All of us familiar with the stock markets. Stock markets are the marketplaces where financial instruments and securities like bonds and stocks are traded. The market where the foreign currencies are bought and sold is called Forex or Foreign Exchange Market.

Understanding and becoming part of the stock markets is an art, and only the masters of this art can capitalize on their investments. The speculation mechanisms, blank selling, and other shady practices are as old as these markets themselves.

In the early days, when rules and regulations were not strict, investors used to get involved in many shady activities to maximize their return or avoid tax liabilities. With the advent of time, the regulations have become strict, making it hard for the investors and market players to carry on such activities.

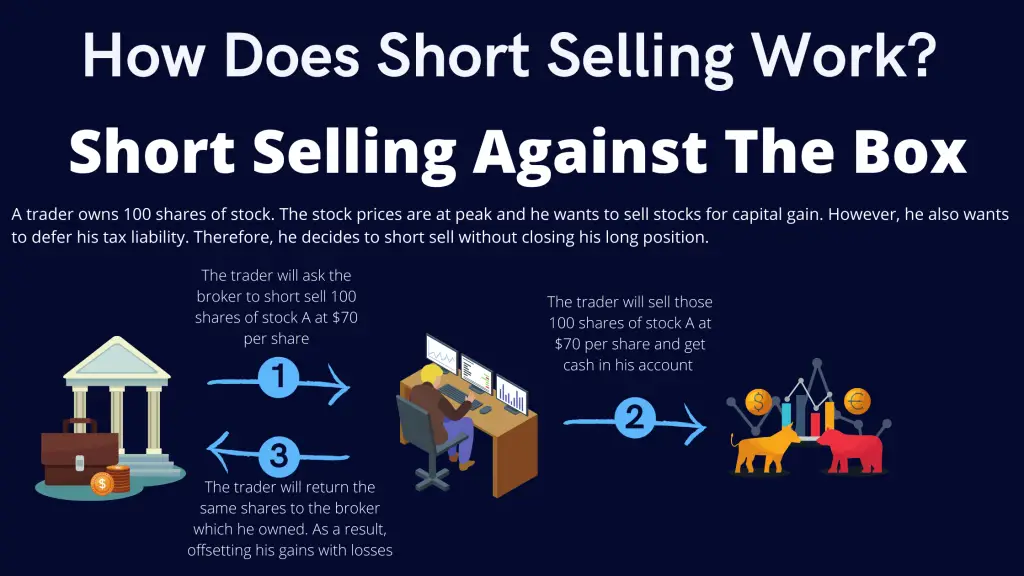

Short selling against the box is a market practice where an investor short sells the securities owned by him without closing his long position. This practice is very common among investors to save themselves from the tax liability on the capital gains.

In this article, we will explain the concept of short selling, short and long position, and legitimacy of short selling against the box.

What Is Short Selling?

Short selling is a finance term that means that an investor has sold some securities that he does not own. A short sale is made against security that the seller does not own, but a promise to deliver such security is made.

The concept might be confusing so far. Let’s break it down to understand the short-selling process. So let’s understand this idea by example.

Mr. X is an investor in the stock market, and he has short-sell 100 shares of company XYZ. He doesn’t own these shares. Instead, he lent them from his broker with a promise of returning on a future date. Now the broker has given him shares from his brokerage firm’s inventory or from any other brokerage firm’s inventory.

The sale is made, and the sale proceeds are transferred to Mr. X’s margin account. Shortly, Mr.X has to close his ‘short’ position by returning the same number of shares to the broker. If the shares price drop in the coming days, he can buy them from the market at a lower price and earn some profit.

Let’s suppose the expectations of Mr. X about shares’ price drop are not met. Now, he is obligated to purchase the market shares at a higher price and return to the broker. In this scenario, he will lose the money.

It is the whole concept of short selling. We must understand the short selling is done based on the short seller’s expectation that certain security will have a bearish trend in the near future. The motivation behind the short-selling can be speculation or hedging. We will explain the terms later.

Short Position And Long Position

Many of us often get confused between the short and long positions of the investor. Let’s explain this simple concept so that we never get confused again.

When an investor has a long position, it means that he has bought the shares and he has absolute rights of ownership.

However, if an investor has a short position, it will imply that he owes shares to someone, but he has not completely owned them.

Let’s make it easy with the help of an example.

Suppose that Mr. David is an investor who has owned 100 shares of XYZ Limited. He has paid the full cost of these shares; therefore, he owns them. Mr. David is said to have a long position or to be long by 100 shares.

If the same example is implemented on another investor, Mr. Mike has sold 100 shares of XYZ limited but doesn’t own those shares.

He needs to own 100 shares by the date of sale settlement for delivery, and he will have to buy from the market. Mr. Mike is said to have a short position or short 100 shares. There might be a scenario like the above-discussed example where an investor had borrowed shares from the broker.

Short Selling Against The Box

After understanding the concept of short-selling, let’s get to short-selling against the box.

Short selling against the box is an act of short-selling securities owned by an investor without closing his long position. A neutral position of the investor is created where the gains on stocks offset losses. The short-selling against the box is mostly done to avoid tax liabilities.

The concept of the short sale against the box might not be clear enough by definition. Let’s understand it with example.

Short Sale Against The Box Explained

The sole purpose of short selling against the box is to delay a taxable event. However, let’s break down the definition of short selling.

An investor M owned 100 shares of Tesla. He doesn’t want to close his long position till the end of this financial year. He asked his broker to short sell 100 shares of Tesla. If a short sale occurs, the trader will have to buy stock from the market. In this scenario, he has a long position on one of his margin account.

He is short selling on the other margin account. The loss on his short position will offset the capital gains on the long position. The net result will be zero. Therefore, no taxable activity will be recorded.

Example Of Short Sale Against The Box

Let’s say that Mr. David has owned some shares of a company in his brokerage account that was not a margin account. He got a considerable paper gain on the shares, and he wants to sell his shares. He has long position on his brokerage account. But since this sale will give rise to a taxable income of capital gains, he decides to short sell.

He asks his broker to short sell the same number of shares of the same company. In short selling, it is customary to return the shares to the lender. Mr. David has made the short sale on the expectation that the shares have peak price and it will increase more.

However, once the time of settlement arrives, he transferred the same shares as owned by him. Virtually he has purchased the shares from the market at a higher price, hence resulting in capital loss.

His capital gains on the brokerage account will be settled off by capital loss on a short sale. This is the whole concept of short sale against the box.

Why People Short Sell Against The Box And Is It Legal?

If we analyze the short selling against the box, most investors’ only motive behind this is to lower their tax liability for a certain tax year. For instance, a person has made a short sale against the box with the belief that his income will be low in the next year, and he will close his long position.

If we talk about the era before 1997, this practice was the most common source of deferring tax payments for one year. According to the tax laws of that year, if an investor owns one short and one long position, all the capital gains on long positions will be temporarily offset by the losses on the short sale.

However, in 1997, the tax laws were revised hence avoiding the investors from using short sell against the box as a tax delaying event. Under TRA97, any gains or losses against the sales are not deferred from tax. Instead, the capital gains of a certain year will be taxable in the same year.

Later on, the SECP and Financial Industry Regulatory Authority(FINRA) also limits when an investor can short sale. For example, a limitation was put in 2010 stating that there will be no short sale if a price drop of a certain security is more than 10% in a single day.

If we are to answer the question of whether short selling against the box is legal or not, the answer is a bit complicated. The legitimacy of such boxing entirely depends on the purpose, time, and method of doing it.

The Consequences Of Short Selling Against The Box

Short selling against the box is a trading strategy of the stock market. Like any other trading strategy, there are certain upsides and downsides of short selling against the box.

The revisions in tax laws have limited the short selling against the box; there is a loophole in the law. Therefore, this strategy can still be used to delay a taxable event.

For instance, an investor has a short against the box position. Within the first 30 days of a tax year, if he buys in short, leaving his long position at risk for 60 days before closing long, the constructive sales act will not apply.

So, here is an opportunity of selling short against the box but with a risk of exposing yourself for 60 days in every tax year.

Bottom Line

We have tried to explain the short selling against the box as a trading strategy used in the stock market. Any opinions, examples, or arguments are not to be considered any legal advice. You must consult your attorney before taking any action to save yourself from any penalties.