The main source of finance for companies is equity finance. Companies raise equity finance by issuing shares of the company to investors.

To buy these shares, investors must pay a price, which is the market value of the share at the time of issuance.

All shares of a company have a par value, that is the book value of the shares. However, the market value of the shares might be different than their par value.

There are many factors that determine the price of a share of a company in the market.

These factors may include but are not limited to, the performance of the company in recent years, any market speculations around the shares, or the supply and demand of the shares in the market.

For example, if the performance of the company has been improving recently, the share prices of the company will also experience a raise.

Mostly, the reasons for fluctuations in the price of the share of a company in the market are beyond the control of the company.

While companies can control their performance, other factors such as market supply and demand are outside their control.

Apart from the performance of the company in recent years, there are some other factors controlled by the company that can result in a fluctuation of the market prices of the shares of the company.

These factors are mainly influenced by movement of shares in the company, which trigger external events, thus, affecting the prices of the shares.

For example, if a company issues more shares in the market, the supply for the shares will increase, consequently, decreasing the market price of the shares.

In addition to issuing shares, other types of share movements can also dictate the price of a share in the market.

The other share movement-related factors that can be controlled by companies and can dictate the market price of the share are bonus issues, rights issues, stock splits, buyback of shares, and paying dividends.

Any of these events will alter either the demand or the supply of the shares of the company, thus, affecting the price of the shares of the company. These effects can be positive or negative.

Bonus Issues

When a company issues its shares to its existing shareholders without any charges and based on their current holding of shares, it is known as bonus issues.

Bonus shares are issued from the reserves of the company. Bonus shares are mainly used as an alternative to paying cash dividends.

For example, a company has 100,000 issued shares in the market and announces a 2 for 25 bonus issue shares.

This means that the company will issue a total of 8,000 (100,000 x 2 / 25) shares to its existing shareholders.

Regardless of the market price of the shares at the time of bonus issue, the shareholders of the company will not have to pay any cash to receive these shares.

Bonus issues will create an increase in the supply of shares of the company in the market. This will result in a decreasing of the market price of the shares.

Since there is a decrease in the market price of the shares after bonus issues, the prices of the shares have to be recalculated after every bonus issue is made.

The reduction in the price of the share is directly proportional to the number of shares issued as bonus.

Example

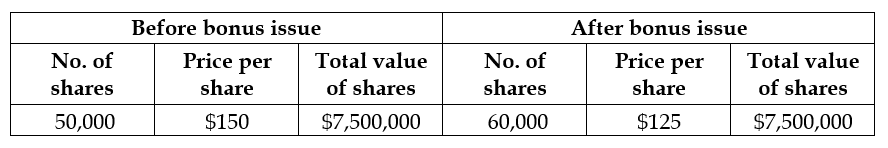

A company, ABC Co. had a total of 50,000 shares currently issued with a market price of $150 per share.

The company announced a bonus shares issue of 1 bonus share for every 5 shares owned. This means the company issued a total of 10,000 additional shares (50,000 x 1 / 5).

To calculate the share price after bonus issue of ABC Co., the total value of the shares before the bonus issue must be determined. The value of the shares before the bonus issue was $7,500,000 (50,000 x $100).

After the bonus issue, the number of shares of the company increased from 50,000 to 60,000.

To calculate the share price after the bonus issue, the total value of shares before the bonus issue must be divided on the new number of shares. Therefore, the share price after the bonus issue will be $125 ($7,500,000 / 60,000 shares).

This can also be summarized in the table below:

What happens to the share price after the bonus issue?

A bonus issue, also known as a stock dividend, is a distribution of additional shares to existing company shareholders in proportion to their current holdings.

When a bonus issue is announced, the total number of outstanding shares in the company increases, but each shareholder’s proportionate ownership remains the same.

In general, the announcement of a bonus issue can positively impact a company’s share price, as it is seen as a signal of the company’s financial health and positive outlook.

Investors may perceive a bonus issue as a sign of confidence by the company’s management in the company’s prospects, which could increase demand for the company’s shares.

However, the impact of a bonus issue on a company’s share price can vary depending on various factors, including market conditions, investor sentiment, and the specific details of the bonus issue.

For example, if the market is already saturated with the company’s shares, the announcement of a bonus issue may not significantly impact the share price.

Additionally, suppose investors view the bonus issue as dilutive, meaning it could reduce the earnings per share for each existing shareholder. In that case, it could hurt the share price.

Overall, the impact of a bonus issue on a company’s share price is difficult to predict and can vary based on various factors.

Investors should consider the specific details of the bonus issue, the overall market conditions, and the company’s financial health and outlook before making investment decisions.

Should I buy before or after the bonus issue?

Whether to buy a stock before or after a bonus issue depends on the specific details of the bonus issue and your investment goals and risk tolerance.

On the one hand, you are buying a stock before a bonus issue can be beneficial, as it allows you to purchase shares at the pre-bonus issue price and potentially benefit from the increase in the company’s share price following the bonus issue announcement.

Additionally, buying before the bonus issue may allow you to participate in any potential price appreciation of the shares leading up to the ex-date (the date the stock begins trading without the bonus shares).

On the other hand, buying a stock after the bonus issue may be advantageous if the bonus issue has already been priced in and the stock has decreased in price, creating a potential buying opportunity.

Additionally, buying after the ex-date allows you to avoid the potential volatility surrounding the ex-date and the period immediately following the bonus issue.

Ultimately, deciding whether to buy a stock before or after a bonus issue depends on various factors, including the specific details of the bonus issue, the company’s financial health and outlook, and your investment goals and risk tolerance.

It is important to conduct thorough research and consider all relevant factors before making investment decisions. Additionally, it may be helpful to consult with a financial advisor or investment professional.

Can I sell bonus shares immediately?

Yes, you can sell your bonus shares immediately after receiving them. Bonus shares are treated like regular company shares and can be bought and sold on the stock exchange like any other shares.

However, it is essential to note that the market price of the bonus shares may be affected by various factors, including the overall market conditions, the financial health and outlook of the company, and investor sentiment.

Additionally, selling bonus shares immediately after receiving them may result in a higher capital gains tax liability than holding them for a more extended period.

It is important to consider your individual investment goals and tax situation before deciding whether to sell your bonus shares immediately or hold them for a longer period.

Also, consult a financial advisor or tax professional to discuss the potential implications of selling your bonus shares.

Conclusion

The market value of the shares of a company is determined by mainly external factors but can also be influenced by internal factors.

Share movements caused by internal factors such as bonus issues can affect the market price of the shares.

Bonus issues are shares issued by a company to its shareholders based on their existing holding of shares.

These issues are made as an alternative to cash dividends and are free of charge to the shareholders.

To calculate the share price after bonus issues, companies must divide the total value of shares of the company before the bonus issue on the number of shares of the company after the bonus issue.