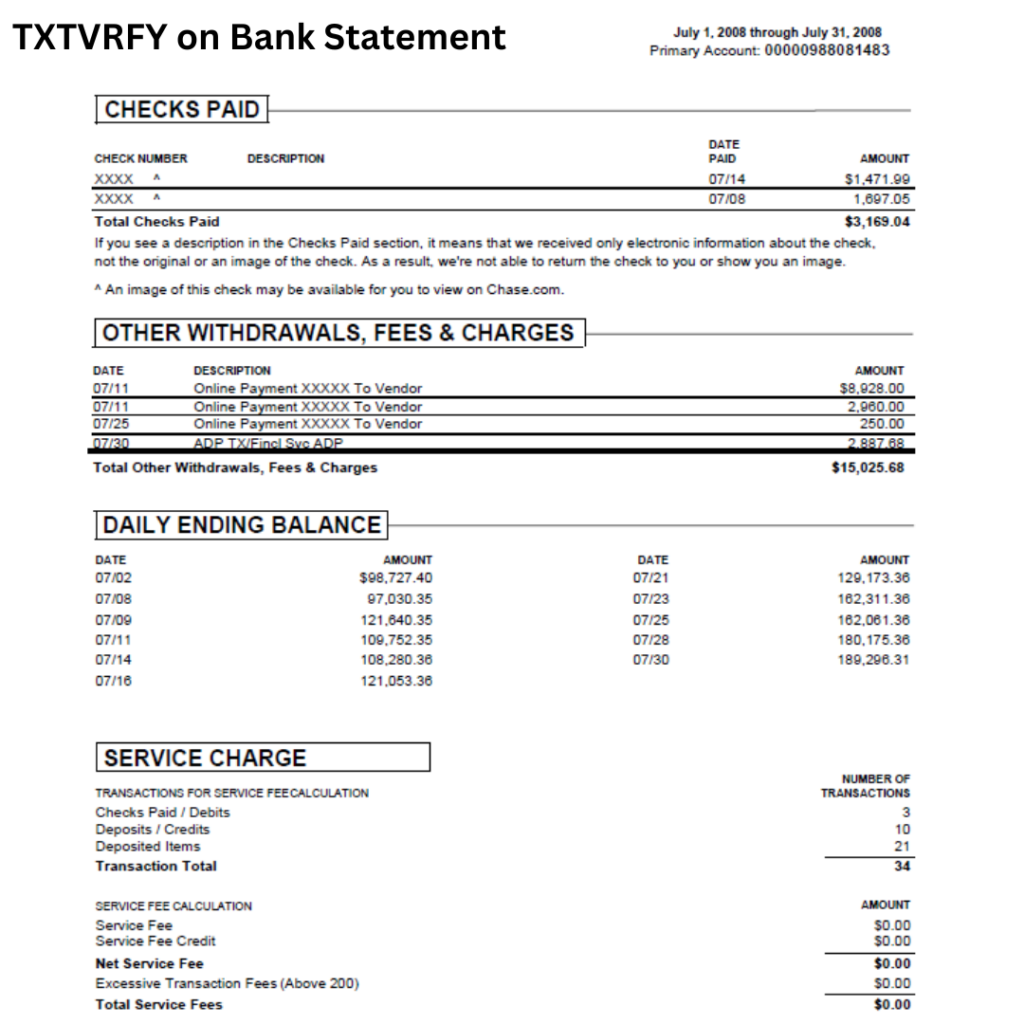

“TXTVRFY” is a crucial text verification code frequently found on bank statements, playing a pivotal role in securing online and mobile banking activities.

This code, short for “Text Verification” or “Text Verify,” is a potent safeguard against unauthorized access and fraud.

When an account holder logs into their online banking account or initiates a mobile banking transaction, a unique TXTVRFY code is sent via text message to their mobile device.

TXTVRFY is a digital guardian, working diligently to validate the account holder’s identity.

By requiring the input of this code during login or transaction, financial institutions can confidently ascertain that the person seeking access is indeed the authorized account holder.

Including a TXTVRFY code on a bank statement signifies the institution’s commitment to bolstering security measures and preserving the integrity of its client’s accounts.

It is of paramount importance to safeguard your TXTVRFY code with utmost care.

This code is a strictly personal security identifier and should never be shared with anyone.

It is exclusively intended for the verified account holder, acting as a critical barricade against potential threats.

Should you encounter a TXTVRFY code on your bank statement and have queries, it’s prudent to engage directly with your bank.

They can offer insights into the circumstances that prompted the code’s appearance and guide its implementation.

So, a TXTVRFY code on bank statements serves multifaceted purposes, including:

- Identity Verification: Ensuring the account holder’s identity during online logins.

- Secure Transactions: Validating the account holder’s identity when executing mobile banking transactions.

- Unauthorized Access Prevention: Acting as a gatekeeper against unauthorized entry into the account.

- Fraud Deterrence: Bolstering defenses to ward off fraudulent activities.

As a proactive measure to safeguard your financial assets, the TXTVRFY code stands as a sentinel, fortifying the security of your banking transactions and interactions in the digital realm.

How to Stay Alert for Potential TXTVRFY Scams or Frauds?

In an era where digital security is paramount, being vigilant against potential scams or frauds, including those involving TXTVRFY, is essential.

Here’s how to recognize red flags and protect yourself from falling victim:

Scam or Fraud Sign: The text message is not from your bank. What to Do: Do not reply to the text message.

Additionally, avoid clicking on any links embedded within the message.

Scam or Fraud Sign: The text message asks for personal information, such as your account number or password.

What to Do: Under no circumstances should you divulge any personal information.

Safeguard your account details diligently.

Scam or Fraud Sign: The text message is urgent and asks you to act immediately.

What to Do: Refrain from taking immediate action based on the message’s urgency.

Instead, directly contact your bank to verify the message’s authenticity before proceeding.

Scam or Fraud Sign: The text message is poorly written or has grammatical errors.

What to Do: Exercise caution when encountering text messages with poor grammar or writing errors.

Such signs may indicate a fraudulent attempt.

Scam or Fraud Sign: You have not recently done any transactions with your bank.

What to Do: Be wary of text messages requesting verification for transactions you have yet to initiate recently.

It’s a potential indication of a scam.

Additional Tips to Stay Safe from TXTVRFY Scams:

- Only share your personal information with your bank or reputable organizations you trust.

- Approach text message links cautiously, even if they seem to originate from your bank.

- Keep your software up-to-date, including your operating system, web browser, and antivirus software.

- Treat unsolicited text messages with skepticism, even if they appear to be from a legitimate source.

If You Suspect a TXTVRFY Scam Message:

- Do not reply to the message.

- Do not click on any links within the message.

- Contact your bank directly to verify the message’s legitimacy.

- Report the scam to the Federal Trade Commission (FTC).

You can conveniently report a TXTVRFY scam to the FTC by visiting their official website at www.ftc.gov/complaint.

Additionally, you can report the scam to your local law enforcement agency, contributing to combating digital fraud and ensuring a secure online environment.

Stay informed, stay cautious, and keep your financial well-being intact.

Summary of TXTVRFY Credit Card Scam Reports

Numerous individuals have reported encountering a troubling credit card scam associated with TXTVRFY.

Victims from various parts of the United States have shared their experiences, each echoing concerns about unauthorized charges and potential financial losses.

In one instance, an individual noticed unauthorized charges of $500 from the scammer’s website, TXTVRFY.

Another victim found multiple unapproved charges of $50 each on their rarely used credit card.

For some, the unauthorized charges left them grappling with financial hardships, such as a disabled widow on a fixed income losing $205.

In addition to unauthorized charges, victims have expressed distress over the lack of security measures.

Despite cardholders not authorizing transactions, their accounts were debited.

Many victims expressed their frustration, wondering how their card details could have been compromised without their card being stolen.

However, not all hope is lost. While victims await resolution, they’ve taken proactive steps.

Many individuals reported disputing charges with their financial institutions, like PayPal and Chime, hoping to recoup their losses.

Some expressed optimism about being reimbursed but also highlighted the frustratingly slow pace of investigations.

The impact of these scams goes beyond financial loss. Emotional turmoil and a sense of helplessness permeate the victims’ experiences.

Many questioned the state of the world, lamenting the difficulty of surviving on fixed incomes and the impossible cost of living.

The rapidity and frequency of these unauthorized charges raise concerns about the vulnerability of personal information and the overall security of digital transactions.

Through these shared experiences, it’s clear that the TXTVRFY scam has affected people from various walks of life.

As they navigate the aftermath, victims emphasize the importance of promptly reporting scams, seeking reimbursement, and fostering awareness to prevent others from falling into the same trap.

While the road to resolution may be extended, these individuals are determined to regain their financial stability and peace of mind.

Why You Might be Scam Through TXTVRFY?

Scammers are constantly devising new ways to exploit unsuspecting individuals, and the TXTVRFY scam is a prime example of their cunning tactics.

Understanding how these scams work is crucial to protecting yourself from falling victim.

Here’s a breakdown of the reasons why you might be targeted through TXTVRFY and how scammers manage to carry out their schemes:

- The text message is not from your bank. Scammers often employ a tactic known as “spoofing,” where they manipulate the sender ID to make it appear that the text message originates from your bank. This deceitful technique aims to gain your trust and make the scam appear legitimate.

- The text message asks for personal information, such as your account number or password. When a scammer obtains your personal information, they gain access to a treasure trove of opportunities to steal your money or engage in identity theft. By posing as your bank and requesting sensitive details, scammers can wreak havoc on your financial and personal security.

- The text message is urgent and asks you to act immediately. Scammers understand that urgency can lead to hasty decisions. By creating a sense of impending danger or opportunity, they manipulate you into revealing your personal information or clicking on a malicious link, all while under duress.

- The text message needs to be better written or have grammatical errors. Often, scammers need to pay more attention to language quality. If you notice a text message with mistakes, it’s a clear sign of a scam. Reputable organizations take the time to ensure their communications are clear and error-free.

- You have yet to do any transactions with your bank. Scammers may seize the confusion from a text message about an unfamiliar transaction. Scammers exploit your uncertainty and apprehension by posing as your bank and asking you to verify a transaction you didn’t make.

Staying vigilant and informed is your best defense against TXTVRFY scams.

Always exercise caution when receiving unsolicited text messages, especially those asking for personal information.

Remember, legitimate financial institutions will never request sensitive information through text messages.

If you ever receive a suspicious message, it’s wise to contact your bank directly to verify its authenticity.

By taking proactive steps, you can shield yourself from falling into the trap of scammers who exploit TXTVRFY to target unsuspecting individuals.