A vertical spread option is a complex derivate option that involves both puts and calls at different price points. Each Vertical spread has two parts: Buying an option and the other part is writing an option. Writing an option means paying a premium to a writer, which allows you to buy or sell an option on an agreed date in the future at the future price.

So, basically, what a vertical spread option does is that it allows you to reduce your risk by using two or more options against each other. It is also an advanced hedging tool. The two options are combined to give the trader either a debit or credit.

Debit is when the trader owes money, and credit is when somebody owes money to the trader. These are also known as debit spread or credit spread. Debit spread costs money, and credit spread gives money to a trader.

Take the example of a retail trader. He puts a one hundred dollar put and receives fifty dollars in call options, which means he has a fifty-dollar debt. If the situation is reversed, and the trader calls fifty dollars inputs and one hundred dollars in option, he would have a fifty dollar credit spread. The trader plays both sides to reduce risk and make profits.

Types of Vertical Spread options

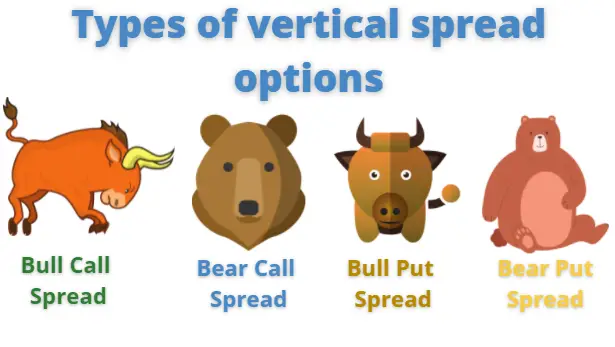

There are four main types of vertical spreads. Each has its own advantages and disadvantages and has a specific use in specific market environments. The four vertical spread options are depicted in figure 1 below:

Figure 1: Main types of Vertical spread option

The four types of vertical spread options shown in figure 1 are Bull call spread, Bear Call Spread, Bull Put Spread, and Bear Put Spread. All four types of vertical spread options are explained below:

Bull Call Vertical Spread Option

A bull call vertical spread option means purchasing a call option and at the same time selling a call option of the same underlying security. The expiration date of the call option is the same as the purchased one’s expiry date, but its strike price is higher. A strike price is basically the price of the derived option. It can be a call option or a put option. We can observe that this will create a debit spread which means that the losses of the trader would be limited only to the premiums paid for the contract minus the purchase of the call option. In contrast, the profits would be the difference in strike prices of both call options and subtracting the premium paid for these call options from the profits.

This vertical spread option is used when the trader is expecting the security price to go up, and hence the bull vertical spread is this derivate’s name.

Bear Call Vertical Spread Option

A bear call spread is selling a call option and at the same time purchasing a call option but at a higher strike price. The expiration date of both call options is the same, but the purchase call has a higher strike price. This is the opposite of a Bull Call, and here the trader uses credit spread, which means that the trader is owed money. The profit and loss scenario is the bear call vertical spread becomes opposite of the Bull call vertical spread option. The Profits of the trader would be limited only to the premiums paid for the contract minus the purchase of the call option. In contrast, the losses would be the difference in strike prices of both call options and subtracting the premium paid for these call options from the losses.

This is a hedging strategy that is used in bear markets to limit the exposure to losses in the underlying security.

Bull Put Vertical Spread option

The bull put vertical spread option involves underwriting a put option while also purchasing a put option but at a lower strike price. The expiration date is the same for both contracts, but the strike price is different. A put option allows the option to sell the underlying security in the future at the present price of the security. This strategy is used in a bear market.

The Bull Put Vertical spread option is a credit spread strategy. It means that the trader is putting more in than he is getting from the sale of the call options. This means that the profit will only be of the net premiums received from both put options, whereas losses would be the difference in strike price contact minus the premiums earned on selling the put option.

This way the losses are limited, while the profits are magnified.

Bear put vertical spread option

A bear put vertical spread option is purchasing a put option contract, while at the same time selling a put option contract but at a lower strike price. Again, both of these contracts have the same expiry date, but there is a difference in the strike price of both contracts.

This strategy is used to make money in a bear market or expected bear market. The losses are hedged while the profits are magnified.

This is a debit spread strategy. It means that the trader owes money and as a result, the losses will only be of the net premiums received from both put options, whereas profits would be the difference in strike price contact minus the premiums paid on buying the put option.

This is also called a bear market profit vertical spread option as the trader believes that he can make money in a bear market by using the put options.

Conclusion

The vertical spread option is an advanced derivate contract used mostly by professional traders. A retail trader should not use this strategy if he/ she does not fully understand how it works. It can cause insurmountable losses if misused. So, traders should be very cautious when using this strategy.