Securitization is a financial process that converts the asset provided into security and makes them a tradeable financial asset. The assets that provide the basis for securitization are generally trading receivables, basically, debt owed to the company by its debtors and customers. Trade receivables comprise capital and periodic interest. Assets used for securitization include loans from students, credit card loans, vehicle loans, and mortgages.

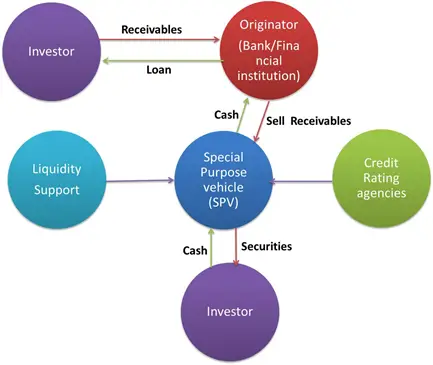

When a company wants to securitize such assets, it takes debt that is owed and keeps it into a separate entity called trust or special purpose vehicle. This entity then sells on to other investors or a pool of investors. The organizing company receives consideration for transferring the debt to the pool of investors and now becomes out of the transaction.

The SPV is in the hands of pool of investors which consist large number of assets of some type or other. This generates receivables and later on generates income for pool of investors. These assets are divided into several tranches based on their credit rating from lower risk rating to higher risk rated assets.

The equity tranche of assets is the riskiest tranche of assets. The tranches are sold as per the risk appetite of investors. Lower risk-rated assets generate lower income and higher risk-rated assets generate higher returns for the investors. However, the risk of default is higher in the higher risk-rated assets.

Securitization process:

Analyzing the above flow, the first step is of the originator. The originator has already underlying assets or needs to get one in order to securitize the asset. The receivables need to study. The special purpose vehicle is then formed.

SPV takes the responsibility of acquiring the receivables under discounted value. The servicer is appointed to do the transaction i.e. generally the originator. The servicer collects the receivables and pays off the collection to special purpose vehicles.

SPV passes the collection to investors or reinvests the same. In case of default, the servicer takes action against the debtors as the agent of SPV. At the end of the transaction, the originator’s profit, if retained and subject to any losses to the extent agreed by the originator in the transaction is paid off. Securitization helps to boost the liquidity in the market.

Further, it helps financial companies to raise funds. If a company exhausts its funds by giving loans and wants to give more loans, securitization has to raise more funds. The company can club its asset n the form of a financial instrument and then issue it to the investors.

Underlying assets of Securitization:

The following are the assets that can be securitized

- Residential mortgage loans; this category includes the infamous “subprime mortgages

- Commercial mortgage loans

- Bank loans to businesses

- Commercial debt

- Education loans

- Credit-card debt

- Automobile loans

- Leasing assets

- Marketable financial instruments

Advantages of Securitization

- The primary advantage of securitization is that it creates liquidity in the marketplace for the assets being securitized. This provides the company with debt removes some debt off from its balance sheet and acquires new funding in place of that debt. As a result, the company receives liquid funds in exchange for debt that it has moved into securities.

- The other advantage would be the creation of tranches with different risks. The assets are classified into several tranches with each representing one kind of risk. These are then presented to investors. Investors based on their profile chose these types of assets. An investor with high risk may choose to invest in risky assets while those who have a low-risk profile would select low-risk assets.

- It is also beneficial for borrowers. Securitization allows companies to efficiently use debts on their books and make them liquid. This gives investors a range of attractive options for investment. Hence, companies offer loans to borrowers and this will lead to an advantage for the borrowers.

Disadvantages of Securitization

- The primary disadvantage of securitization is the complexity of risks involved alongside the process.

- Securitization creates enormous complications which sometimes leads to inaccurately assess the level of risk. Such a wrong assessment of risks is very harmful to investors.

- As long as the economy is going well, the process and all the parties involved in securitization are well off. When the economy starts to contract, repayments would get missed and defaults in some assets would make the entire asset tranches look unattractive. This may set off panic button that spreads beyond the markets and would end up affecting the entire market. Similar things happened in the 2007 financial crisis.