Introduction

Accounts payables are those financial obligations or liabilities that a company has to pay its suppliers for the product or service it received from one of its suppliers. At the same time, accounts receivables are the receivables that a company has yet to receive from one of its clients for the provided product or service.

So, accounts payable and accounts receivable are different sides of the same coin. One is what a company or a business owes to another company or business, whereas the other is what the company or a business is owned by from the businesses.

Explanation

The accounts receivables are noted as assets in the balance sheet of a company. At the same time, the accounts receivables have the normal balance as current assets in the company’s balance sheet. The normal balance for the accounts receivables is debit, and the normal balance for the accounts payable is credit.

This is because the product or service is purchased on credit from the supplier, and the product or service is provided on credit to the client. In one scenario, the company is the client, while the company is the supplier in the other scenario.

Example

Consider a company ABC which supplies products worth one thousand dollars to one of its clients. The product is listed as an account receivable on the balance sheet of the company. Meanwhile, the company has also received services worth one thousand dollars from one of its suppliers. This service is listed as accounts payable in the liabilities section of the balance sheet.

The company has two accounts, accounts receivable and accounts payable. One for the product it has delivered to one of its clients, and the other for the service it has received from one of its suppliers.

Seven Main Differences Between Accounts Payable and Accounts Receivable

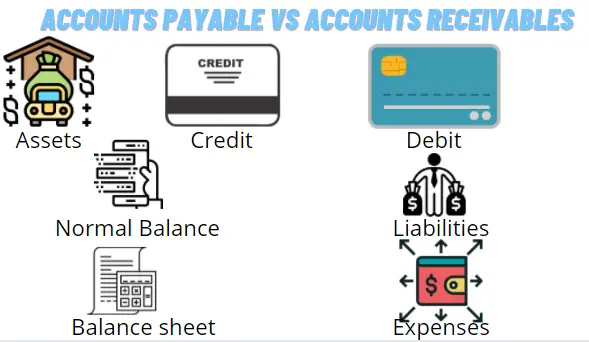

The seven main differences between accounts payable and accounts receivables are shown in figure 1 below:

Figure 1: Seven main differences between accounts payable and accounts receivables

Figure one shows the seven main differences between accounts payable and accounts receivables: assets difference, credit difference, debit difference, liabilities difference, normal balance difference, balance sheet, and expenses difference. All seven of these differences are explained in great detail below:

Assets difference between accounts payable and accounts receivables

The accounts payables are recorded as liabilities, whereas accounts receivables are recorded as assets. So, the main difference between both types of accounts is that one type is considered an asset, which is account receivables, and the accounts receivable are classified in the asset’s sections of the balance sheet.

The balance sheet shows accounts’ payables as liabilities. This is because accounts payables are bills that a company has to pay to its clients.

Liabilities difference between accounts payable and accounts receivable

The liabilities side is the opposite side of the assets side. The accounts payables are recorded as liabilities, whereas accounts receivables are recorded as assets.

So, the main difference between both types of accounts is that one type is considered a liability, which is accounts payables, and the accounts payables are noted in the asset’s sections of the balance sheet.

The balance sheet shows accounts’ payables as liabilities. This is because accounts payables are bills that a company has to pay to its clients.

Debit side of the balance sheet of accounts payable and accounts receivable

The debit is which a company is to be paid by its client for the product or service it has provided. The monetary value of the product or service is listed in the company’s balance sheet under the assets section.

Most products or services are listed under current assets when these are debited in the balance sheet. The accounts receivables are for which the balance sheets are debited. Because the debit means the company has to be paid by its clients.

Credit side of the balance sheet of accounts payable and accounts receivable

The credit side is exactly the opposite of the debit side. Credit is which a company has to pay its suppliers for the product or service it has provided. The monetary value of the product or service is listed in the company’s balance sheet under the liabilities section.

Most products or services are listed under current liabilities when these are credited in the balance sheet. The accounts payables are for which the balance sheets are credited. Because credit means the company has to pay for the products or services, it has procured.

Normal Balance difference between accounts payable and accounts receivable

The normal balance is credited for the accounts payable, whereas, for accounts receivables, the normal balance is debited. The accounting equation is through which it is calculated whether the accounts payable or accounts receivables are credited or debited.

The main difference between them is that accounts receivables are usually debited, whereas accounts payable are usually credited.

According to the accounting equation, the normal balance is debited when assets are higher than the sum of liabilities and shareholders’ equity. Similarly, the normal balance is credited when assets are lower than the sum of liabilities and shareholders’ equity.

Balance sheet difference between accounts payable and accounts receivable

How the balance sheets show accounts payable and accounts receivables is totally different. Accounts receivables are listed as assets in the asset section of the balance sheet.

Whereas the accounts payable are listed as liabilities in the liabilities section of the balance sheet. The accounts receivables are debited in the balance sheet, and accounts payable are listed as credit in the balance sheet.

Expenses

The expenses are mainly associated with the accounts receivables in the balance sheet of a company. This is because the liabilities are what a company has to pay to other entities. As a result, the expenses are associated with liabilities, which are associated with accounts payable.

What is accounts payable and accounts receivable process?

The accounts payables are the financial obligations which a company owes to other entities. The usual process is when a company buys a product or service from one of its suppliers. The suppliers supply the product or service, and the company receives the product or service.

In the balance sheet of the receiver, the monetary value of the product or service is noted as accounts payable. In contrast, in the supplier’s books, the monetary value of the product or service is noted as accounts payable.

The company usually pays for the product or service it receives after one to three months. As a result, the accounts payable and accounts receivables are cleared from the balance sheet of both the suppliers and the company.

Are accounts receivable higher than accounts payable?

The accounts receivables can be higher than accounts payable, and accounts payable can be higher than accounts payable. It is different for different companies. The higher accounts payable show that a company is in great financial health because it is expected to receive more money than it is expected to pay.

In the reverse situation, the company’s financial health is in a bad position because the company has to pay more than it is expected to receive from its clients.

What is the double entry for accounts payable?

The accounts payable are recorded as a credit in the balance sheet of the receiver. At the same time, it is recorded as a debit in the balance sheet of the supplier. In the double-entry bookkeeping to balance the sheets, the credit would have an equal debit on the other side of the balance sheet and vice versa.

So, the credit in the balance sheet of the receiver is balanced by an equal amount on the opposite side of the balance sheet.