The share buyback is when the Company repurchases the shares it had issued to the private and public investors in the past. The Company repurchases the share by paying the current market value of the shares plus some premium as compensation to the shareholder for selling the shares when the Company needs them. In recent times, there has been an increase in the stock buyback trend as a way to distribute returns among shareholders. Let’s discuss in detail that why a company would buy back its own shares.

Detailed concept

The Company is expected to buy back its own shares under the following circumstances. In other, words the following can be motives of the Company to opt for buyback of the shares.

Undervalued market share price

When management believes that the share of their Company is undervalued in the market and there is a need to enhance the investors’ confidence in the security so the price can be revived, share buyback can be an excellent opportunity. Now the question arises of how the buyback of the shares increases the market’s confidence in a specific security.

The increase of confidence can be associated with the signaling effects of the buyback process. The market perceives that the Company’s management is confident about the operational and strategic capability of the business and moving for a strong financial future. Even, they’ve generated excess cash from operations to finance the shares buyback scheme. So, the market is expected to be optimistic about the Company’s future performance, which leads to an increase in the share price. In other words. It’s due to the perception that there are fewer chances of economic default, and the Company is expected to enjoy a prosperous financial future.

Improvement in EPS and P/E

Earnings per share and the price-to-earnings ratios are well known among investors in the stock market. Most of the investors compare the EPS and P/E of different companies before finalizing purchase options. Investors are attracted to high EPS and low P/E ratios as high EPS elaborates that the Company has earned higher profit which is the Return for the shareholders. Similarly, a low P/E ratio indicates that the earnings of the Company are higher in comparison with the price of the shares.

The buyback reduces an outstanding number of shares, which means earnings of the Company are distributed among fewer shares. Hence, there is an increase in the EPS – for which investors are attracted while making a purchase decision. Similarly, buyback results in an increase in the proportion of retained earnings per share for existing shareholders.

Further, an increase in the EPS leads to a decrease in the price-to-earnings ratio, which helps develop a perception of the investors that the price of the shares is low relative to earnings on the shares. Hence, it helps them opt for the shares of the Company with Higher EPS and lower P/E.

Improvement in Return on assets– (ROA), and Return on equity – (ROE)

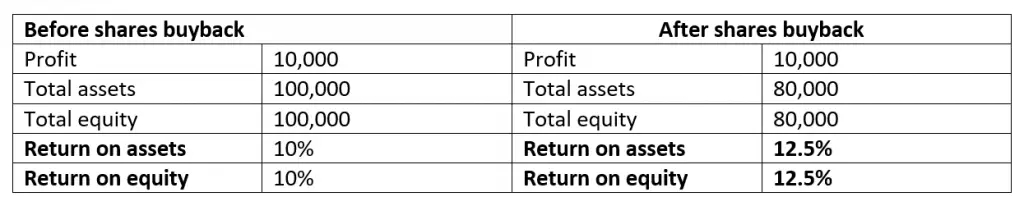

The buyback of the shares decreases assets and equity. Since the Company has to pay cash which is credited from the financial statement and corresponding retained earnings is debited, this leads to a decrease in both denominators and an increase in the ROA and ROE, as shown in the calculation below.

Further, share buyback reduces the supply of the shares in the market, and reducing the supply is expected to increase the share price, which again brings financial benefit for the shareholders.

Control on diluting EPS

The EPS of the Company is diluted when the Company issues shares. The issuance of the shares may be in a public offering, conversion of the convertible options to equity instrument, or issuance of the shares under an employment scheme. The issuance of shares impacts the EPS as earning is divided among a greater number of the shares. Hence, EPS gets diluted. At the same time, the reverse impact is made by the buyback of shares. It means the EPS increases when the number of shares decreases. Hence, a buyback strategy can be used to control the EPS.

However, decreasing the number of shares and improving the EPS does not mean the Company has improved its performance; it’s a change due to formula mathematics.

Management of voting rights / controls

The shareholders have the power to make decisions in the general meetings. If there are several shareholders of the Company, the decision-making power is diluted, and there may be difficulty in smooth operations of the Company due to conflict of opinion. So, sometimes companies want the power to be concentrated on some specific shareholders/group. Hence, the Company can proceed with another group of shareholders to buy back the shares and control dilution. So, the shares’ buyback helps the Company manage the concentration of the power/voting rights.

Compensation purpose

Companies also buy the shares for compensation purposes. Some companies link the performance of the employees with rewards in the form of shares. This motivates employees to work hard. So, the share price of the share can increase. In other words, it’s a practice to align the employees’ goal with the investor’s goal. So, when employees achieve the set targets, the Company has to buy back its own shares for fulfilling the commitment.

Best investment

Sometimes, the Company may have excess cash in the bank accounts but no feasible investment opportunities. No feasible investment opportunity means the Company cannot find the projects that are expected to deliver Returns higher in comparison with the cost of the capital. So, there is a potential of loss if the Company proceeds with any such investment. So, the best investment seems to return the excess money to the shareholders, which can be done via a buyback.

Excess cash is a costly item in the balance sheet.

Excess cash in the balance sheet may be a peace of mind for the management. However, there is a certain cost of holding extra cash for a longer period. For instance, the Company’s shareholders might get signals that the Company is not even competent to find feasible investment opportunities in the world. So, they might think to divest and reinvest their amount somewhere else.

Similarly, there is an opportunity cost for piling up the extra cash. For instance, the Company could manage to invest and earn a 20% return, but the Company has lost this opportunity by piling extra cash.

So, to avoid adverse impacts of the excess cash, share repurchase can be an excellent practice as it creates a win-win situation for the shareholders and the Company.

Tax benefits

The Company can distribute Return in the form of dividends or by repurchasing the shares from shareholders by paying a premium price. If the Company pays Return in the form of a dividend, it’s taxed at an ordinary income tax rate, which is higher. On the other hand, if the Company pays Return by share buyback, it’s treated as gain on the disposal and taxed under rules of capital gain tax which has a lower tax rate.

Frequently asked questions

Q1- In what scenarios, shares buyback is not a good option?

The share buyback is not a good option when the Company’s stock price is overvalued in the market. It will lead to a loss for the shareholders who decide to hold the shares as they’ll lose value by holding even more overvalued stock aftermarket response.

Q2- How share buyback helps to control the EPS dilution?

Share buyback reduces the number of outstanding shares. Hence, earnings for a period are divided among a fewer number of shares. This results in enhanced EPS.

Q3- Is it good for the Company to do share buyback for increasing EPS?

Increasing EPS with the share buyback does not indicate the enhanced performance of the business as the Company has not earned additional income; it’s just due to a decrease in the number of shares. However, buyback leads to a decrease in cash and equity. So, sustaining the level of income after buyback can indicate the enhanced performance of the Company unless buyback is made with the excess cash.

Q4- What’s the impact of buyback on ROA and ROE?

ROA and ROE increase with the buyback of shares if profit remains the same. It’s because the buyback results in a decrease in assets and equity. If the same Return is divided with decreased denominator, the value of ROA and ROE increases.

We can assume that the Return of the Company remains the same as buyback is expected to be made by excess cash which is not being used in the business.