Who are Arbitrageurs?

Arbitrageurs are investors who make money by taking advantage of inefficiencies in the market.

These inefficiencies can be presented in any financial market such as stocks, bonds, debt, and dividends. By taking advantage of the inefficiencies present in the market, they can make risk-free returns.

Take, for example, a stock that is listed on two stock exchanges. In one of the stock exchanges, the stock is quoted at a higher price than the other stock exchange.

What an Arbitrageur would do is that he/ she would short the stock in the overvalued stock exchange and simultaneously buy the stock in the stock market where it is undervalued.

This will allow the arbitrageur to earn no risk return in the market.

The Arbitrageur bases their investment thesis on knowing about the noises in the market and the inefficiencies in the market.

This is the same strategy that is used by the highly secretive hedge fund of Jim Simon, Renaissance technologies. It uses computer algorithms instead of people to run its arbitrageur strategy.

It has shown a whopping 40% annual return since its inception. In the 1990s, they would take advantage of such simple market inefficiencies such as after the announcement of the fed policy and it took about thirty minutes before this policy announcement reaches the whole market.

So, they would bet in the market with the information they have about the Fed policy to earn risk-free returns.

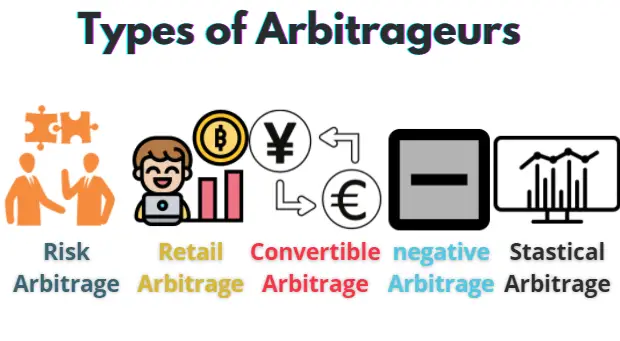

Types of Arbitrageurs

There are five main types of Arbitrageurs. All of these Arbitrageurs are divided based on the type of Arbitrage they prefer. All five arbitrageurs are noted in figure 1 below:

Figure 1: Five main types of Arbitrageurs

The classification of Arbitrageurs is as follows: Risk Arbitrageurs, Retail Arbitrageurs, Convertible Arbitrageurs, negative Arbitrageurs and finally Statistical Arbitrageurs. All five of the Arbitrageurs types are discussed in great details below:

Risk Arbitrageurs

Risk Arbitrageurs are those arbitrageurs that use risk arbitrage as an investment strategy.

We can also call risk arbitrage is as merger arbitrage. In this strategy, an investment fund would buy the stock of the targeted company, while also shorting the stock of the buyer company.

This way the investment would make money when the stock of the acquirer goes down and the stock of the targeted company would go down.

This works because the acquirer would need to pay a higher price of the target company as the stock price would go up.

This is a preferred strategy by the hedge funds. This Arbitrage strategy can also backfire as the stock of the targeted company would go down and the stock of the acquirer goes up, sometimes the stock of the company goes down based on the fact that the market thinks the merger is not a good idea.

Retail Arbitrageurs

These are not professional arbitrageurs. These are everyday people who want to make money by using the same strategy as that used by professional arbitrageurs.

The retail arbitrageurs are called retail as the everyday investors are called retail investors.

The retail arbitrageurs do not have sophisticated tools or strategies. Their arbitrage strategy is extremely simple.

Examples of Retail Arbitrageurs are the sellers on eBay. If we look at the price of products on sites like Alibaba which sells Chinese products and the price of the exact products on eBay, there is a price differential. The retail arbitrageurs earn money by taking advantage of the price differential.

Convertible Arbitrageurs

Convertible arbitrageurs use the strategy of convertible arbitrage. This strategy involves buying a convertible note issued by the company and simultaneously short-selling the company stock.

This arbitrage strategy takes advantage of the pricing inefficiencies displayed in the market between the convertible note and the stock of a particular company.

This is a highly complex arbitrage strategy as it involves multiple steps. This arbitrage strategy is used a lot by hedge funds. This is a particularly risky strategy.

The rationale behind convertible arbitrage is that the risk is reduced. It is also known as the long-short strategy. As the arbitrageur goes long on the convertible note while also shorting the stock of the company.

Negative Arbitrageurs

The negative arbitrageurs are those who invest in negative arbitrage. This arbitrage strategy is used in bonds. These may be government bonds or corporate bonds.

This arbitrage strategy takes advantage of the fact that a particular bond may be carrying a higher interest rate than the bonds that are a part of the fund’s portfolio.

There is a natural arbitrage created when there is a high price differential between two bonds.

A fund can short the bond which is carrying a lower yield, while also simultaneously going long the bond carrying a higher yield. It is a very less complex strategy and it also carries less risk.

This strategy is widely used when the bond market is in turmoil. The bond yields also go through a lot of turmoil and there may exist a huge price differential that can be taken advantage of.

Statistical Arbitrageur

The statistical arbitrageurs use complex financial models to run the statistical arbitrage.

This requires a significant investment in computational resources. They use complex algorithms to take advantage of very small price inefficiencies that exist in the market.

As mentioned before, Renaissance fund uses the same arbitrage strategy and its annual returns are phenomenal. The funds that use Statistical arbitrage are also called quant funds.

Instead of human traders, this strategy takes advantage of the fact that computers can trade in milliseconds, way faster than a human trader can trade.

This allows for taking advantage of the price changes that exist only for milliseconds. So, you need very fast decision-making to take advantage of these arbitrage opportunities.

Conclusion

The Arbitrageurs are those who use arbitrage strategies for investment. The arbitrage strategies range from simple arbitrages such as selling on eBay and complex strategies involving the usage of sophisticated computer models.

So, these strategies can be great for reducing the risk in an investment.