American retailer Tracto Supply Company specializes in home improvement, agriculture, livestock, and household products.

Whether you’re new to the world of Tractor Supply credit cards or you’ve had them for a while, we know how difficult it can be to try and remember all the details involved with using this card.

From logging into your Tractor Supply Company account to paying your balance off or canceling your account, everything you need to know about using Tractor Supply credit cards can be found here in this guide on tractor supply credit card login, payment, customer service, and cancellation.

Key Takeaways:

- You can Tractor Supply Credit Card Login here if you want to pay your bills and keep track of your account

- With Citi’s online service, you can make your Tractor Supply Company Credit Card payment online and by phone at 1-866-668-3706

- Contact Tractor Supply’s customer service department by calling 1-866-668-3706

- Don’t hesitate to contact the credit card company if you want the account to close.

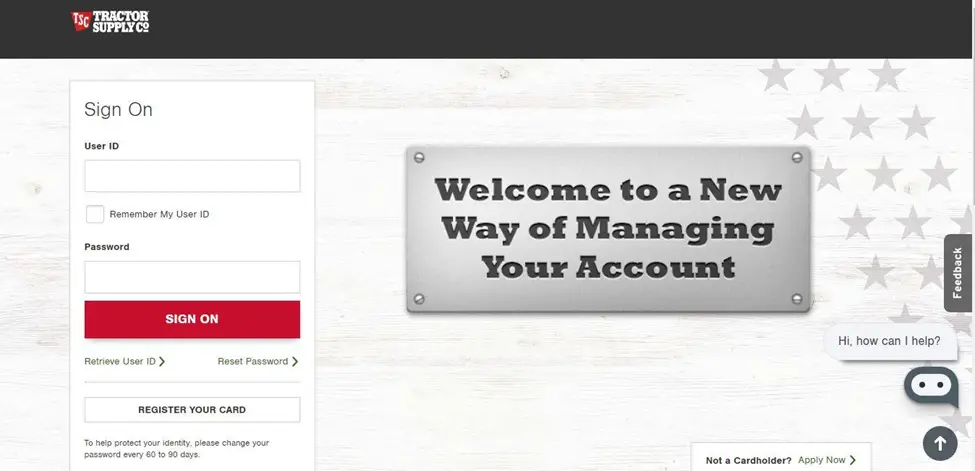

Tractor Supply Credit Card Login

Before you log in, know which Tractor Supply credit card you have. Here we are going to mention both credit card login methods.

- Sign in here if you want to pay your bills and keep track of your account.

- Tractor Supply business credit card holders can access their accounts here.

You will need a device and a stable Internet connection to complete your Tractor Supply credit card registration. Secure web browsers such as Microsoft Edge, Chrome, and Safari are recommended to keep your Tractor Supply credit card account safe.

Tractor Supply Credit Card Payment

You must make all your payments through Citibank, which issued this credit card. Keeping track of your spending and paying bills is easy with an online credit card management service. Alternatively, you can transfer money to your bank to pay your bill online.

How to Pay Online Payment for Tractor Supply Credit Card?

With Citi’s online service, you can make your Tractor Supply Company Credit Card payment online, view your statement, manage your account, and access your account details via mail and phone. If you want to make a payment by mail or phone, click the Pay Online button below.

Pay by Phone:

To make a credit card payment, call the tractor supply company at 1-866-668-3706.

Pay by Mail:

Here is the mailing address for tractor supply credit card payments:

- Citibank / Tractor Supply

- O. Box 183037

- Columbus, OH 43218-3051.

We recommend mailing your tractor supply payment at least five business days before the due date listed on your monthly statement to ensure timely delivery.

Tractor Supply Credit Card Customer Service

Contact Tractor Supply’s customer service department by calling 1-866-668-3706. There is both Tractor Supply and Citi customer support available.

Tractor Supply credit services can be reached at 1-800-263-0691, while Citi credit services can be reached at 1-866-668-3706.

Please contact Tractor Supply Company’s Online Customer Service by email or postal mail at 200 Powell Place, Brentwood, TN 37027, or [email protected].

There are the following times when customer service is available:

- Every Monday and Friday between 7 AM and 7 PM Eastern Time

- Saturday between time 7 AM and 7 PM Eastern Time

- Sunday between 8 AM and 6 PM Eastern Time

Customers with a business account with TSC can reach customer service at 1-800-559-8232 between 8 AM and 8:00 PM Eastern Time.

How to Cancel Tractor Supply Credit Cards?

Don’t hesitate to contact the credit card company if you want the account closed. If you complete the card with a zero balance, you should also ask for a written acknowledgment from the credit card company.

If you have other credit card balances, it becomes an even more significant problem. It may temporarily lower your credit score when you close your credit card. Still, the more substantial issue is that you may increase your utilization ratio, which is also likely to lower your credit score.

The credit limit available across all your credit cards will be reduced if you close even one card. An increased utilization ratio can have a bad impact on your credit score. Regarding the utilization ratio, it is not important if none of your credit cards owe balances.

What Are Tractor Supply Credit Card Interests and Terms?

Purchases are typically charged an annual percentage rate of 25.99%. The APR on extended buying plans (24 or 48 months) is 13.99%.

There is a fee of $10 or 5% of the transferred amount for cash advances at 29.95% APR. Interest on balances is charged at a minimum of $2 per month. Up to $40 is charged for late payments and returned payments. It is possible to find the complete terms and conditions on the company’s website.

How You Can Use Your Card?

To use your card, enter the 16-digit number on the front of your card (both cards have a 16-digit number) into the card number field. Next, you’ll need to enter your CVV code (3 digits on the back of your card).

Finally, you’ll need to choose a one-time or monthly recurring charge.

Select a one-time or monthly recurring charge in the billing frequency dropdown menu. After selecting your desired payment option, click submit at the bottom of the page.

It’s also important to know that you can’t see what your purchase will be for before it goes through.

How to Apply Tractor Supplies Credit Cards Online?

If you would like to apply for a Tractor Supply Company Credit Card online, you simply need to go to their website. You can fill out the application on their website. You can apply for this card through the Tractor Supply mobile app on iOS and Android.

Online

Visit the Tractor Supplies Credit Card website and fill out the application to apply for Tractor Supplies Credit Card.

Mobile App

Both iOS and Android apps are available for Tractor Supply Card applications.

Tractor Supply Store

You can apply at any Tractor Supply Company Store location if you wish to do so in person.

Tractor Supply Credit Cards Have Some Advantages And Disadvantages

Before applying, you should know the advantages and disadvantages of a Tractor Supply credit card.

Advantages

- Obtaining this financing product does not require you to pay an annual fee.

- Balance transfer offer with 0% interest

- A Tractor Supply store offers several financing options for any item you purchase.

- During the promotional period, it is not possible to charge interest if you pay special financing within the promotional period.

- Your credit card will notify you of any transactions.

- Deliveries were made the same day with Neighbor’s Club.

Disadvantages

- This type of credit card (APR) has a maximum annual percentage rate.

- Customers do not receive the same sign-up bonuses as other products.

- Prizes or cashback cannot be guaranteed by using this card.

- Any purchases made at any store will not earn the customer rewards.

- There are generally fewer benefits associated with Tractor Supply credit cards compared to other similar products.

Conclusion

Tractor Supply has been a popular retailer for years. With such a large selection of items, finding something you need at any given time is easy.

You can find your account balance and make payments using your Tractor Supply credit card login. If you need help, call customer service or visit the store in person.

In addition to the great TSC credit card, Citi Retail Services offers a loyalty program that benefits consumers and businesses.

Additionally, Tractor Supply credit provides innovative credit programs and a Neighbor’s Club initiative to increase client and business loyalty.

FAQs

Is There Any Credit Score Requirement For A Tractor Supply Card?

You’ll need a credit score of at least 640 to qualify for a Tractor Supply credit card, which is a fair score.

What Is The Annual Fee Associated With The Tractor Supply Credit Card?

There are no annual fees associated with the Tractor Supply credit card.

Is It Hard To Get A Tractor Supply Card?

A minimum credit score of 640 is required for the Tractor Supply Company® Credit Card. Therefore, this card can only be approved if you have fair credit or better.

What Bank Does Tractor Supply Credit Card Use?

Through innovative credit programs and company-wide support, Citi Retail Services has been a trusted partner to Tractor Supply for over 20 years.

Can I Check The Status Of Tractor Supply Credit Card?

(888) 201-4523 is the number to call to check on your Tractor Supply Credit Card application status. If they deny your application, you still have hope. You can request a reconsideration by calling (800) 695-5171.

Does Tractor Supply Offer Military Discount?

There are no military discounts available at Tractor Supply! However, the company offers a 10% discount to senior customers 55 years or older on regularly priced items “subject to availability.”

Does Tractor Supply Do Payment Plans?

Several financing options are available from Tractor Supply for purchases of $199 or more. However, interest will be charged to your account if the balance is not paid in full within six months.

Where Is The Expiration Date On A Tractor Supply Credit Card?

You cannot use this card until it has been activated at the register. The card can be redeemed at any TractorSupply.com or Tractor Supply company store within the United States for merchandise.

To make an in-store purchase, the card must be presented. Cash or credit cannot be redeemed with the card. No expiration date is associated with this card.