What are accounts payable?

Accounts payables are liabilities or financial obligations which a company owes to its suppliers. Basically, accounts payable are short-term debts that a company has borrowed due to buying their product or service on credit.

The accounts payables are noted in the journal entry as current liabilities under the liabilities section in the balance sheet.

Most of the account payables are due within one to three months, and the current liabilities are defined as those due within a year.

Analysts use accounts payable as a measure to compare cash flow between different accounting periods of the company.

If the accounts payable have increased, it means the company is buying more products or services on credit, which means it is using less cash, which can lead us to reasonably infer that the company’s cash flow has increased from the previous accounting period.

Explanation

Management of accounts payable is an essential part of any business. In the journal entry of any business, all account payables are listed under the liabilities section as current liabilities. The accounts payable are usually due within one to three months. So, that is why they are classified as current liabilities.

A good Accounts payable journal entry can help the company better manage its liabilities. The company knows which accounts payable are due, which helps the company avoid any fines associated with late payments.

Example

Consider a company ABC. It gets a supply of screws worth one thousand dollars from one of its suppliers. The company gets its own credit.

As a result, the screws are noted as current liabilities under the liabilities section. The company ABC is expected to pay for it after one month.

Before that payment is made, these would appear as account payables on the company’s balance sheet. How an account payable is noted in the journal entry is noted in figure 1.

Figure 1: How Journal Entry notes accounts payable

Figure 1 shows how the purchase of the screws by the company ABC from its suppliers looks on the balance sheet of the company ABC.

Types of Accounts Payable Journal Entries

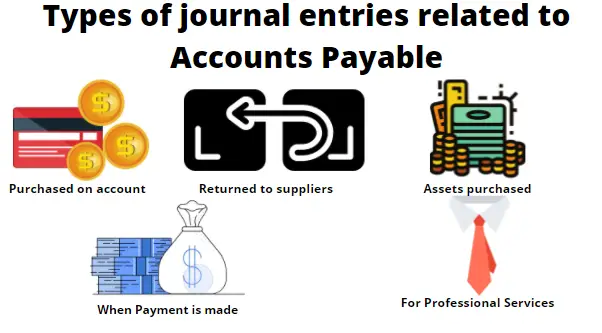

All five types of account payable journal entries are shown below in figure 2:

Figure 2: Types of journal entries related to Accounts Payable

The five main types of journal entries made on accounts payable are when a product is purchased on accounts when inventory is damaged and returned to the supplier when a company purchases assets other than the fixed assets, when payment is made, and finally when a company purchases professional services on accounts payable. The details of all five types are given in detail below:

When something is purchased on credit (Account Payable)?

This is the most basic form of accounts payable. It covers every type of simple transaction between a company and its supplier. Most purchases are made based on credit, which is noted as accounts payable in journal entries.

These results are in two separate entries in the journal. One is for the Purchase account, which would show the purchase, and the other is for the accounts payable, where the credit for the purchase is written down.

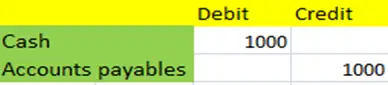

There are always two entries in double-entry bookkeeping, one is the credit entry, and the other is a debit entry. When a company purchases something on account payable, the account payable is where the credit entry is done, and the purchase entry is where the debit entry is done.

The credit and debit entries are equal to each other. Figure 2 below shows one example of such a purchase worth one thousand dollars.

Figure 2: Credit Purchase

When inventory or product received is damaged?

Sometimes, what happens is that the product received is damaged or does not meet the requirements, and then the company sends back the order to the supplier. In this case, the journal entries done for the account payables are reversed.

The accounts payables are debited for an amount equal to the monetary value of the products delivered by the supplier.

The purchase account is credit for an amount equal to the monetary value of the product delivered by the supplier. So, when the goods are returned, the position is reversed.

When an asset other than the fixed equipment is purchased?

When an asset other than the fixed equipment is purchased, the journal entries are a bit different. In the account payable in the liabilities section, the entry is made of the purchase asset’s value. Still, the company also has gained an asset whose value is equal to the value of the account payable.

So, in this scenario, the company also has a journal entry in the assets section, which reflects the value of the asset gained by the company.

So, the assets gained by the company are equal to the liabilities owed by the company for that particular asset.

When payment is made to a supplieror a creditor?

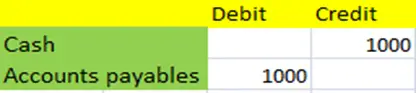

When the payment is made to a supplier for products purchased, the changes occurred in two sections in the journal entry.

One is the accounts payable in the liabilities section, and the other is the cash position in the assets section.

The liabilities are reduced due to the payment of the accounts payable, and the reduction in the cash position is due to the payment made by the cash to pay the accounts payable to the supplier.

Figure 3 below shows the example of this:

Figure 3: When payments are made to the supplier

When company hires for Professional services?

When a company hires a firm for professional services, such as a company for marketing or ads, the accounts involved in the journal entry are different from those used when paying for products. Because a product is also an asset, but service is an expense.

So, the two accounts are both on the liabilities side of the balance. One is the expense account which is debited of the service, and the other is the accounts payable which is the account that is credited. The company does not gain any assets, so the services are recorded as expenses when the journal entry is made.

Frequently asked questions

Is accounts payable a debit or credit?

Accounts payable in finance are usually credited. But, it can serve as both credit and debit because it is on the liabilities side of the balance sheet. What accounts payable show is the amount owed by the company to its suppliers.

So, it is usually recorded as a credit on the company’s balance sheet. It is because the product or service that the company has purchased from the supplier is on credit.

Is accounts payable a liability or expense?

Whether the account payable is a liability or expense depends on whether the company buys a product or service. The account payables are considered liabilities if the company purchases equipment or a product.

But, if a company purchases a service on credit, it usually means it is an expense, and as a result, the accounts payable is expressed in terms of expenses on the company’s balance sheet.

Because when a company gets a product on credit, it also gains an asset, but it does not happen. The company does not gain an asset when it purchases a service.

Why is accounts payable not expense?

Accounts payable are usually expressed in terms of liabilities. Because of the companies, most of them have accounts payable for products, such as equipment or other fixed assets. These products are considered assets. But, they are also listed in the liabilities sections when the company buys them on credit.

But, accounts payable are noted as expenses when a company purchases a service. But, in the majority of cases, it does not happen. That is why the accounts payable are not considered as expenses.