Looking for rental car insurance and wondering whether USAA offers this service or not? Well, there is no doubt that those who have to rent cars a lot should have insurance. Bad times come unexpectedly, but the damages can be reimbursed if there is rental car insurance.

Luckily, USAA does offer rental car insurance. In fact, it is one of the best in the USA as it covers damages (up to your policy limit) and is always quick in response. Furthermore, the company also offers rental car insurance even if you have to travel outside the country.

However, there are some problems with USAA Rental car insurance too, which we are discussing in detail here. So, stay till the end.

Let’s start.

Key Takeaways

- USAA offers one of the best rental car insurance in all 50 states and also outside the US (in some specific parts only).

- It covers up to the policy limit in your plan, and the remainder will have to be paid by you.

- If you pay for the rental using a USAA credit card, then you will also be able to enjoy secondary rental car insurance worth up to 50,000$.

- USAA rental car insurance also covers the damage to the other car you hit.

- Paying the deductibles is necessary if you want to avail the insurance benefits.

Now, it’s time for details.

USAA Rental Car Insurance- Key Details

USAA does offer rental car insurance to the policyholders. You can go for it when you enroll for an auto policy plan and then get yourself free from worry if you ever have to rent a car.

Sometimes, when a car is in the mechanic shop or causing any minor problems, people prefer to rent a car to go to a far place. Rental car agencies make them sign a piece of paper that renters will be responsible if the car is damaged.

If you rent a car and it is damaged, then you might have to pay hundreds to thousands of bucks, depending on the damage. But if you have signed up for USAA auto insurance, then there is good news for you, as it covers rental car insurance in most cases.

However, there are some exceptions as well (More on that later). First, know how the USAA rental insurance policy works.

How Does USAA Rental Insurance Policy Work?

When you get into an accident and the rented car gets damaged, the first thing to do is to contact USAA if you have already signed up for the company’s auto insurance policy.

Here are the two steps:

Step 1: Contact USAA

You will first have to get in touch with a USAA representative and inform him that you have been in an accident in a rented car. You can either:

- Call the agent at 844-288-2141.

- Log in to the USAA official app and chat with the agent.

Step 2: Pay the Deductibles

After you inform the USAA, you will have to make a deductible payment on your auto policy. The rest of the charges will be covered by the USAA.

However, if they exceed the policy’s limit, you will then have to pay the remainder.

That is why it is advised to check the deductible amount before you rent a car. Also, it is better to keep in mind the auto policy’s limit as well.

What Does USAA Rental Insurance Cover?

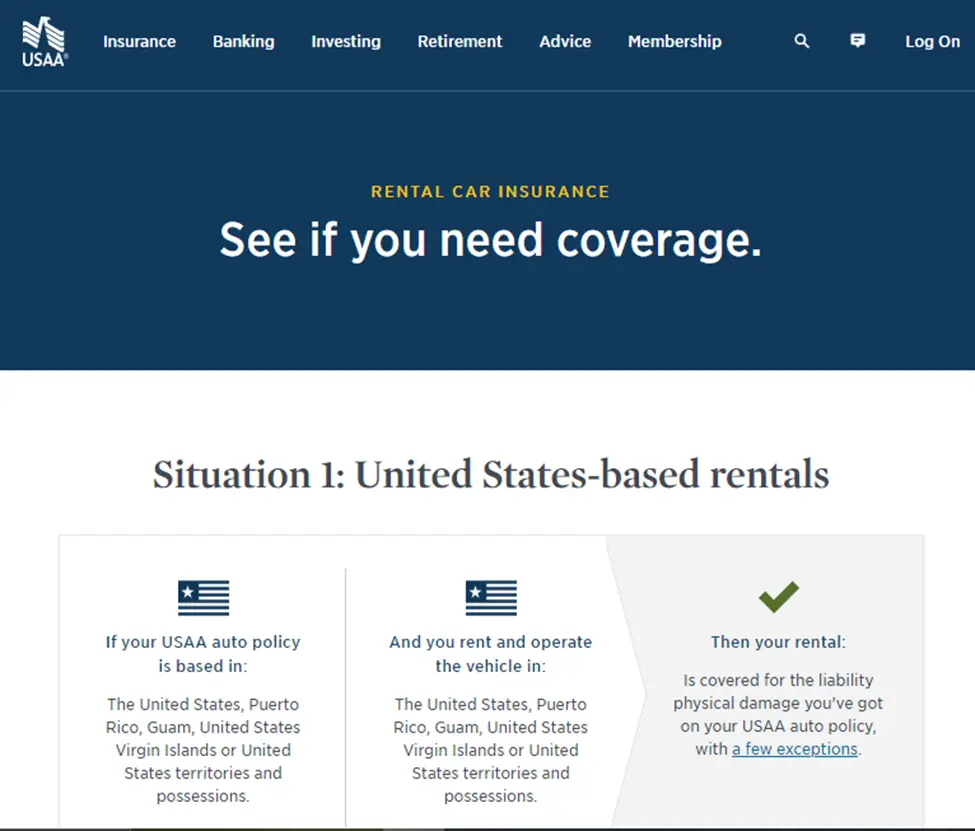

USAA rental insurance coverage limit is similar to what you are enjoying on your main vehicle. But note that the coverage might not be the same as renting a car and going outside the USA.

The company’s Rental Insurance also covers outside US areas too, but only some specific territories, which are:

- Canada

- Puerto Rico

- US Virgin Islands

- Guam

To know about the renting coverage, you can go to the official website’s coverage page, fill in the form about the renting, and the USAA will show you what is being covered and what is not.

In addition to the above areas, if you get into an accident in any other territory, you are paying the full amount. USAA does not cover damages in any other parts of the world (not even if you used a USAA credit card to pay for the rental car).

However, there are some extra advantages you can get if you use your USAA card.

Do USAA Credit Cards Offer Any Benefits to Rental Car Insurance?

USAA also offers multiple credit cards to customers, but the USAA Visa and American Express credit cards provide additional benefits, and one of them is rental car insurance.

It means that if you pay for the rental car using a USAA Visa or American Express card, you will be able to enjoy secondary car insurance, which covers up to 50,000$.

However, note that the secondary car insurance will only cover those areas that the USAA auto policy doesn’t. So, if you rent a car using a USAA credit card and the car gets damaged in an accident, you will still have to contact the USAA, pay the deductible amount, and the rest of the procedure will also stay the same.

Only the insurance premiums will be increased. Thus, you can even say no to the CDW/LDW offered by Rental car companies.

Now, it’s time you know about the complete benefits of USAA Rental car insurance.

USAA Rental Car Insurance Benefits

USAA rental car insurance provides a bundle of benefits.

● Covers All 50 States and Some Other Parts

The rental car insurance offered by USAA covers all 50 states of the country and some other parts, including Puerto Rico, Canada, Guam, and the US Virgin Islands. You can rent a car and travel to any location without any worry.

USAA also offers towing services if you have added a road assistance program as well.

● Covers Other Person’s Damages too

If you have damaged another person’s car too in an accident, the USAA also covers it. In addition, if you or the other person gets harmed, the insurance can also cover the medical expenses as well (but only under the limits of the plan).

● Extra Advantages for USAA Credit Card Holders

If you pay for the rental using USAA Visa or American Express credit card, you can enjoy secondary insurance of up to 50,000$

● Easy to Get In Touch With

If you have any queries about USAA rental car insurance or its coverage, you can just call 844-288-2141 and get all answers.

If your USAA policy is outside the USA, then don’t worry. You can still get in touch with the company to discuss your coverage by calling these two numbers:

- 800-531-USAA (8722)

- 210-531-USAA (8722)

USAA Rental Car Insurance Problems

USAA Rental Car Insurance is not all good. You can still face some problems with it that can cause lots of frustration.

Let’s have a look at them.

● Be Careful About the Rental Car Selection

If you own an old vehicle and added it to the insurance plan, then don’t rent a brand-new car. The reason is that USAA usually refuses to pay the expenses for such cars if you had purchased insurance for old cars, like an old Beater. Also, you must always check the coverage before renting a new car because USAA rental insurance covers a specific limit.

● If You Don’t Use Your Name

Cars must be rented in your own name. If you rent a car using any other person’s name and get in an accident, USAA won’t cover the expenses.

● Have to Pay in Full With USAA Credit Card

If you want to enjoy secondary insurance, then you will have to pay the full rental with a USAA credit card. If you pay even a penny less, then you won’t be able to get the extra benefits.

Moreover, USAA credit card secondary insurance is valid only for 31 days. So, if you have to rent a car for more than a month, then paying with a USAA credit card is not much worth it.

● Valid For Only Passenger Cars

The Rental Car insurance is only valid for passenger cars. If you have rented SUVs, trucks, vans, and motorcycles, then USAA does not cover any of them.

Are you now confused about whether you should go for the USAA to get rental car insurance? Then, the next part is for you.

USAA Rental Car Insurance Pros and Cons

A pros and cons table really helps you get all the information you need within seconds. So, here’s the table about USAA Rental Car Insurance’s pros and cons that will help you make a decision.

| Pros | Cons |

| Covers all 50 states. | Rental insurance is only valid for passenger cars |

| Can also cover some territories outside the US, which are Puerto Rico, Canada, Mexico, Guam, and the US Virgin Islands. | If you rent a brand new car, then chances are USAA might not cover it |

| Quick customer response. | The rental car should be rented under your name, or USAA won’t pay the expenses. |

| Can let you enjoy secondary insurance if you pay the rental with a USAA Visa or American Express card. | |

| Covers property damage and health expenses of other people too (who you hit with your car), but only till a decided limit. |

So, that’s all about the USAA Rental Car Insurance.