The income statement is a general term that’s widely heard in the accounting world. The income statement is not just a profit and loss report. There’s a lot more to it than you may think.

An income statement is a report that displays everything about a company, including its expenses, profits, losses, and income. It is used to calculate the net profit and net losses of a company.

The income statement comprises three main elements. To help you better understand the income statement, we have compiled the three elements in this blog post.

An Overview to Income Statement:

An income statement is a financial statement used by a company to report its financial performance for a specific time. The company’s income statement is also known as the p&l statement or profit and loss statement as it mainly represents the total revenue and expenses of a company for a particular timeline.

The income statement is a company’s report that measures its financial performance. Companies produce income statements quarterly and yearly to measure their performance over a specific accounting period.

The profit and loss statement sums up all incomes and costs in the business transactions during the bookkeeping time frame by following the overall type of “Income less Expenses equals to Net Income,” which are the three primary components of the income statement.

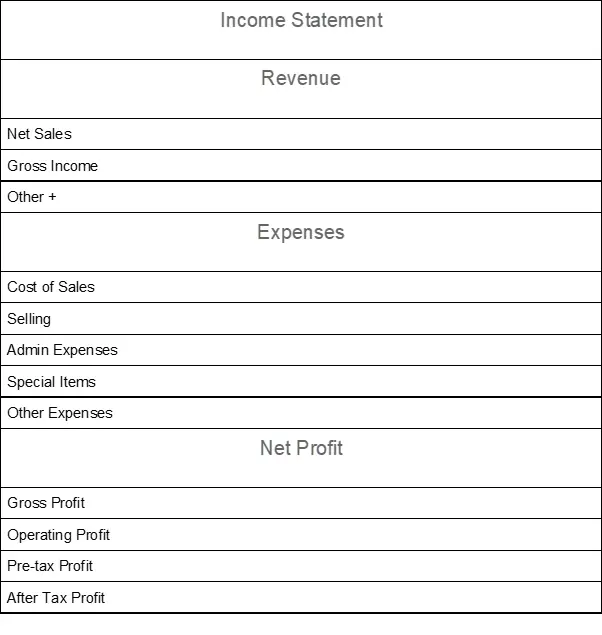

This is how different revenues and expenses are listed in an income statement:

The net profit of a company is calculated on the basis of its revenue and expenses.

The income statement is further mainly divided into two sections: the operating section and the non-operating section. Both sections display revenue and expenses that are associated with different activities.

The operating section of the income statement displays the revenue and expenses that are directly associated with the regular business functions and activities.

In comparison, the non-operating section of the income statement shows the revenue and costs that are not related to ordinary business activities and operations.

Professionals of accounting and finance fields like financial analysts analyze the income statements to understand what measures and steps should be taken to reduce their expenses further and increase their company’s revenue.

There are a lot of uses and benefits of an income statement that plays a vital role in strengthening and enhancing the financial strength of a company.

3 Main Elements of Income Statement You Should Know

There are three main elements of an income statement.

They are:

- Revenues

- Expenses

- Net income

These three elements are the core elements of an income statement. They make the income statement one of the most beneficial financial statements that play a vital role in the company’s betterment.

Revenue:

Revenue is defined as the income or money earned that a company generates through its sales, be it goods or services. Consider you have the total sales that a company makes during a particular accounting period, which is said to be revenue.

As per Investopedia’s post, there are two different types of revenues that a company can generate: operating revenue and non-operating revenue. This belongs to the two sections mentioned above of an income statement: operating and non-operating.

Operating revenue is made by the goods or services primarily associated with the operations within the company.

Whereas non-operating revenue is made through the non-business activities or operations that do not regularly occur within the company.

Revenue and gains are the first part of the income statement, always mentioned on the top. Revenues are recognized instantly once the goods and services are delivered to the customer regardless of the fact that the company might not have received the payment at that time.

Expenses:

The second part of the income statement is about a company’s expenses to sell its products. It is also called the cost that a company usually spends to generate revenue by promoting its products and driving business growth.

There are two main types of expenses that a company usually bears: the cost of goods sold and operating expenses.

The cost of goods sold is the cost that comes with the production of goods. It is the direct cost and includes all the expenses our company will spend to maintain and enhance its quality.

On the other hand, operating expenses are not those expenses that are spent on producing goods. They include the costs associated with salaries of staff members, product marketing and advertising, and supplies. Selling expenses and administrative expenses are also part of the operating expenses.

Net Income

Net income/Net profit is the third and last section of the income statement. It represents the overall performance of the company for a particular time.

Net income is calculated based on revenues and expenses. Companies usually calculate their net income or profit by deducting all the costs and expenses from the generated revenue.

Conclusion

The income statement is used by all the businesses that are operating in the World. It is one of the most important financial statements that are vital for a company.

It is used to understand the financial position of a company. The main aim of the company is to understand the total revenue and the expenses.

That’s why income statements are made quarterly and yearly to get a better understanding. There are three main elements of an income statement.

They are revenue, expenses, and net income. The costs are deducted from the revenue to calculate the total profit.

Experts like financial analysts analyze the financial statements and advise companies to take steps that can be beneficial and improve the company’s revenue.

Only income statements are the statements through which financial analysts can decide what should be done to cut expenses and increase revenue.