After tax cost of debt

The after-tax cost of debt is an important financial metric for evaluating the financing cost of the business. It provides strong insights to assess financial leverage and interest rate risk for investing in the specific business as a lender. From a business perspective, tax-deductibility on payment of interest is considered an attractive feature as it positively impacts the net profit by reducing the taxable base.

On the flip side, financing via equity does not qualify for tax deductibility as dividend is not deductible while calculating taxable base. Hence, it makes a difference, especially if a business’s income falls in a higher tax slab.

In addition to this, the after-tax cost of debt and the cost of equity is also used as a discount rate to assess the project’s financial feasibility; the Cost of debt is also referred to as kid of the business. The logic for using an after-tax cost of debt in calculating project NPV is to incorporate the time value of money in and make a decision on the basis of values in today’s terms.

In this article, we have discussed different aspects of the cost of debt, including calculation, uses, impact, and more.

Detailed concept

When the business obtains a loan, it has to pay a specific rate of interest. The payment of the interest is an allowable business expense and reduces overall tax expense for the business.

Further, the cost of debt may vary due to the incremental tax rate of a business. For instance, if a company’s profits are higher in the tax year, the higher tax rate will be applicable, and the deduction of the taxable income with the payment of interest will result in more tax savings. On the other hand, if the business’s income falls in a lower tax slab, effective savings due to tax deduction is comparatively lower.

Another way for the business to obtain financing is equity. However, it’s considered an expensive source of financing as payment of a dividend does not tax allowable. So, businesses look for debt financing. However, the problem with debt financing is that it increases leverage and signals the financial instability of the business if in excess.

Further, the cost of capital (cost of debt +cost of equity) is a great tool for the lenders to assess the risk of leverage in the potential investment. Suppose there is a higher cost of debt; the investment is perceived to be risky. On the other hand, a lower rate of debt financing is associated with lower financial leverage, and that’s because riskier companies generally have a higher cost of debt.

Tax impact on the cost of debt

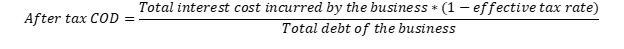

The interest paid on the loan is deducted from the taxable income. So, we deduct income tax savings from the total cost of the debt. To calculate the after-tax cost of debt, the following formula is used,

This formula first deducts the tax savings from the cost of interest. The result is an effective interest cost after deduction, the division of this amount with the total volume of debt results in an effective interest rate.

It’s important to note that both state and federal rates of taxes should be included in the given formula above for more accuracy.

Benefits of calculating after tax cost of capital

Following are some of the benefits associated with the after-tax cost of debt.

- Formation of debt policy– It helps businesses make better financing decisions on available sources of the debt. More effective financing decisions can be taken if the business has comprehensive insights. Especially, debt policy can be formulated considering the effective cost of debt in comparison with the equity. In simple words, it helps the business to set an optimum financing structure.

- Assessment matric for the lenders – The after tax cost of capital is a great matric for the lenders to assess the borrower’s financial risk. So, this calculation allows the management of the company to monitor financial leverage in the business. Hence, they get a strong idea of the cost of interest if they opt to raise more financing for the business expansion etc.

- Financing decision – The management of the company gets a clearer picture of the financing cost with the cost of debt. This puts them in making better decisions for the business with perspective to the financial feasibility of the projects.

Lets’ discuss the steps to calculate the after-tax cost of debt.

Steps to calculate after tax cost of capital

The following steps can be used by businesses to calculate the after-tax cost of capital.

1- Obtain a list of outstanding debt

The list should contain all the interest-bearing loans including secured, non-secured, lines of credit, real estate loans, credit card loans, and cash advances, etc. Further, the list should also contain any loans obtained with a personal guarantee but used by the business.

2- Apply rate of the interest on the debt amount

It can be a little longer work to find rates on all the individual financial products. However, once you have a list of all the interest rates with the debit balances, it should provide comprehensive information about the business’s debt to be used in future financing decisions.

It should give a comprehensive insight regarding leverage to the manager responsible for finance management

3- Calculate the effective rate of the interest and pre-tax cost of debt.

The effective interest rate can be calculated by adding both state and federal rates of taxes. However, you need to only incorporate the tax rate that applies to your business (both taxes are applicable on some businesses, so you need to make a logical selection).

Further, the pre-tax cost of the debt can be calculated simply by obtaining an interest rate in the debt instrument.

4- Calculate after tax cost of debt

You have a pre-tax cost of interest, an effective interest rate, and all the debt balances at this stage. These all the costs need to be entered in the following formula.

Example of cost of debt and application of the formula

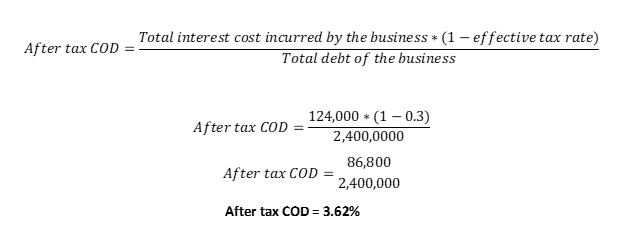

Suppose the company has the following debt profile,

- Loan amounting to $2 million at an interest rate of 5% per annum.

- Loan amounting to $400,000 at an interest rate of 6% per annum.

The rate of tax is 30%.

Let’s first calculate the after-tax cost of the debt.

100,000 (2,000,000*0.05)

24,000 (400,000*0.06)

The total cost of interest before tax is $124,000 ($100,000+$24,000) and debt balance is $2,400,000 ($4,000,000+$400,000).

So, we can put the figures in the following formula,

Optimum debt point and the cost of debt

As per the pecking order theory, debt is a cheaper source of finance than equity. However, if there is an excessive increase in the debt same might not be true due to the higher risk of financial leverage. Now, the question arises how to monitor the financial leverage?

Active monitoring of the cost of debt helps to assess the trend of the financial leverage. If there is a sudden increase in the cost of debt, the debt proportion of the capital might have exceeded the equity side leading to a higher cost of interest and lower profitability. Hence, timely action can be taken with the help of the cost of debt as a financial metric.

Conclusion

There are mainly two sources to raise the finance that include debt and equity. When the business opts for debt financing, it has to pay interest and the interest paid on the debt financing is tax allowable that leads to savings in the tax expense. Hence, we need to calculate the after-tax rate of interest for a better assessment of the financing cost.

Further, the after-tax cost of debt is an important metric with perspective to both investors and the management, Investors assess the business’s overall risk with the help of this metric, and management makes an estimate for the financial viability of the projects by using as a discount factor in NPV calculations.

In addition to this, this metric is an essential input in forming debt policy and deciding which source of income should be opted to fulfill business needs of finance. It’s based on the same concept of controlling the cost and increasing profitability.

Frequently asked questions

Why the rate of interest varies from business to business?

The rate of interest cost varies from business to business as businesses are different in their nature, size, and risk. Further, the length of the loan also impacts the cost of the interest. For instance, if the loan is sanctioned for the greater period, the interest rate risk is set higher as there is more time in collecting the funds, and chances of default are higher.

What’s the difference between the cost of equity and the cost of debt?

Cost of equity is referred to the return that is provided to the shareholders of the company. In other words, it’s the compensation paid to the owners/shareholders for providing their funds to the company. The equity investment makes shareholders owner of the business.

On the other hand, the cost of debt is the finance expense paid on the debt obtained by the business. The loan lenders do not become an owner in the business, but they are first in line for the assets, if the company goes into liquidation.

What are the components of the cost of capital?

The cost of capital is comprised of the cost of debt and the cost of equity. The effective rate and volume of each financing source are taken in proportion to calculate the cost of capital which is referred to as WACC – Weighted Average Cost of Capital.

What’s the impact of the tax on the cost of debt?

The effective cost of debt decreases with the tax impact. It’s because interest is an allowable expense in the taxation. Hence, when the after-tax cost of debt is lower than the before-tax cost of debt.