When you make sales from your business or offer a service to someone on credit, your accounts receivable will record such a transaction. For example, when you make credit sales, you provide your customer a note called an invoice, and then you record the invoice details into your accounts receivable. Thus, the receivable in your accounting book is your outstanding invoices yet to be paid off.

Now, when you attach the term “aging” to the account receivables, you refer to the length of the period of days for which an invoice is overdue for payment. So, the aging of account receivables is a management tool introduced to help businesses keep tabs on debtors and their outstanding invoices to recover them.

Why is the Aging of Accounts Receivables Important?

The aging of account receivables is a report used by the management team of a business. This AR aging report is quite crucial to the company in several ways. Aside from the fact that it gives you a glance of your debtors, it is also helpful in the following aspects:

- A regular weekly or monthly track of your AR aging report will help identify potential unfavorable concerns before it translates into a cash flow problem.

- It grants you a bit of insight into your debtors’ business, which will help you fix your invoice timeline to a financially favorable period, thereby increasing your chances of timely payment.

- AR aging report helps you analyze the late payment history of your customers to adjust your AR procedure to achieve positive results.

- AR aging report helps a business maintain a healthy cash flow and helps identify potentially bad credit risks.

- It also helps in determining how risky extending credit will be for your business.

- It helps you know when to withhold your goods or offered service pending when the customer pays on the due date. This will assist in making sure that you don’t run into unrecoverable debt.

- It keeps you on track with your collection, hinting at how regularly you should contact your customers for their bills.

- It helps you evaluate payment terms with your suppliers in case quantity supplies are necessary.

- Using AR aging-friendly software, you can customize a customers’ invoice base settings that will allow you to send automated personalized payment reminders to particular customers. Your settings will have to indicate the intervals for transmitting the reminders.

- With an AR aging report, a company can identify customers capable of becoming credit risk to her. Identifying such customers saves the company from encroaching into insolvency owing to the risk of the customer’s inability to pay off. The company’s management team may have to check the company’s credit risk status alongside the industry’s standard to know if the company is in a safe zone or adjustment needs to be made regarding the management of their credit risk.

How to Create AR Aging Report

You can follow this procedure to create an account receivable aging report:

- The first thing to do is to review all your outstanding invoices.

- Identify and separate the outstanding invoices using the aging schedule, also stipulating the amount to be received.

- With the list of your customer’s overdue accounts, categorize them based on the total amount you receive and the number of days due.

What Is an Aging Schedule?

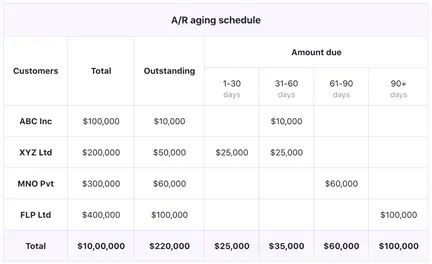

An aging schedule is a table that shows all overdue invoices, the amount dues, and more particularly, the number of days overdue. It gives an overview of the business’s outstanding invoices with their due dates. It helps to know the payment rate of customers, and it is also instrumental in cash flow estimation.

The due invoices are broken down into categories referred to as aging schedules. The aging schedule is generally grouped into 4 categories.

- 1 – 30 days overdue

- 31 – 60 days overdue

- 61 – 90 days overdue

- 90 + days overdue

The four categories of the AR aging schedule are shown in the diagram below.+

Usage of Aging Schedules

An aging schedule can be used in the following ways:

#1. To Indicate Cash Flow Problem

An aging schedule is endued with the ability to shield your business from cash flow problems. In addition, it can help identify issues that might spring up in the accounts receivable since it also identifies changes in the account.

#2. To Adjust Credit Policies

The aging schedule is utilized to recognize customers that are late in paying their bills. If the more significant part of the overdue debt is just a customer, the business can employ strategic means to guarantee that the customer’s outstanding records are cleared.

In cases where many customers with outstanding dues stretch past 60 days, it might flag the need to adjust the credit policy with relation to the current and new customers.

#3. To Calculate the Allowance for Doubtful Debt

Generally, the more debt or accounts receivable prolong in the settlement, the lesser the chances of recovering it. Using the AR aging schedule method, you can estimate the total amount of outstanding bills you have and give an estimate of those with slimmer chances to be recovered.

Means of Using an AR Aging Report

Here are means of using the AR Aging report

#1. Utilize the AR Aging schedule

When using an AR aging report, you will need to go through your aging schedule, look out for customers with larger outstanding debt percentages, and apply more strategic efforts to collect them. You might also want to check how long overdue the debts have been and focus on the longest.

This strategic effort of yours has to do with your planning. You could try sending emails at intervals to the customers as a reminder or give a friendly call. If you encounter difficulties in customer response, you might consider hiring the services of a collection agency or writing it off as bad debt.

Allowance for bad debts

Using AR aging, a company can periodically analyze the percentage of the dollar amount of invoice that eventually turned out to be bad debt and apply the percentage to the present aging report. It can also be used to predict potential bad debt for the current reporting system.

For example, let’s say that Zico Company allows for a 10% bad debts allowance for the first 30 days and a 12% bad debts allowance within the next 31 to 60 days period.

Currently, the company reports $10,000,000 in debts in the first 0 to 30 days period and $100,000 in deficits in the next 31 to 60 days period. This means that the allowance for bad debts is $2,500 as calculated:

Allowance for Bad Debts = [($10,000,000×10%) + ($100,000 x 12%)]

= $1000,000 + $12,000

= $1,012,000

Conclusion

AR aging report is instrumental to a business based on the array of benefits discussed, particularly its ability to keep track of your overdue creditors and your effectiveness in receiving your dues.

While drawing up the accounts receivable aging report, please make a point to incorporate the customer data, aggregate sum to be paid, a backdate and update data of every customer’s financial affairs and collection status.