Definition:

A stability strategy is defined as a business strategy adopted by a business to maintain its market share, current position in the market, and growth and Profit in the present market environment.

The stability strategy is usually adopted by mature businesses in an established market that is the most risk to be disrupted by a new startup.

The company is satisfied with its market position and stock performance. While it is mainly used by corporations competing in a particular market segment; the stabilization strategy has also been recently used by the Governments around the world such as the Government of the United States of America to retain its dominant position in the world.

An example of the Stability strategy is when a company sells an old product with a new one to its clients to maintain its market share.

Another example is when Indian Steel Companies started focusing on their current products to maintain their market shares in an already saturated market.

Meaning of Stability Strategy

The stability strategy means a strategy to maintain stability in an unstable environment. When a market becomes saturated, it is very risky proportion to introduce new products when we do not even know if there will be any demand for the new product, no matter how innovative the product may be.

The time and investment may be wasted which will land the company in a severe financial crisis. To avoid these highly risky proportions, companies stick with proven products and this is what is meant by the Stability strategy.

Types of Stability Strategies

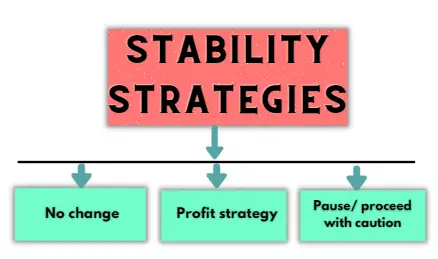

Every market is different and thus it has a different Stability Strategy requirement. The three main types of Stability Strategies are shown in Figure 1, below.

Figure 1: Types of Stability Strategy

The three main types of stability strategies are no change, Profit Strategy, and Pause/ Proceed with Caution.

Each strategy brings with it a set of challenges and demands on a corporation. The corporations thinking of adopting a particular Stability Strategy must carefully study the market conditions carefully because it is the biggest factor that will determine the success or failure of a particular Stability Strategy.

The three main types of Stability Strategy are further explained in detail below:

1 No-change

It is clear from the name that this type of stability strategy does not demand any changes. The company keeps on going as usual and does not introduce any new products.

The focus of the company is on its current products.

This type of stability strategy is adopted by a company that is extremely confident in its ability to execute the strategy and that is why these companies stick with their usual strategies.

The other reason may be Government regulation. In a highly regulated industry, it is extremely difficult for new entrants to make any significant dent.

So, established players do not try to introduce any new and innovative products.

The cigarette industry is a great example of a no-change stability strategy. When you look at the cigarette industry, the market players have not changed for more than a century. So, the Cigarette players adopt a no-change stability strategy.

2 Profit Strategy

This type of strategy is when a company sets the same growth target as the year before. The company may adopt a 3% growth in Revenues or profit and stick with the same growth target for many years.

This stability strategy is considered a no-risk stability strategy as the company is only focusing on growing the sales of its core product.

The company will also not have to invest in new products or hire new people or exert extra effort from its current employees.

General Electric has followed this strategy for decades. G.E does not introduce any new or innovative products until it is forced to do so. G.E did not exit the Vacuum tube market until the complete end.

3 Pause/ Proceed with Caution

The pause and proceed with Caution are adopted for different market conditions.

The Pause Stability strategy is adopted when there is a reduced demand for products and services that the company is producing.

Companies usually adopt this strategy when the economy is going through a recession. In a recession, there will be less demand for many of the products. So, the company adopts this strategy.

It may also be adopted by a company that has experienced explosive growth in the past years. The explosive growth also brings with it growing pains.

So, the company will adopt this stability strategy to pause and slow down, and carefully study the market.

Dell is a great example of this strategy. Dell during the 1990s experienced a great eCommerce boom.

But, the company grew so fast that it was not ready to handle such explosive growth and paused to restructure company.

4. Reasons for adopting a Stability Strategy

The main reasons why a company would adopt Stability strategies are as follows:

1) The management of the company is satisfied with its current market position.

2) The company is operating in a saturated market with little or no growth.

3) The company is looking to consolidate the market.

4) The macroeconomic conditions of the economy are bad.

5) There is little to no risk of disruption from an incumbent player.

6) There is little demand and the risk is high for new investments to turn sour.

7) The company is waiting and seeing before changing the strategy.

5. Advantages

The main advantages of a stability strategy are as follows:

1) Low-risk strategy.

2) Maintain the current routine network.

3) No sense of financial trouble due to risky strategies.

6. Disadvantages

The main disadvantages of the stability strategy are as follows:

1) Risk losing market share to more innovative market players.

2) Little or no growth in the company’s revenues or profits.

7. Conclusion

The stability strategy is adopted by a company to meet its particular set of needs and requirements.

Every company mainly adopts this strategy when it is operating in a saturated market. It is a low-risk, low-return strategy.