Definition:

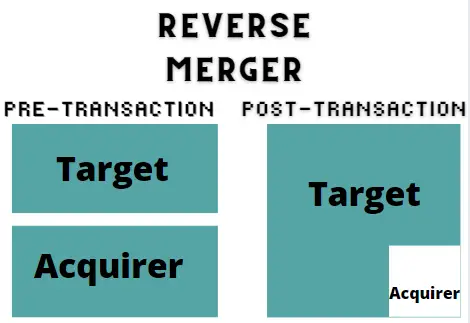

A reverse merger is a process in which a public company acquires a private company which then becomes a public company. It is also called reverse takeover or Reverse IPO. It allows the private company to bypass the lengthy and regulatory complex IPO process that may take a whole year or maybe even more time to become a public company.

Special purpose acquisition companies or spac in short are also one of the ways the private companies become public. So, spacs are the financial products that can also be used to do a reverse merger.

The public company is mainly there for the purpose of bypassing the complex and time-consuming IPO process. So, after the reverse merger, there is an asset swap. The reverse merger also requires a capitalization restructuring of the company that is acquiring. In simple words, it just means that the assets and capitalization of both the acquiring and acquired company are swapped.

How does the Reverse merger process take place?

A detailed step-by-step procedure of reverse merger is shown in figure 1. This is the method through which a private company becomes public through the process of a reverse merger and is listed on the U.S. Stock Exchange.

Figure 1: A step by step view of a Reverse merger process in the U.S.A

Every step of the merger process is extremely important. The details of each step are given below:

Shell Identification

The very first step in the reverse merger process is identifying a suitable shell. Shell is basically the company through which the private company will merge for the reverse merger.

To get regulatory approval from the Securities and Exchange Commission, SEC, you need to find a perfect shell, an abandoned shell cannot be approved for a reverse merger.

The shell company should have a great reputation as it will help the evaluation of the private company. The shell company is also required to have filed all the required documents with the SEC. If any issues are found with the shell company in the subsequent steps, SEC has the power to call off the reverse merger.

The shell must also be very financially sound, if it is not financially sound, it has debts and obligations, it will ultimately be a drag when the private company goes public through the reverse merger.

Financial Audit

You should hire the best financial personnel who have experience in the reverse merger as it will help you in the future. The financial audit is divided into two main parts:

- Before the reverse merger, an audited financial document of both the shell company and the private company with which it will merge is required. Both companies should have a clean chit from the SEC to proceed further.

- The consolidation of financial statements of both the shell company and the private company is required.

There are also a bunch of other things that are required to be done before this step is cleared. A detailed audit, public filings, unforeseen liabilities, and DTC applicability are also reviewed.

After a complete audit and review of the shell company by the reviewing staff, the shell company must be classified. There are three divisions of a shell company: Clean Shell, Messy Shell, and Dirty Shell. What you want is a clean shell company for your reverse merger.

Transaction documents

The transaction documents are a combination of documents that show the contractual agreement between the shell company and private company which is about to be reserve merged. The documents are as follow:

- Letter of Intent: The letter of intent or LOI is as the name implies an intent letter, which is the legally binding agreement between the shell and private company for the reverse merger. It can be basically said to be a key point document, which highlights all the key points.

- The contractual agreement: This document is signed by both private and public company telling us that both parties agree on the key points presented in LOI.

- Super 8-K: It is an SEC form that is designed for shell companies that are looking to be reverse merged with a private company. This alerts the SEC that the status of the shell company has now changed. Every shell company is required to file this before the reverse merger.

Stock Issuance

It is the final step in the reverse merger process. After all the filing of required documents, it can be said that the reverse merger is approved. At this step, the stock of the shell company is transferred to shareholders of the private company.

Finally, after all these steps, a reverse merger is achieved and the private company has now become a public company and is listed on the U.S. stock exchange.

Main advantages of a Reverse merger

The main advantages of a reverse merger are as follows:

i) Fast and quick way to go public for the private companies.

ii) Huge cost saving for the private company as the costly process of an Initial public offering or IPO is avoided.

iii) A less regulatory scrutinizing approval procedure as compared to an IPO.

Main disadvantages of a Reverse merger

The reverse merger carries with itself both advantages and disadvantages. It really depends upon the company going public for it, does the merit outweigh the demerits. So, the main disadvantages of a reverse merger are as follows:

i) There is a risk that the shell company with which the private company will reverse merge is hiding some serious issues such as hidden debt, lawsuits, etc.

ii) A bad reputation of the shell company will also bring down the private company.

Conclusion

The reverse merger is a great way to bypass the traditional IPO process. It saves time and money. Although, recently the reverse merger has come under increased scrutiny due to a bunch of Chinese companies that went public on the U.S. Stock exchange which are now known to have been complete frauds.