducted from the company’s revenue. An expectation, on the other hand, maybe when a corporation sells off all of its manufactured goods.

- As some manufactured products go unsold at the conclusion of a period, it normally results in a gain in net income.

Overall, this statement is much easier to make if you understand product and period costs. Calculate the unit cost first, as that is the most difficult portion of the statement. The rest of the statement is simple once you have the unit cost.