Definition

Average total assets are the assets used by businesses throughout the accounting period. These assets are calculated with the opening and closing of the total assets in the business’s balance sheet.

This figure is mostly used in calculating the activity ratio, where revenue generated by the business is compared with the total assets implied by the business in operations. This figure is calculated by adding opening and closing assets and dividing them by two.

Detailed concept

There are two types of assets implied in the business: current assets and non-current assets. The business’s current assets are usually implied to run business operations or fulfill the needs of working capital. These assets include inventory, cash, accounts receivable and other assets, etc.

As we understand, these assets are obtained via equity or debt, and there is a cost associated with each of the cases. So, with perspective to performance evaluation, it’s desirable to have fewer assets and more revenue. This helps to reduce the cost of financing for the assets and enhance business profitability.

On the other hand, other types of assets are non-current assets. These assets include property plant and equipment, long-term investments, and other long-term assets.

Again, with perspective to performance appraisal, it’s good to maintain a low base and generate a higher return. However, the liquidity perspective is different regarding non-current assets.

Investors and lenders feel more relaxed while investing in the asset incentive business. In case of liquidation, there are higher chances of recovery if the business has a strong assets base.

However, if we think about going concern basis, performance-related factors should be prioritized while investing.

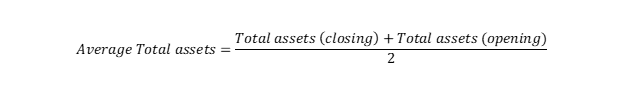

It’s important to note that closing assets of the business can also be used in performance evaluation. However, the use of the average assets is more useful if there is greater fluctuation in the business’s asset base. Further, the following formula is used in the calculation of average total assets

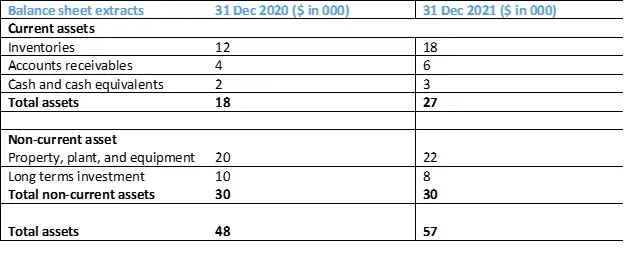

Example for the calculation of average total assets

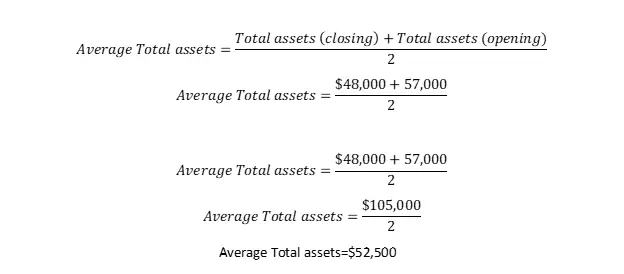

Let’s calculate average total assets with the help of the formula and the following extracts.

$52,500 is the average total assets that can be used in the calculation of ratios.

Return analysis and average assets

Calculation and analysis of the return in connection with total assets helps to understand the performance of the business. It helps to understand how management has used its assets to generate revenue and return. For instance, assets turnover, return on average asset, fixed assets turnover, etc. Let’s these ratios in detail.

Asset turnover

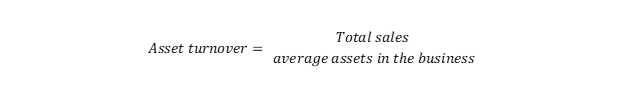

The asset turnover ratio measures the efficiency of the business to generate sales. It helps investors understand how efficient management is in utilizing the business’s assets in generating sales.

A higher value of the asset turnover indicates that the business has efficiently utilized assets in the business and vice versa. The following formula can compare this metric.

It’s important to note that analysis of asset turnover is meaningful when compared with companies in the sector, it’s because of the difference in business model as some businesses can generate revenue with a small base of assets (service sector). In contrast, other businesses require an extensive base (manufacturing sector).

However, this matric can be impacted by the sale/purchase of significant assets during the year. Hence, we use average assets implied in the business to get a more accurate assessment.

Return on average assets

This matric helps to understand how efficiently the business has used its assets to generate the return. Investors are more attracted to companies with a higher return on average assets. Return on average assets can be calculated with the following formula.

Again, we have used average total assets as significant sale/purchase of the asset might impair our assessment for the matric. This ratio is also dependent on the sector and requires comparison with the sister companies. However, the companies with a higher assets base tend to show lower returns on average assets and vice versa.

Banks and other lenders use this matric to assessability of the company to generate a return and repay their funds. At the same time, it’s more important matric when banks assess loan applications for the asset base expansion.

Similarly, management can use it to assess if they’ve been efficiently utilizing their assets. However, this ratio includes elements of working capital. So, to assess earning potential of the non-current asset, another ratio is calculated called the fixed asset turnover ratio.

Fixed asset turnover ratio

This ratio helps to understand if the business is efficiently utilizing its fixed assets to generate sales. A higher fixed asset ratio is desirable from a profitability perspective. On the other hand, a lower fixed asset ratio might indicate the over-investment in the fixed assets and the need to adjust production and utilization patterns. This ratio can be calculated by using the following formula.

Conclusion

Some industrial sectors require an extensive asset base, and some require a lower base of the assets due to differences in their business model. For instance, manufacturing companies are expected to have multiple production steps and require an extensive asset base. On the other hand, service, and financing companies are expected to have a lower asset base.

From a profitability and efficiency perspective, a lower asset base is more desirable as it predicts the efficiency of business to drive most from the use of assets. However, sometimes investors might be interested in the business with a higher asset base as they want to be sure of investment recovery in case of company liquidation.

So, an accurate assessment of the average asset base requires comparison with competitors and other companies in the sector to identify if the business is underperforming.

The asset base of the business is often analyzed in connection with its return generating ability. A business with a lower asset base and higher return is considered more desirable and vice versa. Different ratios are calculated to analyze the average asset base in connection with the return, including asset turnover, return on average assets, fixed assets turnover, etc.

Frequently asked questions

Why is the average total asset calculated?

Average total asset is calculated to be used in the calculation of ratios. This figure represents more accurate numbers for the assets used in the business throughout the accounting period. In other words, the assets at some specific date may not accurately represent the assets used in the business throughout the year.

Why do lenders desire to invest in a business with higher average total assets?

It’s because if the business goes into liquidation, they have a preferred right to collect their dues. In other words, lenders of the debt are the first to stand in a queue to collect their dues if the business goes into liquidation. Hence, their fund’s recovery chances increase with the larger asset base/significant amount of the average total assets.

How to interpret return on average assets?

Return on average assets highlights the efficiency of the business to generate a return. If the business can effectively utilize assets, it’s expected to generate a higher return and vice versa.

What’s the impact of a higher cash balance on total average assets?

Total average asset increase with the higher cash and bank balances. However, it leads to an adverse impact on the return on average assets. Further, holding a high level of cash balance might indicate that the business has nothing to do with the money. Hence, excessive cash is not considered a good sign for business performance.