ERP stands for “Enterprise Resource Planning System.” It is a management software businesses use to manage and integrate their main operations onto a single platform.

The enterprise resource planning system allows a firm to integrate its financials, supply chains, operations, and Human resources activities onto a single platform.

It also collects a swath of data that improves the performance and efficiency of a multifold firm. By integrating all of its main operations onto a single platform, the whole organization can be analyzed as a single creature.

Companies that use simple accounting software cannot perform as well as those that use enterprise resource planning systems.

It is because accounting software is very simple, and an accountant requires up-to-date data to perform his/ her task.

The ERP system makes it possible.

The ERP system provides an accountant with real up-to-date data, with the data being divided into sub-classes which makes it much easier to analyze.

The whole process is also highly automated, whereas, for simple accounting software, the whole process is slow and manual, and highly frustrating.

The ERP system also improves the performance of the accountant using it.

Main advantages of an ERP system to an accountant

The reasons and benefits of using an ERP system for an accountant are given as follows:

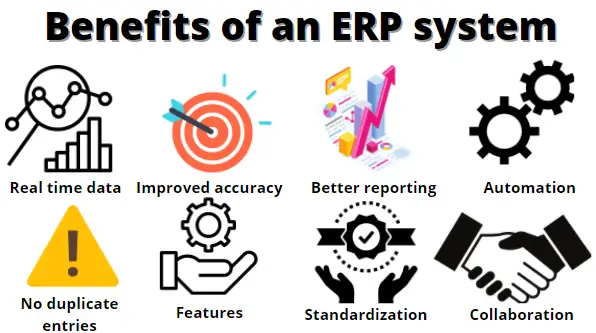

Figure 1: The main advantages of an ERP system

The main benefits of using an ERP system are shown in figure 1 above. Some benefits are Real-time data collection, improved accuracy, better reporting, automation, standardization, and collaboration.

All eight of these advantages are explained in detail below:

1) Real-time data collection

The biggest benefit of using an ERP system is the real-time data collection and update. The data is collected and updated in real time.

This data allows an accountant to study a company’s financial position and make changes or make early payments to save on later payments. If a payment is due now, the payment can be made immediately.

2) Improved accuracy

The improved data collection, collected in real-time, also improves accuracy by reducing errors. Because there is little human interaction, the data collected is also highly accurate.

There would be no mistakes, such as a late payment to a supplier, which would incur fines. The chances of this type of scenario occurring is reduced to zero due to the real-time collection of data and highly automated process.

3) Better data reporting

The data reporting is improved multifold. Because the data collection is improved multifold, the data reporting would be reporting naturally.

The data collected is automatically analyzed and divided into parts, which makes it easier for an accountant to analyze and report the data.

The accountants can focus on the big picture while leaving small tasks to the ERP system.

4) Automation

Simple, repeatable tasks can be easily automated by implementing an automated, improving the pace, increasing productivity, and reducing the chance of human error.

For example, the payments can be automated by connecting the account payables to the ERP system. So, on the payment date, the payments are automated.

5) Reduction of duplicate entries

The need for duplicate entries is greatly reduced when using an ERP system. When using simple accounting software, accountants have to reenter data multiple times in multiple places.

This slows down the work process and increases transactions’ processing time, reducing productivity.

But through the use of an ERP system, the duplicate work is automated. There is no need for an accountant to spend their valuable time making multiple duplicate entries repeatedly. This is also very frustrating work.

6) Business-Friendly Smart Features

Many tools are available in an ERP system that turns boring old data into colorful and interactive charts and graphs.

This makes it easy for an accountant to report numbers to non-accountant people, which may face difficulties in understanding data.

The ERP system can be set up to analyze and report KPIs or key performance indicators, which are important to an accountant.

The real-time reporting of key performance indicators can help in averting real disasters before they occur.

For example, the ERP system can report that a certain department has run out of budget or a certain payment is due today, which, if not made, can contribute to late fines.

7) Standardization

It is one of the best features of an ERP system. The standardization allows everyone to report data in the same metrics.

Sometimes, one person may report net income while the other reports profit, which can confuse.

Although both terms express the same number, workers in an organization who do not understand these terms can confuse them, reducing cooperation.

The company needs accurate data sets when making important decisions, such as where to invest or what payments to make first.

If the data is confusing, it can cause issues when making these important decisions.

8) Collaboration

As stated above, the Enterprise resource planning system integrates all the important operations of a company onto a single platform.

This results in better collaboration between different departments of a single company because everyone has access to the same data at the same date and time.

For example, the production department can request extra money to increase its production through the ERP system, and the accounts department can check whether it needs that money.

The whole process happens fast, which helps improve productivity.

Top 10 Disadvantages of ERP for Accountants

- High cost: ERP systems can be expensive, depending on the size of your organization and the complexity of its needs.

- Setup time: Installing an ERP system requires a significant investment in time as staff must be trained, and processes must be updated to use the new software correctly.

- Rigid structure: Many ERP systems are built with a fixed structure, which could make it difficult for organizations to modify the system or integrate other applications into their workflow.

- Poor user experience: ERP packages can sometimes feature clunky user interfaces or lack usability features that make them difficult for accountants to use efficiently and accurately.

- System incompatibility: Depending on the system’s architecture, some existing hardware and software may not be compatible with an ERP system, requiring costly upgrades or replacements.

- Data corruption risk: Long-term data storage within an ERP system can result in corruption if there is no reliable backup system, leading to data loss or inaccuracies within databases.

- Security risks: As with any networked application, there is always a risk of undetected security flaws leading to unauthorized access to confidential information stored on the ERP system by third parties or hackers.

- Lack of flexibility & scalability: Many older versions of ERP packages are not very flexible when adding new features or scaling up operations due to their rigid structures and limited customization options available in some boxes.

- Vendor lock-in: Vendor lock-in refers to being tied into a single provider’s product suite and unable to switch quickly if needed—this could cause problems if the vendor changes prices suddenly or discontinues certain services without warning.

- Customer support issues: Having customer support available is essential when using an ERP system because problems can occur without warning—but finding competent technical help quickly can prove difficult if it’s not provided through your chosen vendor’s service plans.

10 Most Popular ERP Systems

The top 10 most popular Enterprise Resource Planning (ERP) systems are:

- SAP Business Suite – SAP is the world’s leading enterprise resource planning software supplier, with a strong presence in 200 countries. Its ERP system offers comprehensive business solutions for finance and human resources, as well as an array of forecasting, auditing, and performance reporting tools.

- Oracle E-Business Suite – Oracle’s ERP system is designed to meet the needs of any size organization by providing a wide range of features such as automated process flows, integrated reporting and analytics, and real-time dashboards.

- Microsoft Dynamics AX – Microsoft Dynamics AX provides advanced financial management capabilities that enable businesses to minimize costs and maximize profits. Its integration with other Microsoft products allows it to be used for customer relationship management (CRM), supply chain management (SCM), and more.

- Epicor ERP – Epicor ERP allows companies to streamline operations by providing customized modules tailored to their business needs. It also incorporates analytics capabilities to enable businesses to gain insights into their operations from data obtained through integration with its various modules.

- Infor CloudSuite Industrial – This cloud-based suite combines Infor’s M3 enterprise applications with their EAM mobile app for asset maintenance. This system enables companies to get better visibility in all areas of the organization while providing access anywhere, anytime with its mobile components.

- Lawson Enterprise Solutions – Lawson provides customers with a comprehensive suite of products for managing finances, inventory tracking, supply chain optimization, CRM, and more. Their software is highly customizable, so customers can tailor it according to their specific requirements or the industry verticals they operate in.

- Sage X3– Sage X3 helps organizations manage processes across departments, including manufacturing, distribution, accounting, and HR, while remaining agile in an ever-changing digital landscape. With this platform, companies gain end-to-end visibility over every step of the production process, allowing them to optimize every aspect of their workflow accordingly.

- IFS Applications– IFS applications provide businesses with an integrated platform that covers a wide range of activities such as service & asset management, project management & control, and financials, among others, to achieve greater efficiency on both daily operations as well as strategic planning tasks

- Unit 4 Agresso– Unit 4 Agresso allows customers to manage complex projects through task automation across HR departments or large-scale operations within services industries using one comprehensive platform which caters specifically to those industries’ needs.

- QAD enterprise Application– Last but certainly not least is QAD’s enterprise application which provides users with powerful analytical tools leveraging Industry 4 expectations along with customizable options for meeting unique customer demands depending on the field they operate in. All features are grounded upon a single-node architecture that ensures users don’t hit damaging information silos while navigating through it.

Conclusion

The ERP system provides many benefits that improve the performance of all organizations. This drastic improvement in productivity and performance also increases the company’s profitability.

The ERP system provides a single platform for a company to integrate all its operations. This improves data reporting, accuracy, and collaboration within a company.