Introduction

Bond is usually priced as a percentage of par, or face value. However, depending on many factors, bond prices fluctuate over time.

This is mainly because of the fact that there are numerous different factors, like interest rate, and compounding type, that impacts the overall bond price.

For bond investors, it often gets confusing to fully understand bond prices and mechanisms. In this regard, two very commonly used terms are clean price and dirty price.

The main difference between both clean prices and dirty price lies in the realm of technical differences.

From the investor’s perspective, interest rate and accumulated interest calculation tend to be crucial in making investment-related decisions.

Therefore, regardless of the type of prices being used, the interest rates cannot be ignored in the bond pricing and analysis.

What is a Clean Price?

The clean price is the price of a coupon bond that does not include any previously or currently accrued interest.

In other words, a clean price implies that the bond price has not been incorporated with the accrued interest between the coupon payments. The clean price is the price that is normally quoted on financial news sites.

Given that interest accrues evenly across the course of time in bonds, calculation of the amount earned can easily be calculated on a daily basis.

However, this increment in interest over time is not accounted for in calculating the dirty price. Normally, bonds are quoted at their face value or their par value.

This means that if the bond’s face value is $1000, and it is quoted at 98%, the clean price of the bond will be $980.

Example of Clean Price

For purpose of understanding how to clean price is calculated and how it works, the following example is given:

Let’s assume that Antsy Co. issued a bond with a $1000 face value, with $960 being the published price of the bond.

The bond is said to pay interest (or a coupon rate) of 5% annually through semi-annual payments. Consequently, this implies that investors would continue to receive $25 every 6 months.

The clean price of the bond issued by Antsy Co. in this regard is said to be $960. However, when this amount is displayed and conveyed to the investors, it also factors in all the accumulated interest within the bond.

This also implies that once a coupon payment has been duly made, the bond’s price is restored to the actual price.

In other words, the clean price, and the dirty price are the same on and after the first day where coupon payments have been made.

As soon as the bond begins to accrue interest again, clean and dirty prices are no longer the same.

What is a Dirty Price?

A dirty price can be defined as the price that includes accrued interest and a bond’s coupon payment.

This implies that the dirty price is over and above the clean price of the bond, simply because it factors in accrued interest payments.

This concept can be explained using the notion of accrued interest on the bonds. Since interest is accrued evenly across these bonds, it is important to consider that after every passing day, the accrued interest is meant to increase.

Therefore, when buying or selling bonds, the investors need to account for coupon payments that are due in the near future and coupon payments that have already been accounted for.

Dirty price accumulates, and this price is subsequently communicated to the investors for their consideration.

Example of Dirty Price

The calculation and usage of dirty price are explained in the following example:

Let’s assume that Bitsy Co. issued a bond with a $1000 face value, with $960 being the published price of the bond.

The bond is said to pay interest (or a coupon rate) of 5% annually through semi-annual payments. Consequently, this implies that investors would continue to receive $25 every 6 months.

In the example above, the clean price will stay the same. It will be maintained at $960 across the course of time.

However, dirty price continues to change with time. Every passing day, interest is accumulated on the bond, and hence, the bond price from the investor’s perspective changes daily.

For instance, in the case of Bitsy Co, it can be seen that there are semi-annual payments. Therefore, the bond’s dirty price will be $960 (par value) + $25 (accrued interest). The total amount, in that case, amounts to $985.

The dirty price of a bond continues to change with every passing day because interest keeps accumulating over time.

When the coupon payment is made after 6 months, the dirty and clean prices would be the same since there would be no accumulated interest on the bond then.

Therefore, the dirty price is the highest right before the coupon payment is about to be made, and it is the lowest (i.e. it is equal to the clean price) right after the bond has been issued, or right after the coupon payment has been made.

How do Clean Prices and Dirty Prices work?

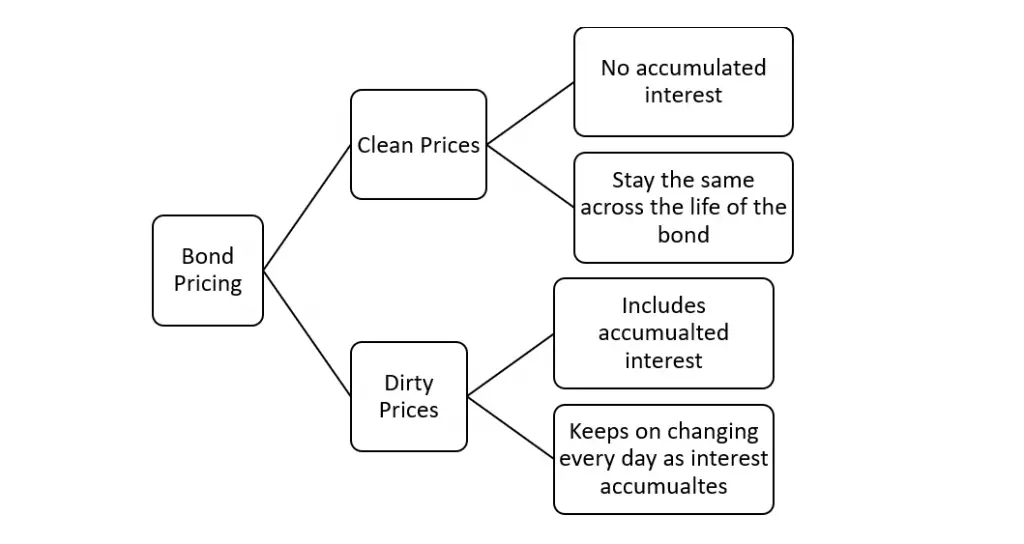

The mechanism of clean prices and dirty prices is illustrated via the following diagram:

What are the differences between clean price and dirty price?

Even though clean price and dirty price essentially convey the same thing (the bond price with or without accumulated interest), there are a couple of differences between both these terminologies.

These differences are given below:

- Firstly, the fundamental difference between the clean and dirty prices is that the clean price does not represent any accumulated interest. Dirty price, on the other hand, includes accumulated interest in the bond price.

- A clean Price is always less than or equal to a dirty price. A clean price can never be higher than a dirty price unless a negative interest rate is applied.

- A clean price just informs the investor about the face value of the bond. Other interest calculations need to be made by the investor himself. Investors use dirty price because it shows a lump sum value of the bond at a certain time.

- Clean Price is mainly used in the US. Dirty price is used in the UK.

- The clean price stays the same across the life of the bond. On the other hand, the dirty price tends to increase till the point where coupon payment is due. After the coupon payment is due, the price restores to the clean price.

However, the main difference between clean and dirty prices is that clean prices do not include interest, whereas dirty prices are representative of the accumulated interest. In most cases, a clean price is a price that is used as a benchmark for comparisons.

Dirty price is used for internal workings and calculations to estimate the expected payoff from purchasing a specific bond.

Therefore, it can be seen that clean prices and dirty prices are two very commonly used that are often mixed upon by investors.

However, these terminologies have numerous staunch differences, predominantly on technical grounds.