The average trade price (ATP) is essential in currency trading because it shows how much money you make (or lose) every trade you make.

Unfortunately, many people don’t understand what ATP is or how to calculate it and don’t realize its importance.

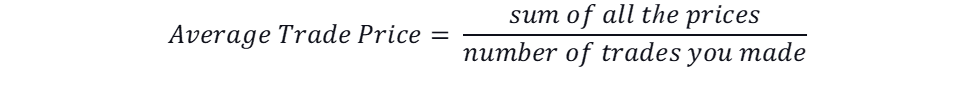

To calculate the Average Trade Price, add all the prices and divide by the number of trades you made. If you buy 50 shares at $200 and then another 50 shares at $300, your average price is $250. We have calculated the ATP by adding the values (200$+300$=$500) and then dividing by the number of values ($500/2=$250).

What Is The Average Trade Price (ATP)?

The average trade price is the average price of all the trades made in a given time. To calculate the average trade price, you add all the prices of the businesses made in a given period and then divide by the number of trades.

The average trade price can be used to help you make decisions about when to buy or sell a security. For example, if the average trade price has decreased recently, it may indicate that now is an excellent time to sell. Alternatively, if the average trade price has increased recently, it may suggest that now is a perfect time to buy.

One thing to keep in mind concerning the average trade price is that this calculation will include both high and low transactions.

That means even if the current trading situation is not at an extreme, there will still be some trades on either side of the distribution, which skews the average towards one end.

So when considering the trend based on a single day’s worth of data, we must believe what kind of price movement we are seeing.

Is it trending upwards? Is it trending downwards? And how big is that movement? It’s also important to know what type of data we’re talking about – is this stock market data? Foreign exchange rates?

How Do You Calculate The Average Trade Price?

The average trade price (ATP) is the average price of all the trades made in a security over a given period. To calculate the ATP, you add up the prices of all the trades made in the security during the period and then divide by the number of trades. The resulting number is ATP.

ATP Formula

It can be used as an indicator of how much supply there is on the market. For example, if an ETF has 1 million shares at $1 each and 200 shares at $2 each, its average trade price would be $1.50 ($1+$2+$1).

If that same ETF had 2 million shares at $1 each and 500 shares at $2 each, its average trade price would be $2.00 ($1+$1+$2+$2).

While the higher volume of lower-priced stocks will likely make the overall ATP more reflective of the actual share value than in the first example, it’s not always accurate to use this measure because some stocks may have been traded only once. In contrast, others may have been changed many times.

An alternative way to assess trading volume is to look at the stock’s turnover ratio, which measures the total dollar amount of shares traded against the total dollar amount of stocks outstanding.

A high turnover rate may indicate that traders actively seek opportunities to buy or sell with little interest in holding onto their positions.

Understanding the Average Trade Price in detail!

The average trade price, or ATP, is the average price of all the trades made in a security over a given period.

The ATP is an excellent way to measure market activity and liquidity. It’s also a good indicator of where prices are headed.

If there’s a lot of trading going on at lower prices and few trades at higher prices, that can indicate that traders believe the stock will go down. Conversely, if more trades are happening at higher than lower prices, this could mean that traders think the stock will go up. In general, the ATP should be between one and two.

A low average trade price might indicate limited liquidity, while a high one might indicate high volatility. It’s important to note that the ATP isn’t an actual traded price.

It doesn’t represent what anyone paid for a share of the company. The cost per share is calculated by dividing the current share price by how many shares are available.

How Do I Calculate My Personal Average Trade Prices?

There are a few different ways to calculate your average trade prices, but the most common method is simply taking the total value of all the trades you’ve made over a certain period and dividing it by the number of trades. This will give you your average price per trade.

If this number is significantly higher than other traders in your area, you may be able to charge more when trading with people in the future. Alternatively, if this number is much lower than other traders in your area, you may want to consider pricing yourself more competitively.

Another way to measure how well you’re doing is to see how many trades you make before losing money on one (also known as your maximum drawdown). Your maximum drawdown should ideally be less than 15%.

To improve these numbers, start analyzing what went wrong on each bad trade and use those lessons learned to avoid making similar mistakes in the future.

For example, perhaps there was a shift in trends after you took the trade, or there was an information leak ahead of time.

Whatever the reason, do not fall into the trap of making excuses or blaming external factors – take responsibility for your losses and learn from them!

Why Does This Data Matter?

The average trade price is essential because it can give you an idea of how much a stock is worth. It can also help you decide when to buy or sell a stock.

To calculate the average trade price, you need to know the volume of shares traded and the total value of those shares. You can find this information on most financial websites.

Once you have these numbers, divide the total value by the number of shares traded. If the number is high (above $500), your average trade price will be higher than if it is low ($10). For example, if the trading price is $11 per share and 100 shares are traded in one day, the trading price would be 11/100 or .11 per share.

If there were 1000 shares traded at a rate of 10 per share in one day, then the trading rate would be 10/1000 or .01 per share.

Remember that this data is not specific to stocks; the same concept applies to other investments like bonds and futures. Knowing the average traded price of different investments can help you decide what kind of investment may work best for you.

How Can I Use This Information in My Trading?

The average trade price is the average price of all the trades that have taken place in a given stock over a certain period. This information can be helpful to traders in several ways.

- First, if you are looking at buying a stock, you can use the average trade price to get an idea of what other investors are paying for it.

- Second, if you are trying to sell a stock, you can use the average trade price to gauge whether or not you are getting a reasonable price for your shares.

- Third, by looking at the average trade price, you can determine how volatile a stock has been recently by seeing how wide the range between high and low prices is.

Finally, trading options with any company will give you an idea of when to buy or sell your options because the average trade price will show which way a company’s shares have been trending recently.

Important Considerations When Evaluating ATPs

When calculating your average trade price, there are a few essential things to keep in mind.

- First, make sure you’re only including completed trades in your calculation.

- Second, take into account the different types of securities traded. For example, stocks and bonds will have different ATPs.

- Finally, remember that the ATP is just one metric to consider when making investment decisions – it’s not the be-all, end-all.

In general, lower ATP prices indicate that the market has been volatile recently. If you don’t plan on holding onto an asset for more than six months, wait until volatility stabilizes before trading again.

If your goal is long-term investing, this could be a good investment time as the market could level out.

On the other hand, if you want to earn a higher return from your assets, this might be the perfect opportunity for short-term investments.

Be aware that some people speculate during periods of high volatility to profit from wild swings in values.

It may seem like easy money at first glance, but it could come with significant risks. If you’re going to speculate, carefully research what type of security you intend to buy and understand how it performs under various conditions.

The information contained in this blog post is not financial advice and should not be interpreted as such.