What is a T-Account?

In double-entry accounting, the T-account is a basic training tool that demonstrates how one side of an accounting transaction is shown in another account. Even the highly qualified accountants clarify transactions that are more intricate using T-accounts. A T-account is a demonstration of a general ledger account in visual form.

The most basic account structure resembles the letter T. above the T, the account title and account number are displayed. Debits are always positioned on the left side of the T, whereas credits are always placed on the right. Each “T” account’s grand total amount shows at the end of the account. To show all of the accounts involved in an accounting transaction, a group of T-accounts is often consolidated together.

Understanding T-Account

All financial transactions are deemed to affect a minimum of two of a corporation’s accounts through double-entry bookkeeping, a common accounting system. To record each transaction, a debit entry will be made in one account and a credit entry will be made in the other. The credits and debits are documented in a general ledger, which must match all account balances.

The ledger journal of individual accounts has a T-shaped look, which is the reason a ledger account is sometimes known as a T-account. Debits and credits might represent either a rise or a decrease for various accounts, but with a T-account the credit is always on the right side and the debit is always on the left side, as per the conventions.

Accountants add increases on the debit side in assets, owner’s drawing accounts, and expense, while on the credit side, there is a liability, income, and owner’s capital accounts. Because increases in any account are normally bigger than losses, the account’s allocated normal balance is on the side with the increased amount.

As a result, debit balances are common in expense, asset, and owner’s drawing accounts. Credit balances are common in income, liability, and owner’s capital accounting.

Here is a closer look at the T-accounts for the primary components of the statement of financial position or balance sheet, namely assets, liabilities, and shareholder’s equity.

The T-Account debit side (left side) is usually a rise for asset accounts, such as accounts receivable, inventories, cash, PP&E, etc. On the other hand, the credit side (right side) represents a decline in the asset account. However, for liabilities and equity accounts, debits always represent a drop in the account, whereas credits always represent a rise.

Why Do Accountants Use T-Accounts?

Accountants make bookkeeping easier in the double-entry system to analyze using T-accounts. A double-entry system is a method of bookkeeping in which each input has a specific format to a separate account.

Taking the term “double” in the expression “double entry,” which stands for “debit” and “credit.” There must be a balance between the two totals for each, or else the recording will be incorrect.

Accountants or CPAs use a double-entry system, which is considered difficult (Certified Public Accountants). The data people enter must be documented in a clear and understandable manner. This is the reason T-account structure is utilized to distinguish between “debits” and “credits.”

A T-account structure in the general ledger would be regarded as best practice for any accounting department (that is not employing the single-entry system of accounting).

Example

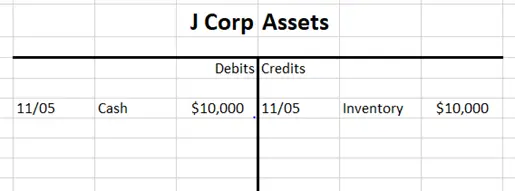

An example of a T-Account entry is as follows:

J Corp has sold a $10.000 product, according to this asset entry. This means the debit account’s cash balance has increased by $10,000, whereas the value of its inventory (under “credits”) has decreased by a similar amount. Consider the following points to properly comprehend this diagram:

- Debits raise asset or expense records, whilst credits lower them.

- Debits reduce obligation, equity, and revenue accounts, but credits boost them.

It is necessary for them to always be in balance with one another. T-Accounts always record entries in the same fashion, with “debits” on the left and “credits” on the right.

Where is T-Accounts Commonly Used

There are two main functions of a T-account. One is to teach accounting since it depicts the flow of transactions through the accounts in which they are maintained in a transparent manner. For the same reason, a second use is to clarify more challenging accounting operations.

When compiling more challenging accounting transactions, where the accountant wants to examine how a company transaction affects all aspects of the financial statements, the T-account idea comes in handy. It is possible to avoid making mistakes in the accounting system by employing a T-account.

T-accounts are not used for everyday accounting activities. Instead, the accountant uses accounting software to make journal entries. As a result, T-accounts are merely a tool for education and account visualization.

T-Account Advantages

Adjusting entries are frequently prepared using T-accounts. In accrual accounting, the matching principle asserts that all expenses must equal the revenues attained throughout the period.

The T-account instructs bookkeepers on how to pass the data into a ledger to achieve an adjusted balance, which ensures that expenses equal revenues.

A business owner may use T-accounts to take information from it as well like the nature of a transaction that took place at a specific time or movements and balance of the respective account.

What Are the Problems with T-Accounts?

T-Accounts are graphic representations of the double-entry accounting system. There are some drawbacks to this system, including:

- Incorrectly recorded information – This might form the basis for a company’s general ledger to be out of balance. Because credits and debits are added at the similar time, these types of errors can be more easily detected if the accountant double-checks his numbers after each journal entry.

- Complete Omissions – When a transaction is not recorded at all, this is referred to as a complete omission. Since a double entry system cannot detect when a transaction is absent, these problems may never be detected.

- Transactions are incorrectly categorized — This is a common accounting mistake. For example, during a busy moment in their factory, a corporation hires some extra temporary labour. Those labor payments are categorized in future as “operation expenses” and not “inventory costs” by the accounting department. This type of error can be difficult to detect if the labour charges are still completely debited and credited. If there is an audit, it will almost certainly be discovered.

- Time Consuming and Expensive — A double entry system takes time to set up and uphold, and might necessitate extra labour for data entering (that means greater money used on staff). The quantity of business a company performs will determine this. Despite the disadvantages listed above, most firms require a double entry accounting system. This is due to the fact that the types of financial papers required by both enterprises and governments cannot be prepared without the details provided by a double entry system. These records will enable financial comparisons to past years, as well as help a business better manage its spending and plan for the future.

Why T-Accounts Can’t be Used by Single Entry Systems?

A single-entry accounting system might not give sufficient data to be characterized by the T-visual account’s arrangement. In contrast to a double-entry system that allocates every transaction to a set and registers both a debit and credit for each, a single-entry system registers separate company’s financial transactions as a single entry in a log. Companies that routine double entry can simply discern between debits and credits with T-Accounts.