Definition:

Debit is a very commonly used term found in almost any financial statement. Its utility exceeds far beyond accounting statements.

Debits are made into the left column of an account as part of the double accounting system. Any amount entered on the left-hand side will always be a debit amount in a general ledger.

Abbreviation for Debit:

Understanding what it is and what is the most commonly used abbreviation for it can help you in your day-to-day business activities.

The most commonly used abbreviation for debit is ‘Dr’. This word is derived from the Latin term “debitum” which means something owed to another individual or business entity.

It also indicates the debtor who owes the remaining balance—signifying that either an asset or payment is due on another party.

The term also dates back to Italy, where it was used five centuries ago until later on accountants became more comfortable using ‘Debit’ instead of its abbreviation.

When Do Firms Debit

Debit balances can include assets, expenses, and withdrawals. Whenever a debit amount is entered, the balance is expected to increase, while credit amounts entered result in a decrease in the overall balance.

These two negate each other to generate a total sum that has to be equal for the entry system to verify its own records. Every debit balance corresponds to another credit balance made in the financial statement.

Businesses may also use debit notes implying that they have made an entry in their books denoting a dealing with another business.

If a company gives service to another party, the party may issue a debit note showcasing the indicated service and the accounting transaction between them.

Another example of this is the debit card issued by banks. Both debit and credit cards serve the same purpose but with different procedures.

While debit cards use funds already present within a customer’s bank account, a credit card allows you to take a loaned amount from the bank based on a set interest rate.

Debit in Accounting:

The father of accounting, Luca Pacioli, was a Franciscan monk who developed the double-entry accounting system.

It was this system that then became the foundational technique for modern-day accountants to employ.

This system is still largely used worldwide for its ending numbers to be equal. Such that debit should also equal credits.

While in a typical standard journal entry, all the records made in the top line are deemed as debit balances, while those recorded near the lower line indicate the credit balances.

In double accounting systems, debit is the entry made on the left side of a general ledger in contrast to the right, which is credit.

Debit will most commonly be found for accounts containing assets and expenses, whereas credit usually deals with liabilities and the stockholder’s equity accounts.

Creating a debit and a credit account is a must for business transactions. Therefore, once two or more accounts are identified, they must be debited and credited equally to generate the same net sum.

In simple terms, whenever you are debiting, you are entering the amount in the left column, while whenever crediting, you are doing the opposite by entering the amount in the right column.

A great way to remember what accounts are affected by debit is to memorize the acronym, DEAL:

These four accounts always increase with debit and are easy to remember when accounting for financial statements.

Example:

An example of this can be derived from the following example.

A business has $1,000 in cash. Therefore, its general ledger will indicate a debit balance of $1,000. Let’s assume the business made sales through which it earned $500.

This figure will be entered as debit resulting in the total debit balance for the business to be $1,500.

In practical life, different terms denoting the debit factor may be used. Such as, in the example above, the sales made reflect the debit balance of the business.

Similarly, an accountant may use other terms such as “Charged $500 for services,” which may denote the same concept adding to the overall debt balance.

So, while the term may differ, the balance score serves the same purpose.

Purpose of debit balance:

A debit balance’s purpose is to counteract the credit balance and serve as an increase in the assets or decrease in the liabilities accounting entry in a business’s financial statement.

Many individuals confuse the debit concept such that debit indicates an increase in the account. This is not true. A debit balance does not necessarily denote either an increase or decrease.

The only constant is that the debit balance is noted and recorded on the left side of the accounting statement.

Varying based on the situation to the situation may increase or decrease the overall balance within the account.

A debit noted for an asset will increase the account, while a debit recorded in a revenue account would decrease the revenue account. Thus, we cannot conclude that debit will always increase the account.

Debit in T-Account:

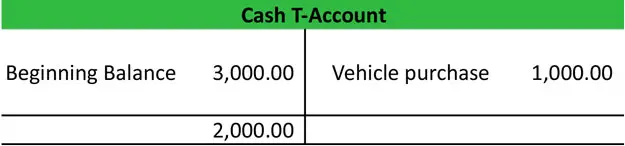

Debits and credit are also used in T-accounts. Since we know that debit in assets increases the balance, it would be recorded as an asset resulting in an increased balance in a T-account of cash.

We can use this example to show that cash as an asset would increase all debit balances recorded while credits in the T-account would decrease the balance.

In the example given below, a cash account is debited for $3,000, while credit is recorded for $1,000. Resulting in a net sum of $2,000. In simple terms, the business now has a debit of $2,000 in its checking account.

Instead, if the credit account were $5,000, the business would have a negative credit balance of $2,000. Meaning that the company over-drafted its checking account and has to pay the credited amount by $2,000.

There are also cases of “dangling debt.” This is simply a debit balance that does not have a corresponding credit balance to counteract it with.

This causes discrepancies in the financial statements, which may be hard to understand later. +These can occur when a company receives the product or service because of goodwill or its relationship with the other party creating a debit balance with no credit.

A Review of debit in accounting:

An accountant makes a debit to implicate a reduction in running debts by a company allowing it to overcome liabilities. Debuting certain accounts means increasing them, while debiting others may decrease them.

Accounts that are increased by debits include the following:

- Assets include cash, account receivables, inventory, land, or equipment.

- Expenses such as Rent, Wages, or interest.

- Losses such as the sale of assets, lawsuits,s or damages.

- A Drawing accounts

Accounts that are decreased by debits include the following:

- Liabilities such as Notes Payable, accounts payable, or interest payable.

- Stockholder’s equity, such as common stock or retained earnings.

The most commonly used double-entry method has debit balances recorded on the left-hand side and credit balances on the right-hand side.

Understanding how debit and credit co-relate with each other allows a business to monitor its financial status and act accordingly.