Introduction

Sales volume variance is used to measure the effect on the profit or contribution margin of the difference between the actual quantity sold and the budgeted sales quantity that is the quantity decided to be sold prior to actual sales.

In absorption costing the variance shows the impact on the profit whereas in marginal costing the impact is reflected on the contribution.

Explanation

Since it is highly unlikely for the producers to achieve the budgeted sales quantity data, the actual quantity will mostly differ from the standard quantity.

The reasons behind this can be changes in the pattern of quantity demanded overtime, sales workforce efficiency and skills and changes in competition in the market.

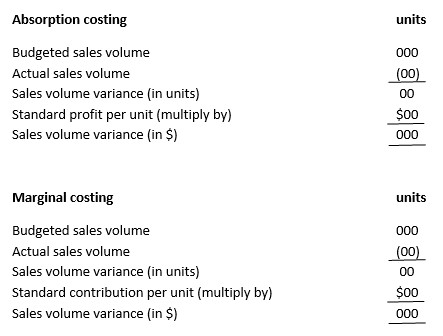

The sales volume variance is calculated by taking the difference between actual quantity sold and the budgeted sales quantity and then multiplying it with the standard profit per unit or with standard contribution per unit depending upon the which type of costing is used that can be absorption or marginal. Following are the formulas illustrated using different costing.

Sales volume variance can be favorable or it can be adverse. In the case of a favorable sales volume variance the quantity actually sold is greater than the quantity which was budgeted.

This means that the producers were successful enough to sell more than they set a band for and earning more.

The reasons for this scenario can include effective skills of the sales department, extensive marketing campaigns or competitors leaving the market and the businesses attracting new customers.

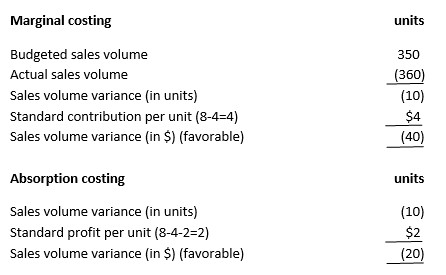

Example:

A company has a budget to sell 350 combs at standard selling price of $8, the standard variable cost to produce a comb is $4 and the overhead absorption rate per comb is $2.

The actual quantity sold by the company is 360. The calculation of the variance is as follows.

The variance is adverse when the actual sales volume is less than the budgeted sales volume, this can be because of the decrease in the quantity demanded as compared to the expected demand, the products going out of fashion, poor quality of the product and rigid competition.

An adverse variance indicates that the company was not able to achieve its budgeted goal and ended up selling the quantity below the standard level, the result of this will be in the form of low profits and contributions.

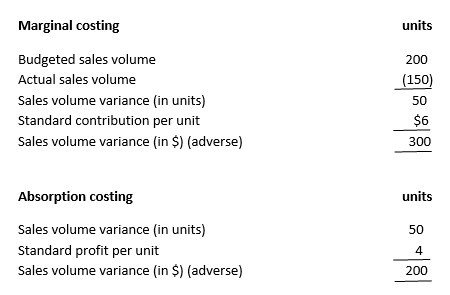

Example:

The budgeted sales quantity to be sold is 200 cups and the standard contribution per unit is $6 and profit per unit is $4, whereas the actual quantity sold is 150 cups.

The variances can also occur due to wrong budgeting of data and poor research skills.