Days sales outstanding is a metric used in the financial analysis to assess the average number of days a business takes to collect credit sales.

It helps to assessability of the business to collect the receivables and directs the business to enhance liquidity by taking corrective actions if needed.

The frequency of metric assessment might be set by the business depending on their discretion. However, the logical approach is to monitor the collecting functions based on operational business policies.

For instance, for a business with a credit policy of one month, it may be logical to monitor the collecting function every month. Similarly, an aging analysis of the receivables can be equally valuable in assessing the collection function.

Understanding days sales outstanding

Cash inflow via sales is considered to be one of the essential operating cash flow activities. The business may not survive in the long term if the cash collection function is not efficient.

For instance, if the business has a scarcity of cash resources, it may obtain a bank loan to maintain liquidity. However, such practice compromises the business profitability as interest is payable on the loan leads to a decline in profitability and an increase in leverage.

Further, there is an opportunity cost for the receivables outstanding in the long term. It’s due to the time value of money and the opportunity cost of using cash in the working capital management and business expansion.

Hence, it’s an essential managerial aspect to monitor the cash collection process in the organization, and monitoring days sales outstanding can be an excellent assessment tool.

Steps to calculate days sales outstanding

1) Obtain total balance for the accounts receivables

Obtain the total balance of the accounts receivable at the closing date of the balance sheet. If the total amount is higher, there are higher chances of increased days sales outstanding, however, it’s dependent on the total credit sales as well.

Further, the average balance of the accounts receivables can also be computed, which helps to enhance the accuracy of the overall metric.

2) Obtain total credit sales in the period under consideration

It’s the total amount of credit sales generated during the period under consideration. For instance, if the days’ sales outstanding is calculated for the month, we need to total the credit sales for the same month.

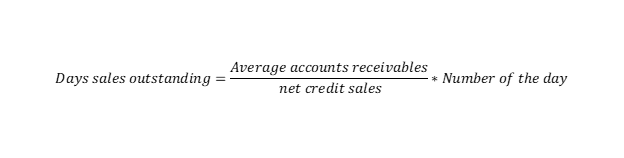

3) Divided average receivables with the credit sales and multiply with a respective number of days.

Dividing average receivables with credit sales leads to the proportion of the outstanding debtors in relation to credit sales.

Further, multiplying the calculated proportion with the number of days under consideration converts the proportion of the day-wise figure.

In simple words, this calculation converts outstanding debtors per day in connection with credit sales. The same can be computed with the formula given below.

Interpretation of the day’s sales outstanding

The higher value of the days’ sales outstanding indicates that the business takes more time to collect the cash from its credit customers. On the other hand, a lower value indicates that the collection processes of the business are efficient.

In the calculation of day sales, cash sales are not accounted for. However, adding cash sales to the total sales volume will lead to a decrease in the days’ outstanding sales, and it’s because cash sales have zero days sales outstanding.

Example of calculating Days sales outstanding (DSO)

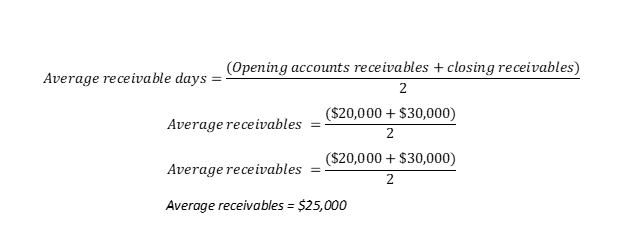

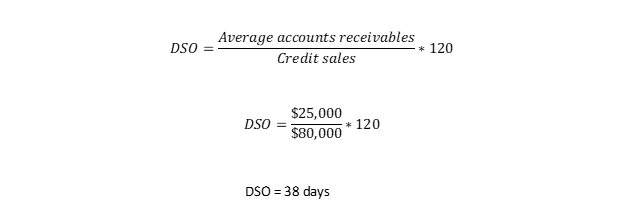

Alpha limited has opening and closing accounts receivables amounting to $20,000 and $30,000 at the end of the quarter. The credit sales for the quarter amount to $80,000. Let’s calculate the DSO.

Step-1

Average accounts receivables

Step-2

Calculate the DSO – (Quarterly)

How to reduce days sales outstanding – (DSO)

Controlling DSO requires strong coordination between departments of the business. It’s not entirely under the control of the accounting and finance department. While, other departments of the business like business expansion, sales, finance, and collection need to coordinate to increase overall efficiency.

Here are the six steps that can help to reduce overall Days sales outstanding.

1) Analyze current DSO status

The first step is to calculate the current DSO and analyze it in terms of trend analysis, benchmarking industry average, and competitors. It’s necessary to understand if the current outstanding period is in line with the normal business practices or due to the weaknesses of the internal controls and the collection function.

This metric can also be used as a key performance indicator for evaluating the individuals responsible for collecting the cash. Further, Reducing DSO as a strategic priority can be an excellent move as it does not only result in business liquidity but profitability.

2) Analyze customer credit risk

Credit risk is the risk of potential loss resulting from the inability of the debtor to repay the contractual obligations. So, businesses need to assess if the credit exposure with the acceptance of new customers is in line with the acceptable level of the risk. The same process of the risk assessment can be applied to existing credit customers.

3) Define customer payment time

Payment days in the invoice heavily influence the volume of DSO. So, there is a need to balance between industry practices and the business goal to control the DSO. The balance can be achieved by offering incentives and discounts to the customers for early payment of their dues.

Further, there is a need to mention the terms of the invoice and due date. In addition to this, Invoicing with the achievement of milestones and or in line with the agreement can be considered.

4) Analyze invoicing process within the business

Sometimes, the delay of cash collection may be due to delayed invoicing to the customers. So, there is a need to design a quick, flexible, and strong system of processes that ensure timely completion of the invoicing operations.

5) Carefully manage accounts receivables

The business needs to monitor outstanding invoices continuously. It may involve sending reminders and following ups on the unpaid invoices. Another important aspect of this communication should be identifying if the major customer has temporary cash flow problems. In such situations, the repayment plan can be agreed upon to ensure things remain efficient.

6) Keep the commitment

Sometimes, it can be challenging to achieve reduced DSO in a short period. So, there is a need to continuously monitor and keep analyzing internal and external factors that impact cash collection.

Conclusion

Days sales outstanding is a helpful metric in the assessment of the business collection function. Lower DSO helps to enhance liquidity and vice versa. Further, the business can improve DSO by redesigning internal revenue processes and implementing efficient credit management policies.

Efficiently managing cash flow is considered to be one of the essential aspects of business management. Sometimes, businesses need to offer incentives and discounts on the early payout, and however, it can lead to compromise on the business’s profitability.

Frequently asked questions

What are the ways to improve Days sales outstanding?

The following action can improve Days sales outstanding for the business.

- Identify the customers who have been consistent in paying late. There is a need to place targeted restrictions on the specific customers in the form of advance payments and to reduce credit limits etc.

- Offer cash discounts on prompt payment. This might result in some compromise on the profitability. However, liquidity is enhanced with such discounts.

- Try to decline payments via credit card and increase incentives for paying with cash.

- Perform strong background checks for approving the credit customers.

What can be potential reasons for the delay in the collection of accounts receivables?

The following can be potential reasons for the delay in the collection of accounts receivables.

- The customers do not have a cash balance to pay off invoices.

- There is a dispute over the account balance.

- The invoices were not issued timely.

- There may be a seasonal/economic downturn.

Why days sales outstanding is considered a good metric?

DSO is considered an essential performance metric in terms of liquidity assessment and KPI for effective business management. Further, it’s strongly connected with the liquidity aspects of the business that can be highly valuable input in financial analysis.