Definition:

Accounts payable are the payments that a business owes to its supplier as a result of purchasing a product or service from that supplier. Account payables are noted in the balance sheet of a company as liabilities because they are the obligations that are yet to be cleared.

Account payables are normally classified as current liabilities, because under usual payment agreements the account payables have to be cleared within a year. But, sometimes account payables may stretch for more than a year, which are then noted as non-current liabilities in the balance sheet.

For purchases that are paid for immediately, they are not noted in account payables in the balance sheet as liabilities, unless the accounting rules of the company require it to be noted as such.

Another term used for account payable is trade payable. Both terms are used interchangeably and mean the same thing. Sometimes, account payables are noted as administrative liabilities and trade payables as account payables for purchase of raw materials, equipments etc.

Example

Let’s say for example that a company has purchased equipment from one of its suppliers. But, the company does not have to pay for the equipment on spot. The company is expected to pay one hundred thousand dollars for the equipment after three months. Now, this equipment will be noted as current account payable of one hundred thousand dollars on the company’s balance sheet. At the same time to balance the balance sheet, the asset value of the company has also gone up by one hundred thousand dollars to match the increase in liabilities on the balance sheet.

Recognition of account payable

By recognition, it means here that how account payables are records in the balance sheet of a company. The recognition of account payable is based on accrual accounting method. The accrual accounting method is a concept where the company records the transactions at the point where they occur. It does not even matter if cash or an equivalent transfer has occurred or not.

If an accrual accounting method is not used, then the account payable is not recognized in the balance sheet. It means that on a non-accrual accounting basis, the account payables are not noted. It also means that the company is not under any obligation to note the transaction on its balance sheet.

Furthermore, the company is required to recognise account payable on its balance sheet only if it receives an invoice from the supplier. But, sometimes it happens that suppliers do not send an invoice. In this case, the company can avoid noting the account payable in the balance sheet until the invoice is received from the supplier.

Measurement of account payable’s Top KPIs

There are multiple KPIs that are used to track account payables. The most 1 below. The four main metrics are processing, cost per invoice, penalties, discounts captured bss offered. Each one of them plays an extremely important role in the measurement of account payable’s performance. The detail analysis of each of these is given below:

Figure 1: Measuring metrics of Account Payable

Average Processing time

The average invoice processing time should be as low as possible. If the average invoice process time is higher, it means the employees are working more on processing the invoices, this is lost time. The slow processing of invoices can also result in losing customers. No one wants slow service. By speeding up average processing time, the company can speed up the average response time, which results in better customer service as well as higher customer retention, which means higher profits.

The expidation of invoice processing time should be on the top of priority list of the companies.

Cost per invoice for different types of invoices

There are multiple of invoices. There are standard invoices, credit invoices, mixed invoices, timesheet invoices, and so many more types of invoices. The cost for processing these invoices is also different for different types of invoices.

Some take more time, some take less time, some cost more to process, some cost less to process, and so on. The company should not mix up all of these invoices. A much better method would be to process these separately. This can help bring down the costs of processing the invoices for accounts payable quite significantly.

Penalties and fines

Some invoices when processed late can cause significant loss. This may be due to contracts, legal requirements, regulations, and some other deals. The losses can be incurred in the form of business loss, extra interest insurrections, and hidden costs.

A good method to avoid these losses would be to buy an account payable which would alert you of the dates and times, and everthing else about an invoice.

Discount captured vs offered

Sometimes, suppliers offer extra discounts to companies if they pay before the due date. This allows a company to reduce the cost of acquiring products and services from their suppliers. By optimizing the process of invoice payments, the company can produce significant cost savings.

Journal Entries

The journal entries is the process of keeping records of financial transactions. At the most basic level the journal entries show the credit and debit entries of a company.

A journal entry also notes depreciation, amortization, assets, liabilities, and shareholders’ equity. A good journal entry also notes time and date. It may also provide a brief description of every entry. A good jounal entry is a very important requirement for keeping track record of account payable.

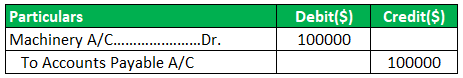

Figure 2: Example of Journal Entry

Figure 2 shows an example of a journal entry of account payable. It shows an example of a fixed asset purchase entry. The journal entry is showing that the purchase has debited one hundred thousand dollars, while also crediting one hundred thousand dollars. This is called a double bookkeeping entry.

Conclusion

Account payables are transactions noted on the balance sheet which help keep track of payments to a company’s supplier. There are some methods lie non-accrual accounting which allows account payable not to be noted in the balance sheets which help reduce liabilities of the company.