Accountants need to keep track of a lot of documents during the course of the financial year. The accounting cycle begins with the transaction and the invoice and then it passes through multiple books and ledgers such as the general ledger, sales daybook, trial balance and finally it ends up in the income statement and the balance sheet.

This whole cycle can be divided into two major phases for the sake of simplicity. The first phase begins with the origin of the transaction and ends with the trial balance and the second phase begins with the adjusted trial balance and ends with the completion of the financial statements.

Any person who has studied accounting will know that most of the hard work happens in the first phase because the financial statements are not prepared during the year, they are prepared once the financial year has ended.

Furthermore, the financial statements take figures from the adjusted trial balance, which means that by this time majority of the errors have been identified and rectified and amounts aggregated. Creating the adjusted trial balance requires going through many different source documents to find out and rectify the errors and adjustments.

Ask any accountant and they will tell you that the end of the first phase is a headache-inducing period, particularly in a large business with a high volume of transactions. Nowadays, with automation, it has become easier because everything is automated but a lot of businesses still require their accountants to close the accounts and prepare the adjusted trial balance manually.

This is where the 10 column worksheet comes into play.

What is a 10 column worksheet?

The 10 column worksheet facilitates the accountants with the period-end reporting process. It is not compulsory to use it, as we have mentioned earlier businesses that have automated their accounting process, have no need for it.

There are however many businesses that have not automated their accounting process, their accountants may find the usage of the 10 column worksheet as a good way to cut down the time and complexity of closing off the accountants and getting the closing amounts ready for the financial statements.

Format of the 10 column worksheet.

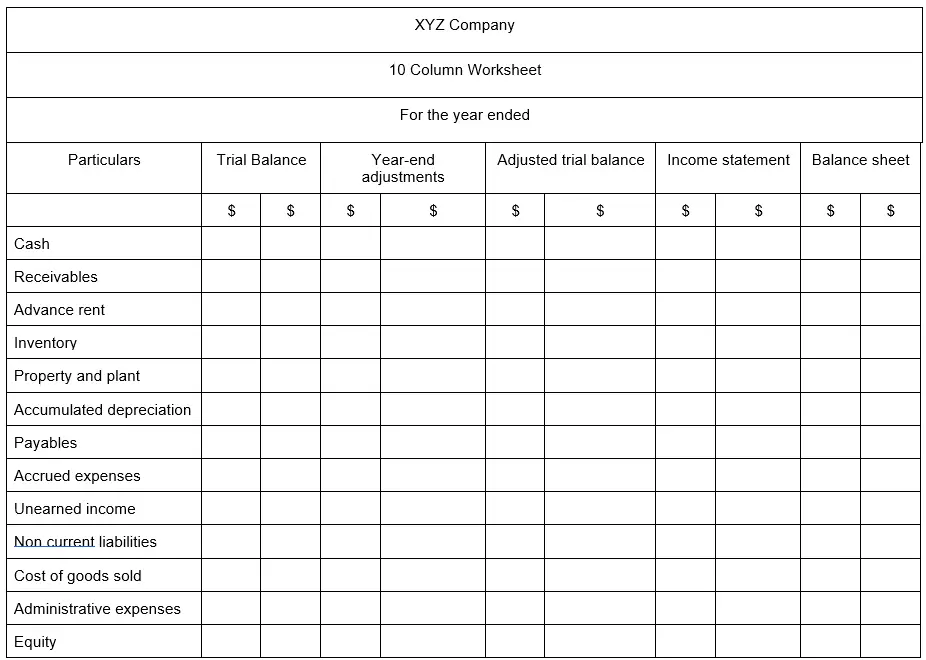

Consider the 10 column worksheet just like a spreadsheet. Understanding the format of the 10 column worksheet is the first step of knowing how to use it. The 10 column worksheet has got columns for the following

- Particulars: 1 column for the detail of the transaction. If we could this column then the worksheet will end up having 11 columns.

- Unadjusted trial balance: A debit and a credit column for the adjustments to the unadjusted trial balance. This is the raw or unadjusted trial balance, before taking the effect of year end adjustments. The balances in these columns come from the general ledger.

- Adjusting journal entries/Year end adjustments: A debit and a credit column for the year end adjustments. The adjustment entries can relate to any class of account or transactions such as income or expenditure, provision or depreciation etc.

- Adjusted trial balance: A debit and a credit column for the adjusted trial balance. The adjusted trial balance is obtained after applying the year end adjustments to the unadjusted trial balance, thus arriving at the adjusted figures.

- Income statement: A debit and a credit column for the income statement.This is basically a columnar income statement instead of the usual tabular income statement. It is important to remember that the credit and debit totals will not balance for the income statement column. Instead the difference will indicate either a profit or loss. A heavy credit side indicates a profit whereas a heavy debit side indicates a loss.

- Balance sheet: A debit and a credit column for the balance sheet. This is a columnar balance sheet, instead of the tabular balance sheet that we are normally used to. If the balance sheet and every other column has been drawn up correctly, then the totals of debit and credit columns of the balance sheet will balance, as long as the profit or loss from the income statement columns has been transferred to the equity portion in the balance sheet.

Now that we have understood, what each column stands for, let us look at the format of the worksheet.

This is how the 10 column worksheet is prepared. The first two columns take the closing balances from the general journal. The second column deals with year-end adjustments and these adjustments are then applied in the third column, which is the adjusted trial balance.

Once the adjusted trial balance is prepared and it balances, we can move on to the income statement and balance sheet. From this point, it is simply a matter of picking up income statement balances from the adjusted trial balance and plugging them into the respective cells in the income statement and then doing the same for balance sheet items.

It can be clearly seen that if prepared properly, the 10 column worksheet can cut down the work of accountants. They can have the “panoramic” view of the account closing and financial statement preparation process. The 10 column worksheet can help with quick analysis and understanding the statements at a glance.