The conventional overhead allocation method assumes that various types of the fixed overhead cost can be absorbed in different products using a single overhead absorption rate. This approach of the conventional method is over-simplistic and does not seem to produce individual product costs with greater accuracy and precision. However, it’s quick, and the cost allocation process can be completed in less time.

To get more accurate figures for the product cost, activity-based costing – ABC system is followed to allocate the overhead cost fairly between different products. The use of the ABC costing system requires us to identify the activities used in the production process and allocate the total fixed overhead based on the usage of activities by individual products.

The use of the ABC system requires monitoring small details of activities and costs with more accuracy. Although, the use of the ABC system requires the use of more administrative resources. However, the results produced for the product costing and profitability are more accurate and precise.

This article intends to provide a step-by-step and comprehensive guide for implementing the ABC system of accounting. We’ll keep gathering details required to complete the process in a flow.

1) Identification of the activities required to produce the products

The business has to perform several activities for the production of the units. Activity is any process performed by the business that is used in production. To implement the ABC system, it’s necessary to identify all the main drivers of the cost activities.

In the real business world, there can be hundreds of activities required to complete the task. For instance, IBM and Hewlett Packard are expected to identify several activities to produce their products.

It’s also important to note that sometimes companies do not use all activities in the calculation but manually select the activities with the most significant impact on the overhead cost. However, if more activities are selected, a more precise result of the allocation can be expected.

Some of the well-known activities with higher cost impact in the manufacturing environment include the following,

- Purchase of raw material.

- Machine set up.

- Machine runs.

- Product assembly.

- Finished goods inspection.

2) Measure cost of overhead incurred on each of the activities

Total overheads incurred on the production need to be traced activity-wise. For instance, we had identified activity as “purchase of raw material.” So, we need to track all of the resources consumed (overheads) on the purchase of the raw material like utility bills of the purchasing department, salaries of the workers, and any other cost related to them.

Similarly, we had identified machine setups as activities; the related cost of this activity can be calculated by obtaining salaries/wages of the staff responsible for setting up the machine, the cost of their sitting area, and any other cost related to them.

So, the cost of all activities needs to be measured. The cost sheet may look like the following once all activity-related costs are measured.

| Activities | Costing factors | Budgeted Overhead cost |

| Purchase of raw material | Salaries/wages of the employees in purchase department + all other indirect expenses related to purchase | $23,000 |

| Machine setups | Salaries/wages of the employees responsible for machine set up and related indirect expenses. | $12,000 |

| Machine run | Depreciation for the machine + cost of maintenance + all machine-related indirect expenses | $16,000 |

| Product assembly | Deprecation of product assembly machine + salaries/wages of assembly department + all indirect expenses | $14,000 |

| Finished goods inspection | Salaries/wages of the inspection personnel + all related indirect expenses | $$8,000 |

3) Identification of the cost driver for each of the activities

The cost drivers are actions that are associated with the activity. In other words, an organization wants to achieve certain actions by using the cost drivers. Cost drivers need to be identified for each activity.

| Activities | Cost drivers | Activities for the cost drivers (supposed numbers) |

| Purchase of raw material | Purchase requisitions received for different products. | 8,000 |

| Machine setups | Number of machine setups | 12,000 |

| Machine run | Total machine hours | 16,000 |

| Product assembly | Direct labor hours | 4,000 |

| Finished goods inspection | Inspection hours | 3,200 |

4) Calculate pre-determined overhead absorption rate for each of the activities identified

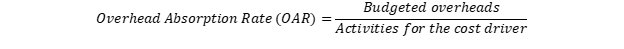

In the stages above, we have identified the cost drivers and budgeted costs for each activity. So, the pre-determined absorption rate can be calculated with the following formula.

The ABC cost sheet after OAR calculations.

| Activities | Cost drivers | Budgeted overhead cost | Activities for cost driver | Overhead Absorption rate – (OAR) |

| Purchase of raw material | The number of purchase requisitions. | $23,000 | 8,000 | 2.875 |

| Machine setups | The number of machine setups. | $12,000 | 12,000 | 1 |

| Machine run | Total machine hours. | $16,000 | 16,000 | 1 |

| Product assembly | Direct labor hours. | $14,000 | 4,000 | 3.5 |

| Finished goods inspection | Inspection hours. | $8,000 | 3,200 | 2.5 |

5) Allocate the cost of overhead for each of the activities

In this final stage of the cost allocation process, all OAR calculated for each activity is allocated in proportion to the usage by the product. So, if product-A has consumed more quality inspection visits, a higher cost of the quality inspection will be allocated for product-A and vice versa.

Allocation for the overhead cost in line with the usage.

| Activities | Overhead cost | Number of cost drivers for product – A (1) | Cost driver for product – B (2) | Total cost drivers | OAR (3) | Cost allocated for product-A using OAR (1*3) | Cost allocated for product-B using OAR (2*3) |

| Purchase of raw material | 23,000 | 2,000 | 6,000 | 8,000 | 2.875 | 5,750 | 17,250 |

| Machine setups | 12,000 | 6,000 | 6,000 | 12,000 | 1 | 6,000 | 6,000 |

| Machine run | 16,000 | 10,000 | 6,000 | 16,000 | 1 | 10,000 | 6,000 |

| Product assembly | 14,000 | 3,000 | 1,000 | 4,000 | 3.5 | 10,500 | 3,500 |

| Finished goods inspection | 8,000 | 1,600 | 1,600 | 3,200 | 2.5 | 4,000 | 4,000 |

| Total | 73,000 | 22,600 | 20,600 | 43,200 | 36,250 | 36,750 |

Calculation control check

Cost allocated for product –A = $36,250

Cost allocated for product –B = $ 36,750

The total allocated cost amounts to $ 73,000 ($36,250+$36,750). Our allocations are correct as the total overhead cost in the first column amounts to $73,000. Hence, we have accurately allocated overhead costs based on usage of OVH’s significant activities.

Advantages of using ABC system of costing

Following are some of the advantages associated with the ABC system of cost allocation.

- Product profitability can be traced with more accuracy.

- It can be of great use for the service sector, as it is expected to have a higher indirect cost.

- It helps in better decision-making as management of the company comes to know profitability with more accuracy.

- Detailed analysis of the cost can be made as ABC costing provides a detailed breakup of different costs.

Disadvantages of ABC system of costing

Following are some of the disadvantages associated with the ABC system.

- The process is complex and requires a strong understanding of the mechanism.

- Sometimes, the cost of implementing the ABC system may exceed the benefits obtained.

- It may be difficult to identify the activities for the production process.

- ABC offers limited value if the OVH costs are related to volume.

- Small companies may not be able to imply ABC as it’s a complex process effectively.

Bottom line

An activity-based costing system helps allocate the company’s overhead cost to different products/services more accurately. The results/cost of the products/services obtained is more accurate because ABC does not use the same overhead Absorption Rate. On the other hand, it makes use of the specific cost driver for the specific cost pool.

However, it may be of little use for the companies’ small in size. Further, the resources required for implementing the ABC may be costly as it’s a complex process.

Frequently asked questions

What is the difference between the traditional system and the ABC system?

The traditional system of costing allocates overhead cost based on a single Absorption rate. For instance, it may be machine hour (in the case of machine incentive business) or labor hours (in the case of labor incentive business).

On the other hand, the ABC system uses different cost drivers for the different cost pools. Hence, more accurate results of the cost allocation can be expected using the ABC system.

What are cost pool and cost driver?

A cost pool is a group of similar costs. For instance, all the costs related to purchasing department may be combined in a cost pool related to the purchasing department.

On the other hand, the cost driver is an activity that leads to changes in the cost of an activity. For instance, an increase in MRN leads to an increase in the total cost of the purchasing department (in terms of cost allocation).

What’s included in the full cost of the product?

The cost of the product includes all the direct and indirect costs. It includes direct material, direct labor, production overhead, and non-production overheads. It’s important to note that the use of traditional or ABC systems is only about allocating the overheads, and other items of the product cost remain unaffected.