Overview

Cash Flows are considered to be one of the most important financial metrics within the company. As a matter of fact, it is highly important to consider the fact that it mirrors the overall ability of the company to not only pay their day-to-day operations but also have sufficient cash in order to finance their expansion in the longer run.

Since cash flows are a basic representation of liquidity, they are mostly categorized with the various different expenses that are incurred by the company. For instance, they are categorized as operating, investing, and financing expenses that can be analyzed by users of the financial statement to assess which particular head took up most of the cash of the company.

However, there are two main categories of cash flows that are used in this aspect. They are referred to as levered cash flow and unlevered cash flow. Leverage is the extent to which the company has taken on debt. For a lot of companies, this tends to be a major expense. Therefore, it is often categorized separately by companies.

Hence, levered and unlevered cash flow is different because one of these cash flow types includes the component of debt, and debt-related payments, whereas unlevered cash flow includes all incoming and outgoing excluding debt and the payments that are made to the shareholders of the company. Further description and analysis of both levered and unlevered cash flow are given below.

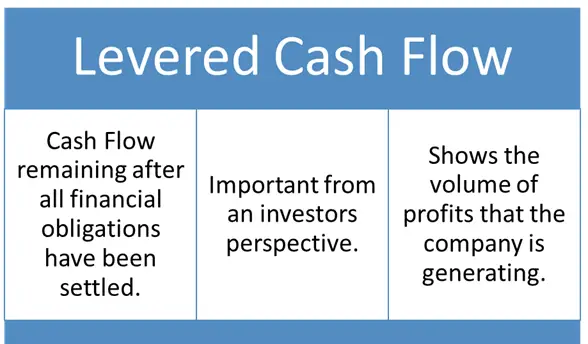

Levered Cash Flow

Levered Free Cash Flow is considered to be one of the most important metrics from the perspective of the investors because it is a very vital indicator of the level of profits that the company is generating. In this regard, it is important to realize the fact that levered cash flow is indicative of the extent of cash that the company has pertaining to their expansion-related clauses.

Levered Cash Flow can be defined as the amount of money that a company has left remaining after they have paid off all their dues and their financial obligations. Therefore, this is the amount that the company has left in order to make dividend payments or to make investments in the business.

A company can have a negative levered cash flow, even if they have a positive cash flow otherwise. When it comes to a company, they might choose levered cash flow to pay dividends, buy back stocks, or reinvest in the business.

Calculation of Levered Cash Flow

Levered Cash Flow is calculated using the following formula:

Levered Free Cash Flow: EBITDA – Change in Net Working Capital – CAPEX – Debt Payments, where EBITDA is Earnings before Interest, Taxes, Depreciation, and Amortization, and CAPEX is Capital Expenditures.

Purpose of Calculating Levered Cash Flow

As mentioned earlier, it can be seen that levered cash flow is considered to be a measure of a company’s ability to expand its business operations and to generate returns to pay the shareholders, via the money that they have earned through operations. In the case where the levered cash flow is lower, it is indicative of the fact that the company might need to obtain some additional capital through financing.

In the case where the company has negative unlevered free cash flow, it might not necessarily be an indication that the company is not doing well. It might imply that the company does not have sufficient funds in order to finance their expansionary projects, but they might still be able to meet their day-to-day expenses, as well as other miscellaneous financial obligations.

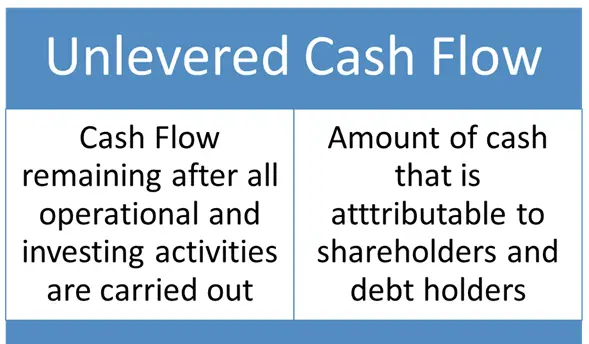

Unlevered Cash Flow

Unlevered Free Cash Flow can be defined as the company’s cash flow before they have taken interest payments into account. This is the cash flow that is reported in the financial statements of the company. Alternatively, financial statements are calculated by analysts. In simple terminology, it can be seen that unlevered cash flow is representative of the cash that is available to the company before they take their financial obligations into account.

Calculation of Unlevered Cash Flow

Unlevered Cash Flow is calculated using the following formula:

Unlevered Free Cash Flow = EBITDA – CAPEX – Working Capital – Taxes

The formula that is used in order to calculate unlevered cash flow does not take into account debt or any payments that have to be made in order to settle the debts.

What is the Purpose of Calculating Unlevered Cash Flow?

Unlevered Cash Flow is also referred to as the gross free cash flow that is generated by the company. Since levered is an alternate name for debt, this implies that if cash flows are levered, they include all debt components and interest payments. Therefore, by this definition, unlevered cash flows simply imply that they do not include debt-related components within the company. Hence, unlevered cash flow is merely representative of the cash that the firm has for all of its stakeholders, which also include the debt holders of the company.

Unlevered Cash Flow also shows the minimum amount of cash that the company has in order to maintain its functionality, and continue working in order to derive revenue. All non-cash expenses, like depreciation and amortization, are added back to the earnings in order to arrive at the firms’ unlevered free cash flow.

However, along with unlevered cash flow, stakeholders also need to include pieces of information that are more relevant to the financial statements of the company. In other words, they should ensure that they also take into consideration other relevant things, like the total debt that has been taken on by the company, because that needs to be duly honored too.

Unlevered Vs Levered Free Cash Flow

The differences between levered and unlevered free cash flow are summarized in the table below:

| Levered Free Cash Flow | Unlevered Free Cash Flow |

| Levered Cash Flow appears on the Balance Sheet in most cases. | Unlevered Cash Flow, if mentioned on the Balance Sheet, comes with a disclosure. |

| Levered Free Cash Flow is the amount that is available to the shareholders (since all debt obligations have been paid out). | Unlevered Free Cash Flow is the money that is available to pay to the shareholders, as well as the debtors. |

| Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. | Unlevered Cash Flow cannot be considered in isolation because it does not incorporate the payments that are to be made to the debt holders. |

| Having a negative levered free cash flow is possible, but it is not necessarily negative. | Having a negative unlevered free cash flow implies that the financial health of the business is not that good. |

| A business might have negative levered free cash flow – this implies that the business does not have sufficient finances to expand its operations. | It is highly unlikely for a business to have negative unlevered cash flow. This is because this would mean that the business does not have the required resources to expand their operations. |

Therefore, it can be seen that the main difference between levered and unlevered free cash flow is that of debt and debt-related payments and obligations. Factually, it is important to consider the fact that there both these cash flows might be used by companies in order to understand and highlight the given position of the company. Hence, there is no restriction, either on companies or on financial analysis to use either of these types of cash flows to ascertain the financial health of the company.